Are you looking into investing in startups and private companies? Find out whether Wefunder vs StartEngine vs Republic is the best place to get started for $100 or less.

Introducing These Equity Crowdfunding Platforms

Wefunder is easily one of the largest players in the entire equity crowdfunding industry. They typically have a large range of companies that raise funds through their platform and have ties back to the earliest days of legal startup investing for everyday people. They are seeking to become the home of the “Community Round” and have already attracted raises from companies like Arrived Homes and Substack.

StartEngine is another well-known platform. Shark Tank’s Kevin O’Leary (he’s a Strategic Advisor) is just one of the things that makes them stand out. A consistent flow of new offerings, their acquisition of another well-known platform (SeedInvest), and their recent feature pushes have made them a leading player in the space.

Republic rounds out what we would call the “Big 3” of equity crowdfunding for non-accredited investors. Republic features quality offerings, a slick platform, and a more open embrace of emerging technologies like crypto and blockchain. For example, they created their Republic Note offering as a “digital security” that allows holders to share in the profits of the venture arm of the company.

Similarities – Wefunder Vs StartEngine Vs Republic

While the vast majority of this article will be exploring the differences between these platforms, it’s important to remember they have a lot of similarities as well.

For the most part, the basic experience between these 3 is the same. It’s in some of the details around things like features, liquidity, and fees where the differences emerge.

Summary – Wefunder Vs StartEngine Vs Republic

Now that we’ve established the platforms and their similarities, let’s take a high-level look at how things stack up between them.

We have a lot more detail on these topics in the sections below.

Take a look to learn more!

Differences – Wefunder Vs StartEngine Vs Republic

Features

For the most part the features between these three platforms for investing in startups and private companies are the same. There are two noteworthy differences that we will cover in more detail below.

Republic Autopilot

A feature unique to Republic is Autopilot. It allows for automated investments. Autopilot can be configured for as little as $150/month of recurring investments. That $150 will be split into 3 different $50 investments and seek to build a diversified portfolio.

StartEngine Venture Club

StartEngine’s unique feature is their Venture Club subscription. It grants 10% additional bonus shares when investing in participating campaigns. For those with over $5000 in StartEngine shares, the bonus provides an additional 10% (20% total) as well.

From our experience, many companies raising on the platform do support the Venture Club bonus shares. That makes the $275 annual subscription a potential winner for anyone that invests on the platform frequently.

Offerings

Now let’s take a look at how offerings differ between platforms.

Types Of Offerings

For all three platforms, their equity crowdfunding offerings are the heart of their offerings. However, there are some additional types of investments you can find on the platforms though.

StartEngine has had a small number of collectibles offerings, as has Republic. Both platforms have also had limited experiments with real estate offerings as well. Neither company has had new collectible or real estate offerings in some time though.

Beyond that, there are occasionally crowdfunding investments with a revenue sharing model or debt offerings. From our experience, these are most commonly found on Wefunder, but they have some presence on other platforms as well.

Deal Flow / Quantity Of Offerings

From our experience Wefunder consistently has the strongest flow of new deals on. to the platform. StartEngine also has a relatively high volume, but less than Wefunder. Finally, Republic has the fewest number of new deals of the three.

Ultimately, all three platforms will have many offerings to review at any given time. As we’ll see in the next section however, quantity and quality are not always the same.

Quality Of Offerings

Our subjective assessment of the quality of offerings on each platform is basically the reverse of the previous section. Republic generally has the highest quality offerings, followed by StartEngine, and then by Wefunder.

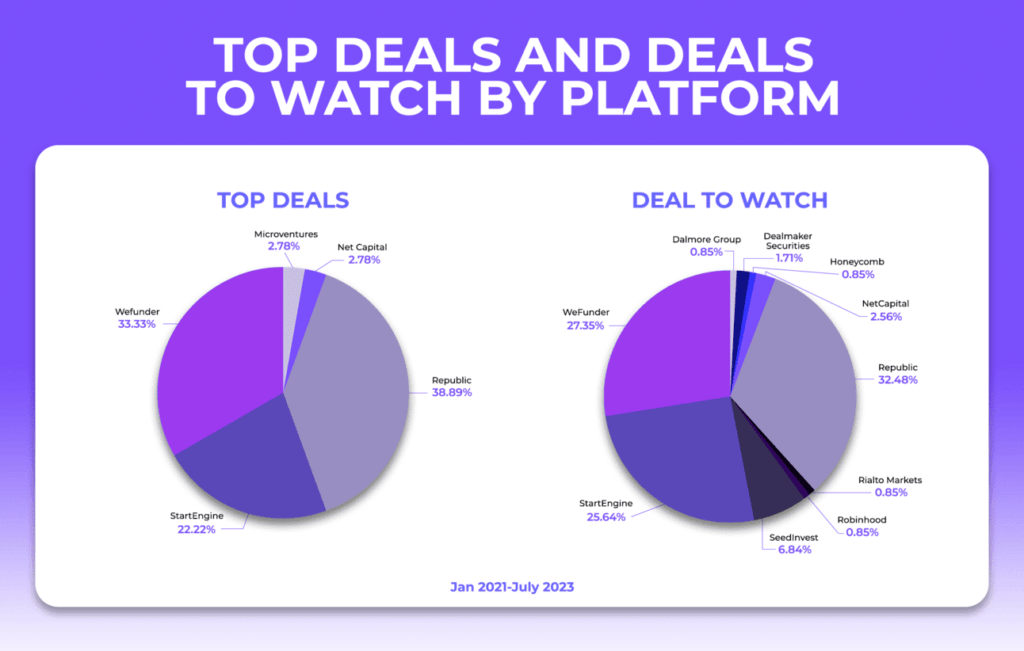

In this case, we can also see how third-parties assess quality as well. Kingscrowd is a platform for finding, researching, and tracking equity crowdfunding investments. They perform qualitative and quantitative assessments of deals and provide a list of “Top Deals” and “Deals To Watch.”

Over about 30 months of data, Republic had the most Top Deals (~39%), followed by Wefunder (~33%), and then by StartEngine (~22%).

For Deals To Watch, StartEngine is tied for the lead, when considering their acquisition of SeedInvest, with Republic (~32.5%). Wefunder isn’t too far behind with ~27% coming from their platform.

All in all, this is a win for Republic.

Accredited Offerings

Each platform has differences to their strategy around accredited offerings.

Wefunder

They have a relatively small amount of offerings for accredited investors. This has ranged from occasional opportunities to invest in individual companies, like Wefunder itself, to the ability to buy into venture funds.

StartEngine

Accredited offerings are somewhat new to StartEngine, appearing shortly after they completed their SeedInvest acquisition. However, they opened their “StartEngine Private” offerings with a bang. Their first two offerings featured investment opportunities into well-known unicorns SpaceX and Stripe.

Republic

Accredited offerings are provided through their Deal Room. These offerings typically have higher minimum investments ($2-$10K) and feature allocations from other companies with significant venture backing. In many cases these are structured as special purpose vehicles (SPV).

These offerings have different fees than traditional offerings. Republic has also experimented with various subscriptions around their accredited offerings.

Accredited Offerings – Conclusion

StartEngine’s offerings have been attention grabbing, but fall into a specific niche – large, well-known companies with high valuations that may IPO soon. It’s unclear whether or not these exciting, yet highly-valued companies provide an enticing risk/reward for most investors.

Republic has a longer history of accredited offerings over a wider range of companies. For that reason, we would say Republic wins here for now.

Fees

Each platform charges fees, though the amounts charged and who pays them differ.

Wefunder Fees

Wefunder has fees for both investors and companies with a successful raise.

Investors pay a one-time transaction fee upon investing. For investments funded through ACH, wire, or check the fee is 2% of the investment amount, ranging from $8-$100. That means on a $100 investment, you’ll still pay the minimum fee of $8. If credit cards, Apple Pay, or Google Pay are used the fee is 5%. In this case the minimum fee is still $8, but there is no maximum.

Companies raising through the platform pay fees based on their type of fundraise. For a Reg CF offering, Wefunder will take 7.5% of funds raised. For Reg A+, the fee is always $375K. That is equivalent to a 7.5% fee at $5M raised. So, depending on the size of the A+ raise, the percentage could ultimately be higher or lower than the benchmark 7.5%.

StartEngine Fees

It’s a bit harder to locate the fees for StartEngine, but it looks like they have a more complicated set of fees for companies raising funds. There’s a lot so we’re just going to directly quote them:

StartEngine Learn Page

- 7% of the amount raised via domestic ACH transfers and Wires taken out at the time of the disbursement(s)

- 9% of the amount raised at the time of the disbursement(s) for international investors (outside of the United States) and 12% for International credit cards

- 11% of the amount raised via Credit Card at the time of the disbursement(s)

- 50 basis points of funds committed as a cash management fee taken by the escrow agent

- $10,000 Service Fee which includes Account Management and Campaign Strategist support, deferred and taken out of the campaign’s first disbursement.

That’s just for Reg CF campaigns, but we can’t find another source for Reg A/A+.

StartEngine doesn’t charge fees to investors. However they do allow companies to pass through a 3.5% fee to investors to offset their fees. From our experience most companies choose to do this.

Republic Fees

Republic does not charge fees for their regular offerings to investors. Instead they charge the companies raising on the platform. If a raise is successful, Republic takes 7% of the amount raised as cash and an additional 2% of the total raise as a Crowd Safe.

For their accredited offerings, Republic has a different model. The base fees are a one-time management fee (typically 2%) and a one-time “organization fee” (typically 1-3%). There may be additional carried interest fees, typically ranging from 10-20%. These fees may be avoided or reduced by purchasing certain subscriptions on the platform.

Fees – Conclusion

Given all the variables at play, it’s a bit hard to build a head-to-head comparison. If we assume a $1M Reg CF raise, here’s our best attempt:

For the most part, the platforms have a similar level of overall fees. StartEngine has the potential to be the best platform for companies. Republic is the best for investors.

A few notes on our approach here:

- We’re adding a 2% investor fee for Wefunder, even though the percentage can be higher at lower investment amounts, or with credit cards.

- For StartEngine, we moved 3.5% of the total fees to investors as most companies do choose to pass this on.

- The $10K service fee and 50bps cash management fee we represent as an additional 1.5% to both StartEngine graphs

- For Republic, we are adding the 2% SAFE at face value to their base fee (9% total)

- There are other fees which StartEngine lists (e.g. cash management) that may exist for fund raises on other platforms, but aren’t documented.

Liquidity

Historically speaking, equity crowdfunding and startup investments are high-risk, long-term investments with minimal opportunities for liquidity. However, things are starting to improve as secondary markets for shares start to emerge.

Wefunder Liquidity

Wefunder does not currently have a secondary market. This generally means that a company has to be acquired or go public in order for investors to receive liquidity.

StartEngine Liquidity

StartEngine recently launched their “Marketplace.” This secondary market reportedly has over 6K companies available for trading.

That gives investors a liquidity option for many holdings – but not all of them. There can also be periodic trading limitations for certain companies if they are currently raising funds or if their SEC filings are too out of date.

Republic Liquidity

While Republic launched a beta of their secondary market in January, it doesn’t appear to have expanded too much. At this point it’s unclear when more investors will have access to it. That means, like with Wefunder, investors should expect to hold their Republic investments until a liquidity event like an IPO occurs.

Liquidity – Conclusion

While no platform has a complete solution for liquidity, StartEngine has the most comprehensive secondary market. From our experience, it’s also easy to use as well. For now, this is a clear win for StartEngine; however, we do expect the other platforms to make an effort to catch up in the future.

Track Record

The track record of returns for each platform is difficult to gauge. The public accounting of acquisitions and IPOs for companies that raised funds through crowdfunding is a bit lacking. Here’s what we have from Crunchbase for each platform:

- StartEngine – 4: Yerbae, Digital Brands Group, Smoke Cartel, and Osurv.

- Wefunder – 3: Vampr, Lawn Love, and Geekatoo.

- Republic – 2: INX and Nanno

However, we know this is a highly incomplete list. StartEngine self-reports 40 exits from companies that raised funds on StartEngine or SeedInvest. The Crunchbase list also misses companies like Knightscope. They raised many millions of funds through equity crowdfunding before going public in early 2022.

This is another case where Kingscrowd provides more data, but it requires being a paying subscriber to access the list of failed companies and exits.

Given StartEngine’s better accounting and public accessibility of data, we’ll say this is a win for them.

Conclusion – Wefunder Vs StartEngine Vs Republic

All three platforms are good places to get started with equity crowdfunding investing. They’re open to non-accredited investors, have offerings available for low investment minimums, and share a common set of core features and information for investors.

Which platform is best for you depends on your needs and priorities.

- If having liquidity options is a priority, then look at StartEngine.

- Want to avoid paying any fees? Then Republic fits the (lack of a) bill.

- If you want a large volume of deals, then Wefunder is a good place to start.

As we said before, all three platforms are respectable. So you can also just browse companies on all three platforms and wait for the right opportunity to pounce – regardless of which platform is hosting the offering.