Alternative asset classes provide a range of potential benefits, but one of the downsides is that there are generally less resources about them. In particular learning how to value music royalties can be tricky, especially for investors that primarily have experience with assets like stocks or cryptocurrency.

That’s where we can help. We’ve got a great guide to get you started. The first part will introduce you to a lot of important concepts. Then we’ll look at some of the key factors to consider for valuations. Lastly we’ll tell you a couple of potential pitfalls to look out for while investing.

Before you get started, if this is your first time learning about music royalties, we would recommend you start with this very accessible introduction:

Introduction To Music Royalties

New to the asset class? No worries! Take a look at this approachable introduction to get started.

Understanding The Value Of Music Royalties

The best place to start is with the fundamentals. How do music royalty assets provide the owner value?

As music is played or performed, including through streaming services, small fractional payments are accrued. As an example, in their Song Valuation Calculator, Royal assumes $0.0036 of royalties are generated per Spotify stream.

The accumulated earnings are then delivered as payouts to the various rights holders. The frequency of payouts can vary significantly, typically ranging from monthly to bi-annually.

Music royalties are primarily a yield-generating asset class. The value they provide to investors is the promise of future cash flow through dividend payments. While it is not impossible for assets to appreciate, it is often not the case. Nor is it the reason to have them in an investment portfolio.

Concept – Profiting From Depreciating Assets

Remember how we just said that you don’t own music royalties for appreciation? That’s because the value typically declines over time. Let’s explain why that is and why that shouldn’t stop you from considering this asset class.

Let’s explore this through an example. While we’ll talk about term length a bit later, we’ll use a 10 year term for our example. We’ll also assume it’s a new song, as the sharp early drop-off in earnings will make our points more clear.

Below, we have a model for what the yearly earnings will be from the asset over the course of 10 years. The pattern displays the “L-Curve.” When the song is new it’s played very frequently before it rapidly tapers off and eventually reaches a degree of consistency.

In the example, there’s $188 of earnings over the course of 10 years. For the sake of argument, let’s just assume that the asset is always worth 50% of future earnings. That provides a value over time that looks like this:

What this produces is a very sharp drop-off, from $94 at the start to $24 three years later. This makes sense intuitively as well. If the asset were only going to produce $48 in dividends, you wouldn’t want to pay the same price as one that would produce $188.

However, in this example, even if you purchase the asset for the full $94 in the beginning and then sell it after 3 years, you’d still have a nice gain. Three years of yield were $140, and if it were resolved for $24, that’d be $70 profit on a $94 investment.

Now to be clear, this is all just for illustrative purposes. We’re not trying to set any specific expectations on returns and what fair prices are. This is just to show that you can have an asset that depreciates in value every year and still have a successful investment.

Important Characteristics Of Music Royalties

Before we get into discussing actual valuations, we need to build on our foundational knowledge a bit further. There’s a few concepts about music royalties that are important to understand before thinking about how to value an asset.

Age Matters – When It’s New, It’s Hot

We mentioned and introduced the “L-Curve” a bit above, but it’s very important to understand, so we’ll discuss it in further detail here.

Basically, when a song is brand new it is typically at its most popular. It will be included in new song playlists, appear more frequently on the radio, and generally have heightened attention simply because it is new.

That newness quickly fades. This leads to a rapid decline in listeners before typically stabilizing in a more predictable range some time later.

Example – “Drawing Symbols”

What might this look like in a real life example? Let’s consider SongVest’s Drawing Symbols offering.

- It is for 50% of the songwriter’s share of public performance income.

- The only asset included in the offering is from YoungBoy Never Broke Again’s song “Drawing Symbols.”

- YoungBoy NBA is a relatively popular artist, with an estimated 9.5M monthly listeners on Spotify alone.

- The song was originally released in September 2018.

Here’s how things started:

OK, there’s definitely a decline there, but it doesn’t really look like an “L.” Are we overemphasizing this point? Even if it declines a bit more, it’ll still have a healthy payout, right? It’d be great to have $1000 in royalties every quarter for years, right? With $4K/year, even a valuation of $50K-$60K isn’t unreasonable, right? Right?

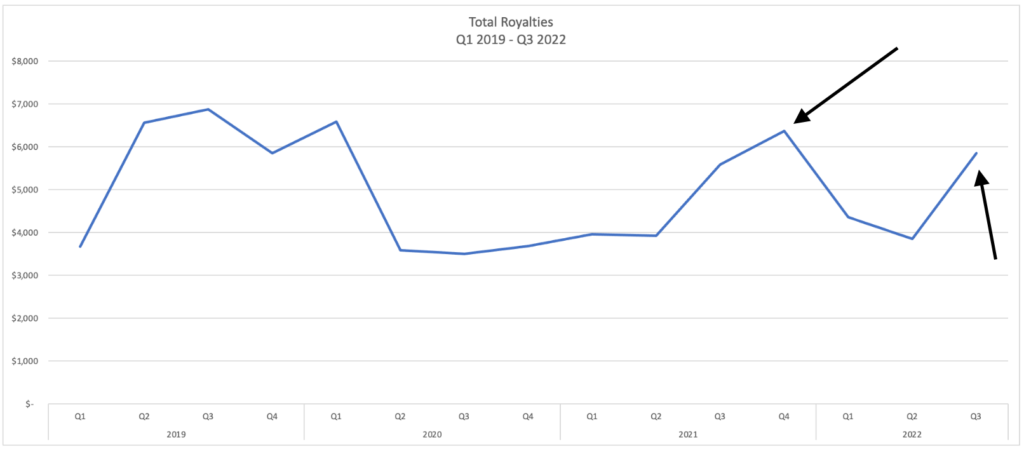

Here’s how the rest of it played out:

This is as far as we have data on the song’s performance. It looks to have stabilized very quickly, but that is somewhat atypical. It’s possible there could be further declines before it finally stabilizes at lower ranges a few years further into the future.

After the big decline, the song was producing roughly $1300-$1500 per year. That’s less than half of the $4k/year extrapolation from the early data above. If you’d purchased shares at a $50K-$60K valuation, that’d be a yearly yield of ~2.15% – 3%. That’s pretty rough, especially for something that might have room to fall further.

This asset actually went on sale at a $13,800 valuation (including SongVest’s fees), with a ~9.5% yield based on the last 4 quarter’s royalty payments. The offering was ultimately withdrawn after not enough shares were purchased.

Term Length

Music royalty assets share a lot of characteristics with bonds and fixed income investments. One such area is that many assets only provide cash flow from the royalty stream over the course of a fixed duration.

Two of the most common term lengths are 10 years and 30 years. At the end of the term, the investor will no longer be entitled to any share of the royalty income. The investment itself will also no longer have any resale value, since the term is expired and it has no potential to provide future value for investors.

That having been said, there are also assets that are for the life of copyright. Technically these are also fixed length assets, though the timelines can be both long and somewhat uncertain.

In the US, for songs produced after the start of 1978, the copyright lasts for 70 years after the death of the author. If the authors of a song are still living, that means the copyright could last for 70 or more years, potentially even more than 100.

Unsurprisingly, assets that offer longer term lengths can command a greater premium over those with shorter lengths. The original term length, as well as the remaining term length are important factors to consider when reviewing music royalty assets.

The Copyright Royalty Board

As we all live through this period of higher inflation, this might be on your mind as well. Will music rights always generate the same rates for each stream, download, etc? Won’t that make the effect of inflation very pronounced on the value of the investment over its lifetime?

While the royalty rates are not automatically adjusted based on inflation, there are changes that can happen over time. The Copyright Royalty Board can – and does – occasionally decide to raise rates for different types of music rights.

As a recent example, the royalties songwriters receive from things like record sales increased at the end of 2022. They will now receive at least 12 cents per track, a significant increase from the 9.1 cents per track they were previously earning. While that’s a large increase, the 9.1 cent rate went into effect in 2006, so it was a long time in the making.

Furthermore, the changes to payment rates for rights holders often involve various legal challenges. As recently as May of this year, the CRB was weighing in on an ongoing battle over rate increases that were supposed to go into effect in 2018.

In summary, yes, over a long term time horizon, the royalty rates are likely to increase. However, it’s not specifically tied to inflation and the path for those increases to be implemented can be slower and messy.

Taxes & Amortization

We are not tax professionals and this isn’t tax advice, so we’ll keep this brief.

If you’ve looked into investing in real estate, you’re likely familiar with the concept of depreciation. It’s basically a way to account for the theoretical decline in the usable life of the physical structure. That decline is then recorded as a “loss” for tax and bookkeeping purposes, even though no money left your pocket for it. This generally allows for some tax efficiency that helps to improve returns in the asset class.

Amortization is the same thing, except for intangible assets… like music royalties. For example, if an asset has a 10 year term length, each year it loses 1/10th of its usable life. This could allow you to use this “loss” to offset the income produced from the asset, lower your overall tax bill, and improve returns. Again, this is not tax advice, so please talk to a tax professional for formal guidance.

Techniques For How To Value Music Royalties

Now that we have a solid foundation on the asset class, let’s look more at some of the considerations for how to value them.

Last 12 Months (LTM)

This is one of the simplest places to start and data that you will see often. Sometimes abbreviated as LTM, this metric is simply the total or per-share royalties earned over the last twelve months.

An easy place to start in evaluating the assets valuation is to see what multiple of the LTM is being asked. To make things a bit simpler, here’s a chart of what trailing yields each LTM would lead to:

For example, an asset priced at $10K with $1K in royalty earnings over the last year would have an LTM of 10. That would also be a trailing yield of 10%.

However, as investors, we primarily care about what future returns will be. So we’ll need to layer in some more factors.

Song Age

LTM is a common and easy way to assign a basic valuation. Anything that is reasonably priced will at least partially factor in expected future performance.

Understanding what type of LTM makes sense will partially depend on the age of the songs in the asset you are evaluating. That means assets with newer songs will typically trade for much smaller multiples in anticipation of upcoming declines. Conversely, older assets will trade for higher multiples since the earnings are more consistent and predictable.

In the ultra-low interest rate environment from a few years ago, there were some giant sales for the music catalogs of very well-known artists with older works. One that stands out is Bruce Springsteen, who sold his music rights to Sony for $550M in late 2021. We don’t know the specifics of the financials; however, we have heard others in the music industry assess that Sony paid at least an LTM multiple around 20 in that deal.

Things have obviously changed a bit since then. Interest rates are higher and it’s possible to get 3.8% yield for 30 year US government bonds, and even high rates on other shorter term fixed-income options like CDs. What is an interesting deal is ultimately up to you, your objectives, and your risk tolerance. However, we feel that deals with multiples that high are not that enticing.

From our observation, it has been possible to acquire life of copyright royalties for stable songs and catalogs with a 14-18 LTM. In some cases you might find an opportunity for even lower valuations. That would provide a yield in the range of 5.56% – 7.14%. That’s much more compelling than the 4%-5% you’d get for assets with a 20-25 multiple.

For new songs or catalogs that generate most of their revenue from new songs, this is where we would recommend the most caution. You don’t know how fast or how deep the falloff from peak performance will be. If the songs are less than 5 years old, then it’s best to assume it’s not yet stabilized.

Term Length

Assets with different term lengths require different approaches. Even if a song’s earnings were perfectly stable, paying a 10 LTM for an asset with a 10 year term… isn’t going to net you anything. Conversely, the same multiple for an asset with a 30 year or life of copyright term could actually be a very fruitful investment.

For a 10 year asset, it should be possible to make a reasonable return at even a 5 LTM, especially with amortizing the cost. That assumes the songs driving the earnings aren’t too new though. If the LTM is higher or the songs are newer, we would recommend greater caution in your evaluation of the asset.

For 30 years and life of copyright, there is more flexibility to pay a higher multiple and still make a good return. This is simply from the longer time period the assets will produce income. However for the same reason, those assets tend to command higher valuations anyway.

Things To Watch Out For When Valuing Music

Finally, let’s conclude with a few areas you need to pay extra attention to when evaluating whether to purchase an asset. Missing the details on either of these could increase the chances that you make a bad investment.

Spikes That Might Not Be Sustained In The Long Term

Even more stable songs aren’t perfectly consistent. This can actually be a good thing. Sometimes older songs will appear in commercials, TV, or films that increase their earnings. However, these spikes often aren’t sustained. These short-term bumps can increase the earnings from the last twelve months and make the multiple look smaller.

Let’s look at an example.

In the screenshot there are two jumps in the royalty earnings. From the graph we can see that it has earned at these levels before. However, there was also about a year where earnings were consistently less, and a couple of recent quarters as well.

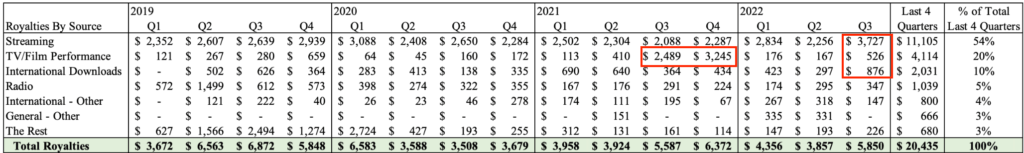

This example is from a SongShares listing from SongVest. Thankfully, they provide both data and analysis that makes investigating this much easier. If we look at the royalties by their source, we get a much better idea of what those spikes are.

As we can see the spike we highlighted in Q4 2021 was primarily driven by a surge in income from “TV/Film Performance” royalties. That was not sustained in following quarters, falling almost 95% in Q1 of 2022. Since we don’t expect it to be sustained, it might be better to regress this to the mean for valuation purposes.

For example, the previous 10 quarters averaged $229. If we use that value instead of $3245 for Q4 2021, then the last 4 quarter’s earnings go from $20,435 to $17,419. This is a more conservative figure that provides a higher margin of safety to make a valuation off of.

Lastly, the spike in Q3 2022 has a somewhat less obvious explanation. There are three categories that are performing at an above-average level. The biggest increase is from streaming. Recent history suggests it would be best to be skeptical that it will continue to perform at that level going forward. The average for the previous quarters was $2,517. That additional adjustment would bring the LTM earnings to $16,209.

For valuation purposes, these adjustments reduce the value of the LTM earnings by about 20%. That moves the multiple from 8.37 to 10.55. An argument could be made that this is now a conservative number. To that we would simply say “good.” It is usually prudent to try to be conservative and to seek a margin of safety when making an investment.

Remaining Term

An important thing to remember is that the term length and the remaining term are not always the same. This is especially true on a site like Royalty Exchange where assets can be bought and listed for resale to other investors on a secondary marketplace.

For example, an asset may have originally had a 10 year term. There may be information about the asset that makes reference to this original term length. However, perhaps that asset was sold 5 years ago. That means if you were to acquire it, it would only produce income for 5 years – not 10.

As we discussed previously, assets that will produce income for lesser amounts of time tend to be worth less. In this situation, you would want to acquire the asset at a very low multiple in order to have a good chance to earn a positive return.

Where To Get Started Investing In This Asset Class

Getting Started With SongVest

A comprehensive overview of SongVest, SongShares, VIP auctions, and how to invest.