Here shutdown all operations on January 3, 2024.

Here allows for fractional investing in a specific real estate niche – short term vacation properties. If you’ve ever wanted to own shares of gorgeous Airbnb rentals, this is a platform worth checking out.

| Potential Yield | 1-10% |

| Potential Appreciation | 1-10% |

| Minimum Investment | $250 |

| Investor Requirements | No accreditation requirement |

| Liquidity | Limited – No secondary market, but early exit options after 1 year |

| Other Highlights | Vacation rental properties have historically seen strong returns |

If that sounds interesting, then you’re in luck! We have a variety of useful information to help you get started below.

What Is Here.co?

Here is a fractional real estate investment platform focusing on short-term rental houses. The property offerings on the platform are concentrated in popular vacation destinations like The Blue Ridge Mountains and The Great Smoky Mountains.

Basically, Here gives investors the opportunity to own shares of high-quality Airbnb houses in tourist hotspots around the US. You do not need to be an accredited investor to use the platform and the minimum investments start from $250.

What Do You Own When You Make An Investment?

As is the case with many other alternative investment platforms, when purchasing shares of an offering, what you are actually doing is purchasing shares of an LLC that owns the underlying property.

How Does It Work?

The Here team will rigorously review potential opportunities across a wide range of top vacation markets across the US. They will attempt to filter the opportunities down to only the top deals and work to secure them. These properties will then end up on the platform for investors to purchase at a cadence of about 1-2 offerings per month.

All properties listed for investment are short-term rentals. If you’ve ever stayed in an Airbnb, you’ll understand that it requires a certain amount of logistics, coordination, and support from the host to provide a good guest experience.

This means that each property must be actively managed. Another LLC under the umbrella of Here companies will be the property manager for each offering. As with any property management company, they will charge fees for their services. In the short term rental space, it is relatively normal for these fees to be 20-30% of revenue. We’ll cover all the details about fees in more detail in a later section.

Once an investment listing closes, the Here team will prepare it for guests and list the property on sites like Airbnb. From there, bookings can begin and the properties will start generating revenue. This should ultimately lead to quarterly dividend payouts to investors.

Properties are expected to be held for 10-15 years. During that time, the properties are expected to appreciate prior to the end of the holding period and the sale of the units. After transaction costs are taken care of, the final proceeds from the sale will be distributed to investors.

Investment Process

Sometimes the exact sequence of events will vary depending on whether or not an upcoming listing is in a new market or not.

If it is a new market, there will typically be communication through email and social media announcing the new market and providing some of the key points. This can include things like the location, details of nearby major metropolitan areas, and high-level statistics of the rental market’s growth and performance.

Outside of information about the new market, notifications about the new listing are also sent prior to the offering going live. It’ll usually include a photo, some very high-level details about the property, and a link to the offering. Offerings that are “Coming soon” have all the details available for review, before launch.

Lastly, the date the offering will go live is communicated out. You can sign up to be notified via SMS from the preview of the offering page. There will also be email and social media communications that get sent out when the listing goes as well.

Liquidity

One of the drawbacks of alternative investments is often a lack of liquidity. You can’t buy or sell things whenever you want. That is mostly true here as well. However, unlike some platforms that offer NO liquidity options at all, Here does provide a way to exit early. The break down can be found below:

- 0–12 Months after investing:

- 80% of the purchase price

- Reduced by distributions given and declared, but unpaid distributions

- 13–24 Months after investing:

- 90% of the purchase price

- 24+ Months after investing:

- 100% of the purchase price

Note: While Here says they don’t provide liquidity in their Help pages, their filings with the SEC detail the above redemption plan. You can find an example on page 44 of this filing.

It is important to also note that there are restrictions on the total amount of redemptions that can happen at one period of time and Here can basically change or cancel the entire redemption plan at any time they see fit without notification.

In summary there is a redemption plan for liquidity. However, it’s not something you can completely count on. Under the plan, redeeming shares after holding them for less than 2 years will likely lose you money on your investment. Even after 2 years, you’ll walk away with only your principal investment in the shares – even if they’ve appreciated and doubled in value on paper.

While we don’t provide investment advice, it seems clear that it would be in investors’ best interest not to request an early redemption of shares. If you are evaluating making an investment on Here, it seems best to approach it as a 10-15 year commitment of capital when making that decision.

Fees On Here

The property management fee is a percentage of the gross receipts generated by the property. The amount varies based on each property.

In general, Here will try to conform to the typical market rates for property management fees. That means, you should expect to see fees ranging from 25-40% of gross receipts.

The asset management fee is 1% of the asset value per year, split into 4 quarterly payments of 0.25%. This is paid from the revenue generated by the property.

The service fee is 10-15% of the property purchase price, plus an additional 10-15% of the costs of repairs and furnishings to list the property. In practice, this has averaged around 15.5% so far.

Understanding Investment Listings On Here

From the Properties page, you can see a list of past, current, and future offerings. If you click on any one of them it will pull up the listing page for the asset. Each page contains several sections of information that we’ll breakdown below.

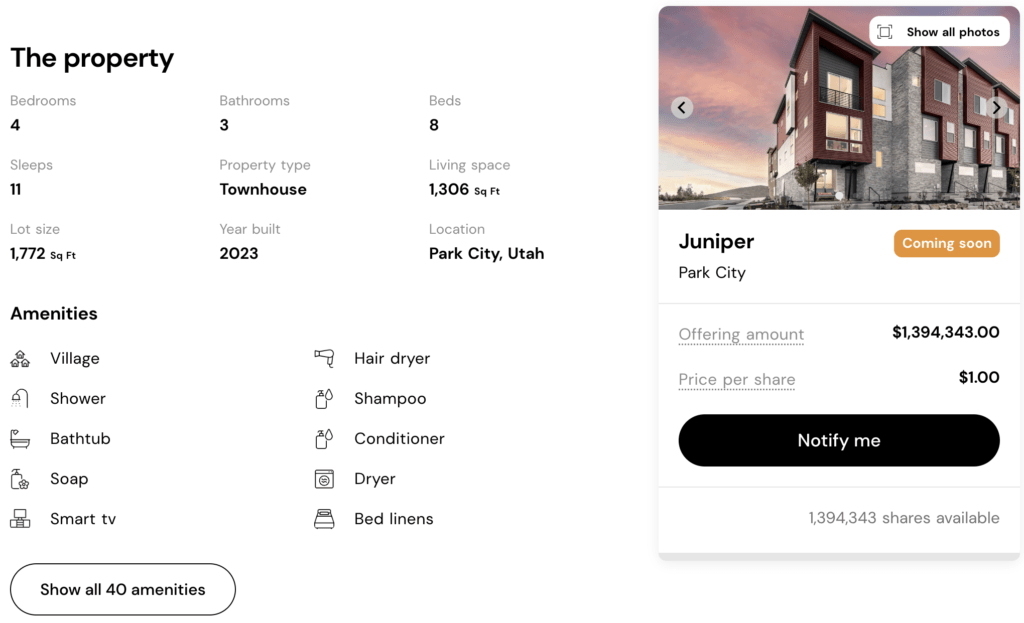

The Property

The first part of any investment listing is an overview of the property details.

This section provides information about the number of bedrooms and bathrooms, the size of the property, the year it was constructed, the location, the amenities of the property, the total offering amount, and pictures of the property.

Overview

The Overview section provides a few paragraphs that are basically outlining the investment thesis. It starts with a description of the property – like what you’d find in an Airbnb listing of the property. The overview then continues on to describe the market / city the real estate is located in and what makes it appealing.

In the case of the Juniper, this includes things like highlighting the fully equipped kitchen and how it can “…bring your culinary dreams to life.” For Park Park city (where Juniper is located), there are notes about the city such as how it is “…one of the top winter sports destinations in the entire world.”

Importantly, this section also includes when the first dividend payouts are expected.

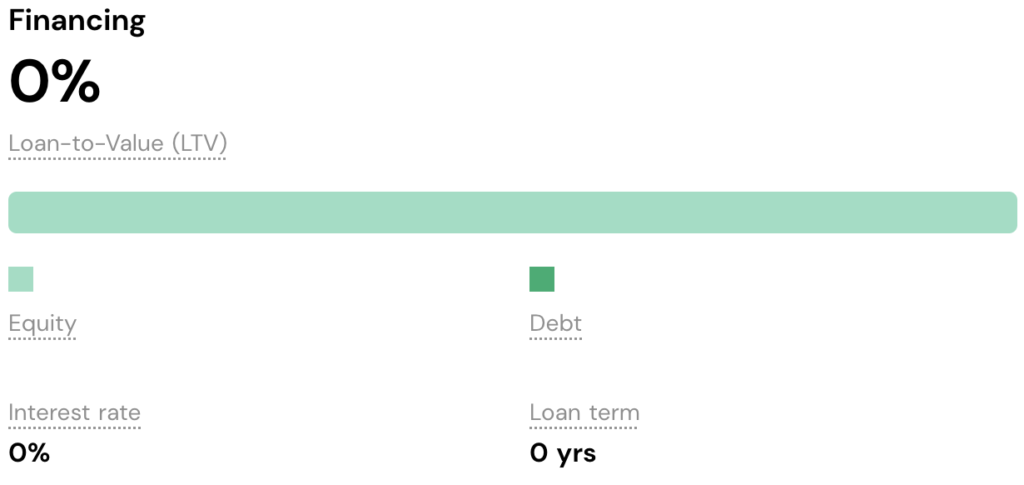

Financials

The Financials section is about the financing arrangements for the property.

In the case of our example, as with all the recent listings on the platform, there is no mortgage or debt associated with the property. This is an adaptation to the risking interest rates and economic uncertainty that has taken place over the past 6-9 months. Older properties routinely featured leverage of 50-60% LTV and interest rates ranging from 6-10% over a 1-3 year duration.

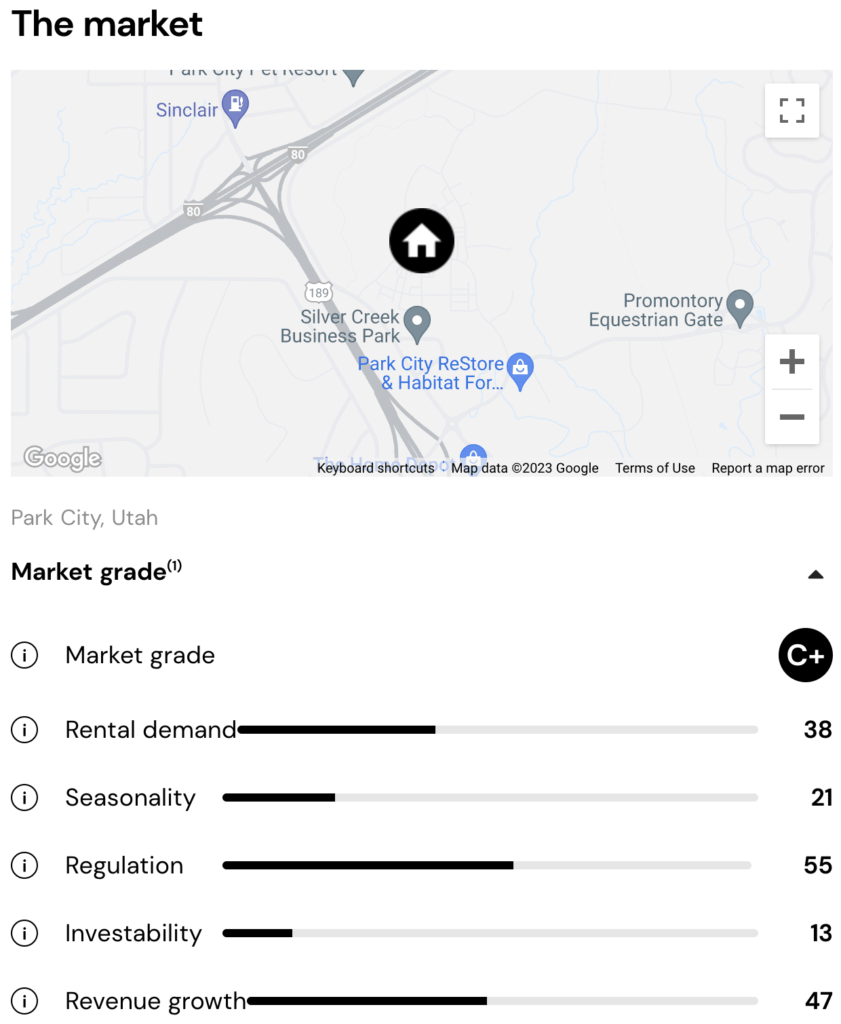

The Market

The next section of the listing, The Market, is one of the most important. It contains all the details about the vacation rental market as a whole and various financial metrics like the appreciation of residential real estate in that market over the past year.

The first part of this section shows where the property is located on a map, the name of the rental market, and the high level metrics about it from AirDNA. This includes an overall grade for the market as well as scores across rental demand, seasonality, regulation, inevitability, and revenue growth.

If you hover over the (i) bubble next to any of these metrics you’ll get more context about what it means and how it’s calculated. For example, a rental demand score of 38 seems like it would make for a bad market to invest in, right? However, the score is based on comparing this market against the top 2000 Airbnb markets globally. The 38 could simply be indicating that there is less rental demand from travel to Park City, Utah than Sens, France or Maui, Hawaii. That doesn’t necessarily mean it’s a bad market.

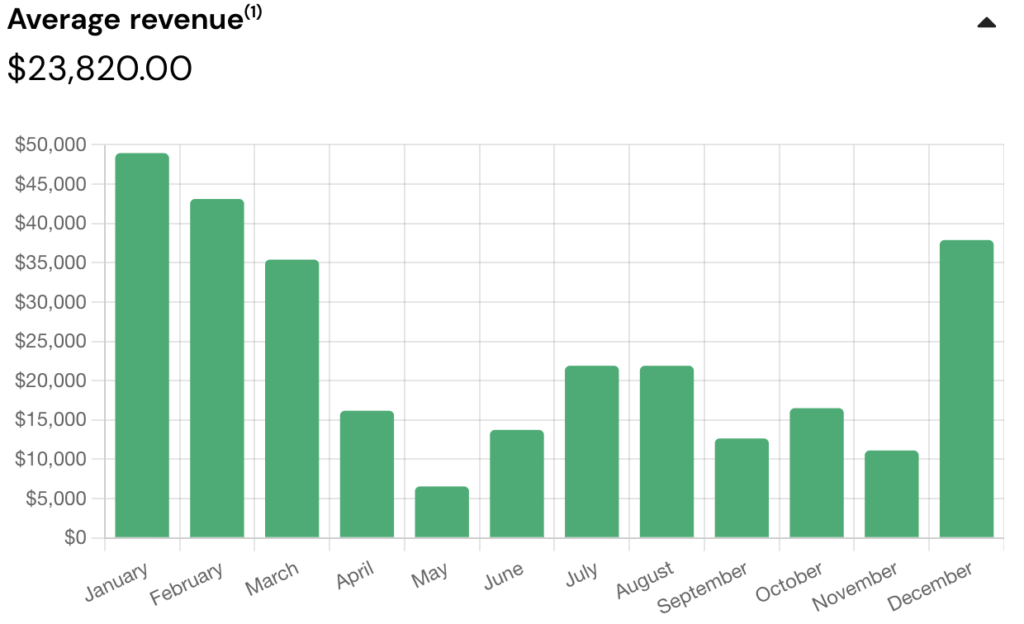

After the overall market summary there are 3 other charts – average daily rate, average occupancy, and average revenue.

Each of these charts shows how the performance of properties in this market vary over the months of the year. In the example above, we can see that the average revenue is very strong in December through March before reaching a low in May.

Something important to note is that Here is showing the information for the 75th percentile of properties. These results are NOT what the average property in the market sees – they are decently above average.

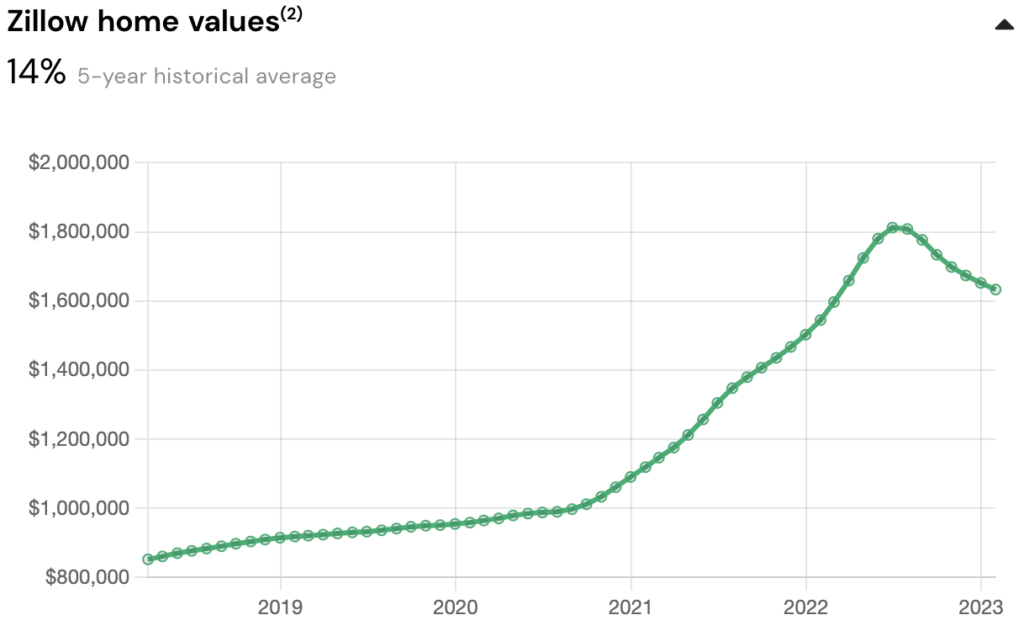

Lastly, each listing provides a graph of the Zillow home values.

These values are calculated for a “typical” home in the property’s zip code. The graph typically provides data for several years, which is very helpful for spotting the effects of the pandemic on the local real estate market.

FAQ

This section of the listing provides answers to a few common questions for Here listings in general, such as the expected holding period (10-15 years).

Resources

Lastly, the listing includes links to some resources for further research. Typically this includes the link to the Offering Circular, along with a few news articles about the property’s real estate market.

The Here Portfolio Page

The portfolio page is where you can see information about your investments and their overall performance. This includes:

- The total number of properties you’ve invested in

- The cash balance in your account

- A performance summary (available both account-wide an per-property)

- Total rental income dividends

- Total appreciation

- Total return

- Next payout date

You can also view this information for all time or only the last quarter.

The portfolio page is also where you can withdraw and deposit funds from your account.

Frequently Asked Questions About Here

Is Here Legit?

Yes, Here is a legitimate business and investment platform.

Additionally, all offerings on Here have been qualified by the SEC under the Regulation A legal framework.

Which Markets Does Here Have Offerings In?

Here has had offerings across a wide variety of markets in the US. These have mostly been in the Southern half of the country and include places like Sedona, Arizona; Panama City Beach, Florida; and Joshua Tree, California.

We have a map of where Here has sourced properties for their offerings so far.

What Is The Minimum Investment?

The minimum investment is $250. Earlier offerings in 2022 had a minimum investment of $100.

What Is The Target Holding Period?

The target holding period for new offerings is listed at 10-15 years. However, earlier listings included no information about the target holding period. At the time, the Investor Relations team told us they were targeting a 5-10 year holding period.

We believe this change in target holding periods is likely related to the lack of leverage for newer listings.

Is There Any Information Available About Their Track Record?

There is very limited information about Here’s track record. Here is a fairly new investment platform and the majority of their listings closed less than 1 year ago.

Their first set of quarterly results came in late February. We have some short coverage of what was announced. If you’d like to stay in the loop for any of our future coverage of Here’s performance, take a moment to subscribe to our newsletter.

Where To Learn More

To learn more about Here, consider checking out their FAQ, their blog, or take a look at our other coverage.

Are you considering whether to get started with Here or Arrived Homes for investing in vacation rentals? We can help! Take a look at our comprehensive comparison of these two platforms.

Lastly, if you’d like to learn more about investing in real estate, you can find additional information, resources, and coverage from our real estate hub page.