Masterworks allows you to make fractional investments into contemporary art from around the world for $5 – $500.

| Potential Appreciation | 5-14% |

| Minimum Investment | $500 for new listings $5-$20 for the secondary market |

| Investor Requirements | No accreditation requirement, but invitation required |

| Liquidity | Good – secondary market available |

| Other Highlights | Contemporary art has historically had low correlation to other assets Art collecting and investing has a very long history |

If you’d like to learn more, we have a comprehensive overview down below.

What Is Masterworks?

Masterworks is a crowdfunding alternative investment platform for contemporary art. The company sources artwork, creates fractionalized investment offerings, and opens them to investors.

New offering IPOs have a $20/share price, with a $500 minimum investment. There is also a secondary market available where shares can be purchased and sold in smaller quantities and at different prices from the IPO.

The Masterworks platform has now hosted hundreds of offerings from a range of artists across the world. This includes works from more well-known figures like Pablo Picasso and Banksy. It also includes artists that may not be as familiar to those who aren’t well-versed in the art world such as Yayoi Kusama, Mark Bradford, and Zao Wou-Ki.

Masterworks Controversy

Due to their heavy advertising budget, Masterworks is one of the more well-known alternative investment platforms. Before we get into how everything works and how to use the platform, we should note that their aggressive push to grow has not been without some controversy.

At the end of 2022, ARTnews posted a lengthy piece detailing a number of things that would be fair to classify as concerning. Among others, the piece documents Masterworks’:

- Having potentially insufficient, or at least less than industry-standard, measures to ensure compliance with FINRA regulations.

- Obtaining net worth information on clients through Plaid. Using that information to target high-net-worth individuals, including through sales tactics like cold calls.

- The use of aggressive tactics to sell securities and to incentivize or motivate their sales teams. One example is an alert being generated within the company any time someone sold over $5,000.

- Frequently waiving the stated $15,000 minimum. It’s estimated that most people started with $100-$500 investments. The frequency of exceptions makes the “minimum” potentially misleading, or at least confusing.

- Various issues with company culture and a lack of human resources to help manage them.

- Using a “diversified art portfolio” offering (exclusive to accredited investors) as a way to accelerate the closing of slow-selling offerings.

- Sales tactics, sales incentives, and company culture that resulted in Sales teams effectively being incentives to “sell” rather than to act in a client’s best interest.

- Failing to honor advertising contracts and, effectively, acting in bad faith with various publishers as it related to their advertising spend.

Now, we should tell you that Masterworks did issue multiple responses to different issues raised in the piece. Generally speaking, those responses either deny various aspects of the report, or explain why no wrongdoing occurred. Here is an example:

(In response to descriptions of the sales team’s tactics, Masterworks emphasized that investors consent to calls in the sign-up process and says calls to investors are not unsolicited. It further noted that the company has conducted over 200,000 “investor onboarding calls” and received only four complaints, “all regarding a single employee who was subsequently terminated.” Internal sources cited to ARTnews two employees who received complaints from investors.)

Understanding Investment Offerings

Before considering whether to invest or not, it’s important to understand what you’ll actually own and what the fees are. We have a detailed breakdown of both of these for you below.

What Do I Own?

Masterworks uses a more complex implementation of a common structure for alternative investments.

First, you don’t actually own any paintings. The painting itself cannot actually be divided up into 100,000 pieces either. So what you actually own when you invest on Masterworks is Class A shares of an LLC.

That LLC owns or has ownership rights to the artwork. That’s the short version.

In actuality, there are more pieces in play. You will own shares of a series LLC. Unlike many other companies’ offerings, that LLC will not directly own the artwork. Instead the artwork is owned by a Cayman Islands segregated portfolio company (SPC). The LLC then owns an equivalent amount of shares of the Cayman Islands SPC. Basically, the general principles are the same, but there’s another layer involved.

From our experience, this extra layer is unusual in alternatives, but it’s not as strange as it may initially seem.

In fact, stocks of Chinese companies that are listed on places like the NYSE and the NASDAQ are actually Cayman Islands holding companies. If you’ve ever bought shares of Alibaba ($BABA), what you’re actually buying is shares of Alibaba Group Holding Limited… a Cayman Islands holding company.

Masterworks’ Fees

The implementation of fees bears resemblance to a “Two and Twenty” fee structure, but it’s actually more complicated. Let’s dive in.

First, when you make an investment on Masterworks, you’re buying a Class A Share. Those shares, collectively, have a claim to 80% of the profits from an artwork sale. So, where does the other 20% go? That goes to Class B shares, owned by Masterworks. Profit is defined as any amount, per share, over $20.

Second, there is a management fee of 1.5% per year. That fee is paid in shares, specifically SPC Preferred shares. This effectively ensures that if artwork is sold at a loss, Masterworks will receive full payment for the management fees before Class A shareholders are paid anything.

Management Fee – Deeper Dive

A complicating factor in how this plays out is the fact that the SPC Preferred shares can be converted into Class A shares. The 1.5% yearly fee is calculated based on the total number of SPC Shares. That means leaving SPC Preferred shares unconverted will actually increase the management fee over time.

Here’s an example based on Series 311’s starting share count of 177,600:

At year 1, the 1.5% fee would result in 2,664 SPC Preferred shares being issued. If no preferred shares are converted, then at year 10 that would grow to 3,046 shares. Or a 1.72% management fee.

As far as we can tell, Masterworks will keep their preferred shares as preferred shares up until a sale is about to occur. In that case, they will convert to class A shares if it would be more profitable for them to do so.

In other words, the “real” management fee will almost always be above the cited 1.5%.

This means dilution will be worse as time goes on. Here’s an example based again on the 177,600 shares from Series 311:

As we can see, despite starting at 80% of profits, converting shares would dilute investors to increasing degrees over time. After a 10 year holding period, that dilution will increase Masterworks’ share of the profits by 55% (20% -> 31%) and reduce investors by 14% (80% -> 68.9%).

Class B Share Conversion

There’s also the potential conversion of Class B shares to add to the mix. We did not see it explicitly stated, but we expect that converting Class B shares into Class A will also reduce Class B’s claim to 20% of profits. For example, if 1/2 the shares are converted, then Class B shares only hold a 10% claim to profits.

The conversion is performed according to a standard formula (with more details for each component of the calculation on page 105 of the offering circular):

(A) Value Increase * (B) Conversion Percentage * (C) 20% / (D) Class A share Value.

We tried this calculation with the following parameters:

- IPO price: $20

- Total number of shares (Year 10): 206,112

- Example Share Price Value: $50

- Class B Shares Being Converted: 1000 of 1000

That gave us the following values for each component:

- A – $6,183,362

- B – $6,183,362

- C – $7,420,034

- D – 148,401

If we start from the previous point, after all the SPC Preferred shares were converted to Class A shares prior to a sale, the results are pretty staggering:

- Shares Owned By Investors: 177,600

- Shares Accrued Through Management Fees: 28,512

- Shares Accrued Through Class B Share Conversion: 148,401

- Total Class A Shares Outstanding: 148,401

- Percentage Ownership By Investors: 50.1%

Basically, this results in a 50/50 split between investors and Masterworks. This is despite potentially millions of dollars being put up by investors to purchase those shares. Masterworks certainly contributed in sourcing, storage, tax documents, and more… but is the value of that potentially worth millions?

We’re hoping there’s something wrong with our calculations.

The offering circular does include an example calculation, but simply states Masterworks would receive 12,488 shares (13.04% of outstanding) if they converted at a share price of $50. The “(A) Value Increase” requires using the “the aggregate value of Class A shares” in the calculation. That isn’t provided in the example, so we aren’t sure how to reproduce the results to ensure our formula is correct.

Offering Expenses

There’s one last factor in the overall amount of fees present in a Masterworks offering. Basically, 10% of the total maximum offering amount goes to an expense allocation. What are those expenses? Here’s how they’re described in the SEC filings:

Masterworks will receive an Expense Allocation for all art-related issuers, including each series, which is intended to be a fixed, non-recurring expense payment for (i) financing commitments, (ii) Masterworks’ sourcing the Artwork of a series, (iii) all research, data analysis, condition reports, appraisal, due diligence, travel, currency conversion and legal services to acquire the Artwork of a series and (iv) the use of the Masterworks Platform and Masterworks intellectual property.

Page 100 of the Offering Circular

Closing Comments

It’s worth noting that the above calculations are based on a 10 year holding period. That provides a very long time for fees to accrue. It’s possible that most works will be held for far less than 10 years. In such a case the calculations above could represent more of a “bad” case, as opposed to the “base” case, or average situation investors would encounter.

How To Invest On Masterworks’ Platform

There are two different ways to purchase shares of contemporary art on Masterworks. The first is through investing in new offerings (primary market). The second is to invest using the Trading platform (secondary market).

New Art Offerings (IPO)

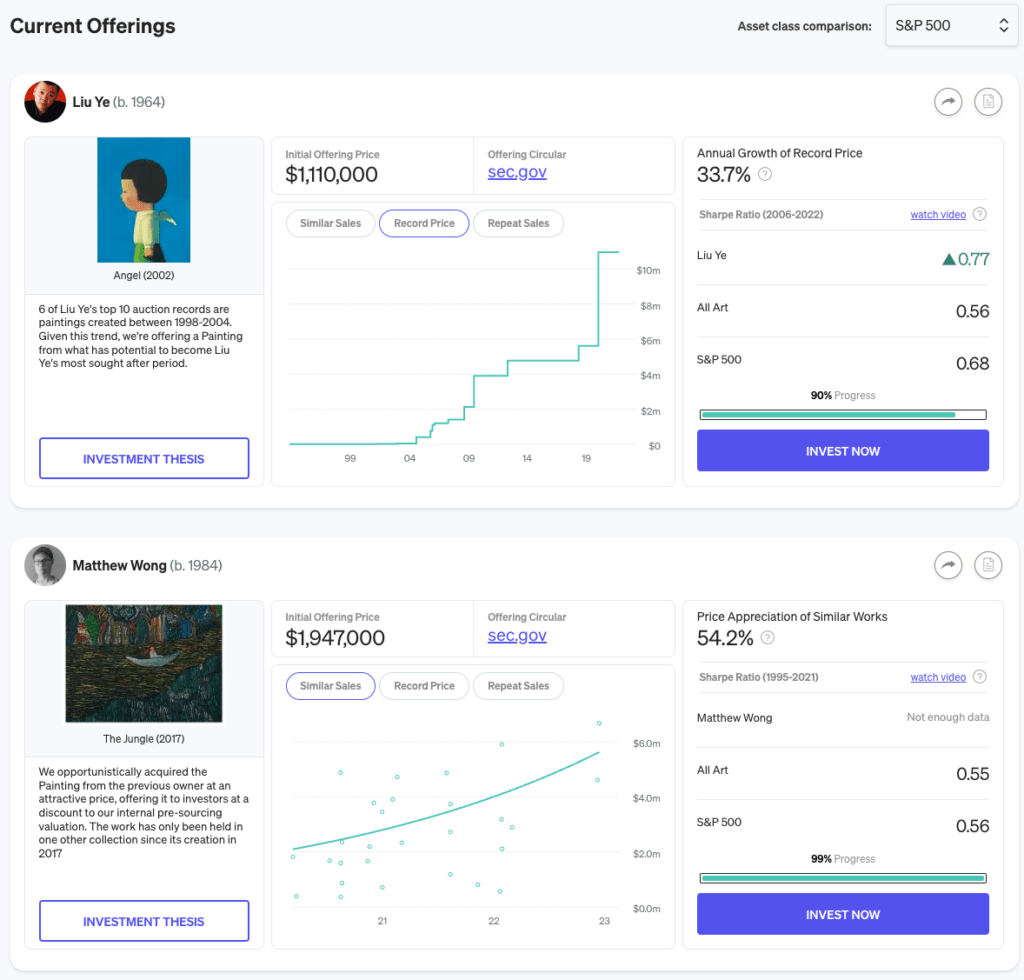

From the Invest page, you’ll see a list of “Current Offerings.” These will change over time as new offerings are frequently added to the platform.

Each offering in the list has an informational card. This is what you’ll interact with to learn more or invest in the asset.

From the card you can see:

- The name of the artist. This includes the year they were born and the year of their death if applicable.

- A thumbnail photo of the artwork

- A brief description of the offering.

- Graphs about similar sales and record auction prices.

- A list of works with repeat sales.

- The initial offering size.

- A link to the offering circular with the SEC.

- Various high-level financial performance metrics.

Investment Thesis

If you click on “Investment Thesis,” you can see a more detailed summary of why the Masterworks team felt the artwork is worth investing in. There’s typically 5-10 points for each work. They cover both financial data, as well as information about the significance of the artist and the particular work. Here’s a couple of examples:

Liu Ye was one of the top 5 contemporary Chinese artists in sales from the years 2000 to 2019, when he would become the first Chinese artist to join the powerhouse gallery, David Zwirner, since they opened a Hong Kong space in 2015.

– Liu Ye, “Angel (2002)” Investment Thesis

As of June 7, 2023, examples similar to the Painting have achieved prices as high as $11.3 million at auction, including: “Because it Hurts the Lungs” (1986) which sold for £8,227,750 ($11,319,730) in October 2021. “Jazz” (1986), the sister painting to ours, sold for $6,928,200 in October 2020.

– Jean-Michel Basquiat, “Black (1986)” Investment Thesis

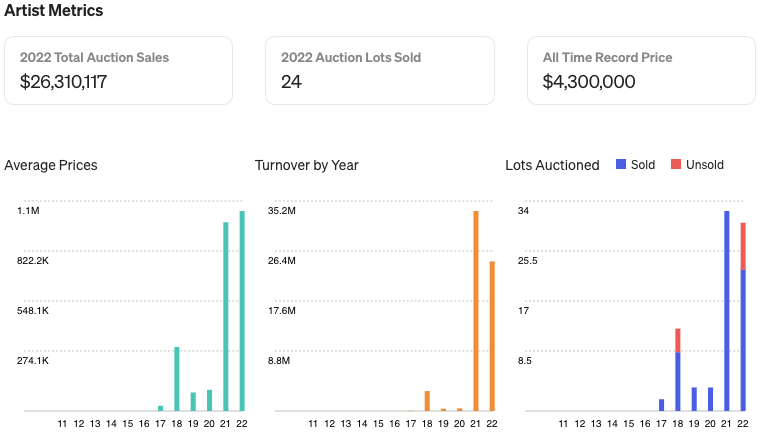

The thesis also includes more metrics on the artist’s auction history, larger photos of the art work, and a brief biography of the author.

In some cases the button may be “Watch Video” instead of “Investment Thesis.” There will still be a written case for the asset, but it will also have a short video available explaining the investment pitch in more detail.

Making An Investment

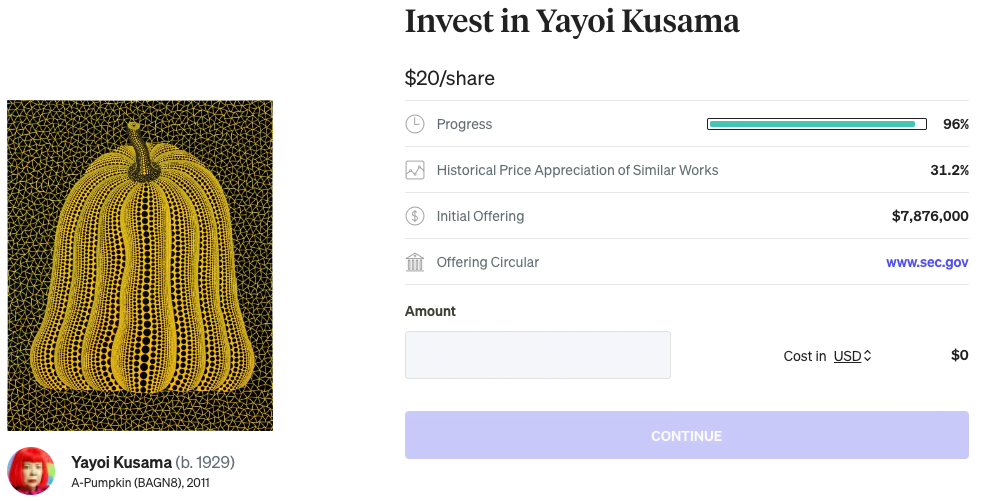

To make an investment, click on the Invest Now button. This will bring up a confirmation screen that looks like this:

The price for all IPOs is $20/share, which you can see at the top. The Progress field indicates what portion of shares have been sold so far.

To proceed with making an investment, type the amount you want to invest and hit continue. The minimum investment for any new IPO is $500.

From there, you’ll be guided through a series of screens to choose things like your payment method and signing the subscription agreement, before finalizing the investment.

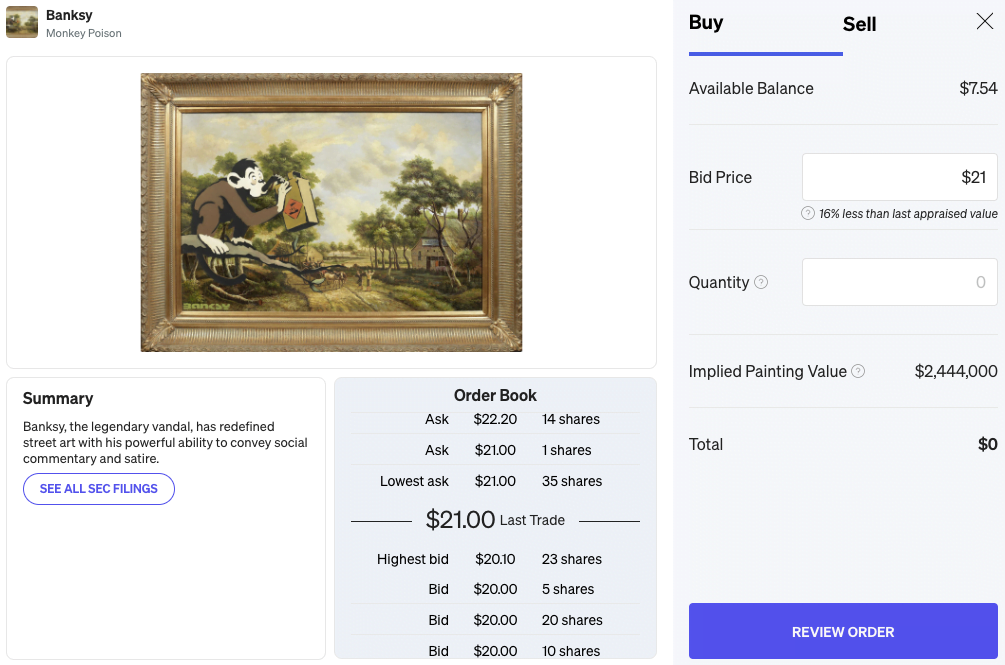

Using The Secondary Market

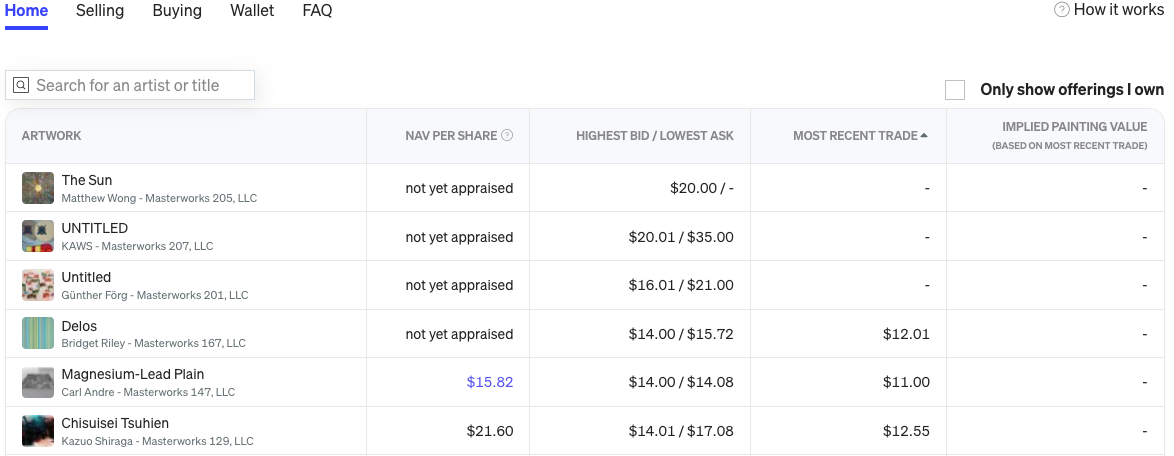

The Trading page allows you to both buy and sell shares on the secondary market.

How Does Masterworks’ Secondary Market Work?

After an offering has closed, it will become available for trading on the secondary market after 90 days. Shares of artwork you own will be synchronized to your Trading account once per week on Fridays.

All orders are placed as limit orders. Buy and sell orders can be placed at any time, but trades will only execute between 8:30 AM and 5:30 PM ET. Once the trade executes, it should settle the following business day by 9 AM ET.

How Do You Add Funds To Your Trading Account?

Underneath the Trading heading there is a Templum Account card. It should have your balance of available funds and a Transfer button. Click that button and then select Make a deposit. You’ll then be prompted to enter the amount you want to deposit, the target account, and the funding source before confirming your transfer.

Once you submit a deposit, it may take up to 5 business days for funds to arrive in your account. Once those funds arrive, there is an additional 2 business day holding period before you can use the funds.

How Do You Place Orders?

On the Trading page you’ll see a list of artworks available for trading. You can click on some of the columns to change the sort, or you can search for an artist or artwork title.

Once you find a work you’re interested in, you can click on it to bring up the trading screen.

From here you can see the artist, the artwork title, a brief summary of the offering, and the SEC filing for it. To our knowledge there’s no way to access the Investment Thesis for works on the secondary market.

Importantly you can also view the order book for the asset in question. This is very important for understanding how likely a given order is to be matched quickly – or at all.

In the example above, there are 36 (35+1) shares available at a $21 ask. That means if you submit a bid price of $21 for 36 or fewer shares, the order most likely will be matched within the next order matching session.

However, if you submitted a lower bid, then it will just be entered into the order book. If someone is willing to sell shares at a lower price later on, your order may be completed. How likely that is depends on how many shares are being sold at the lower price and how many better orders are ahead of yours in the order book.

Masterworks App

Masterworks also has a recently-launched app. It offers a similar experience to the website with a few key differences. First, it is not possible to use the secondary, Trading market through the app. Second, the app may occasionally have exclusive offers. Lastly, it also provides the ability to peek at some upcoming offerings.

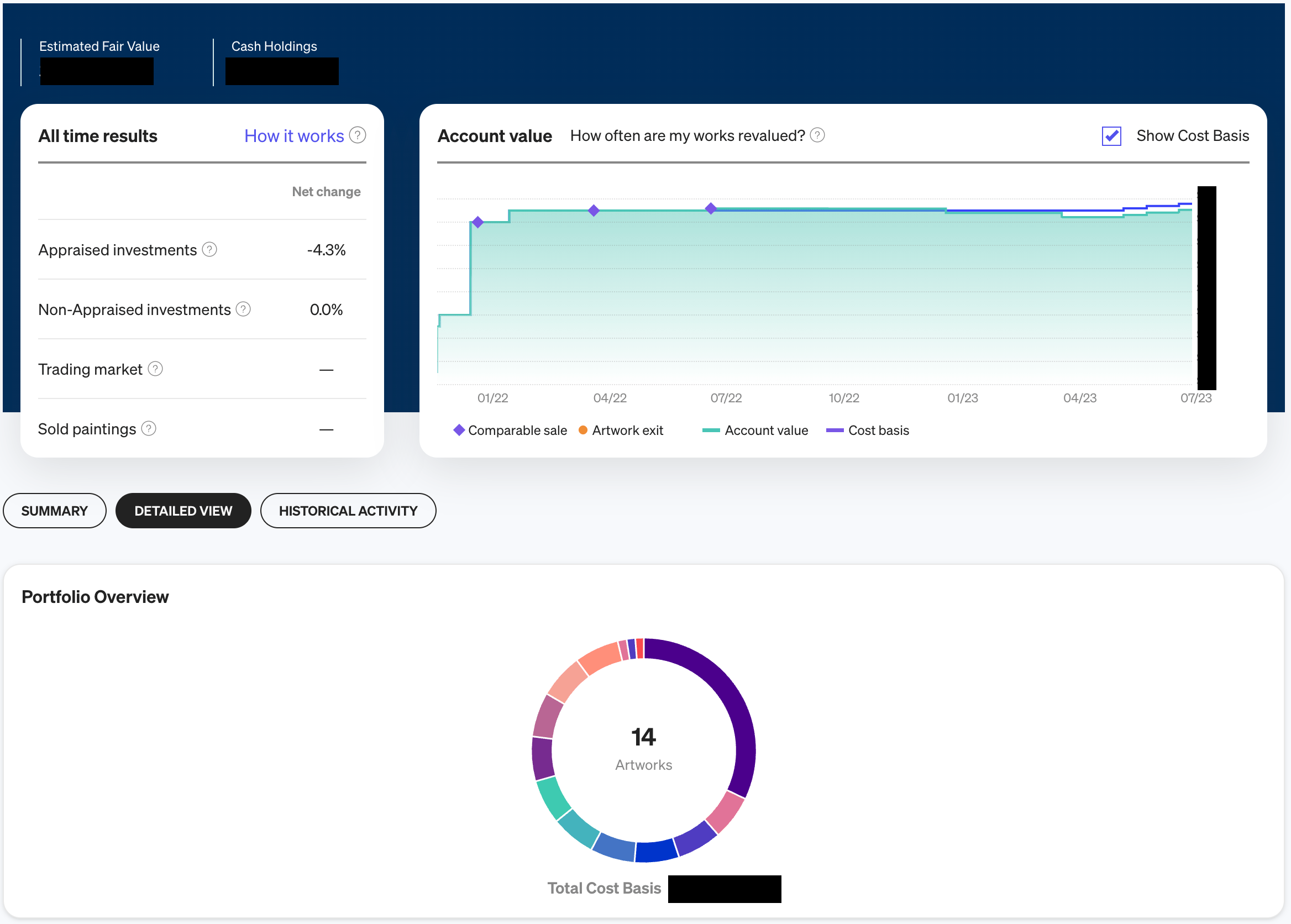

Portfolio

The Portfolio page is where you can see a summary of your holdings, performance, and your historical activity.

When it comes to the results, there are a few important things to keep in mind.

First, this is only showing a change in value for works that have been appraised. It typically takes at least 6 months after an offering closes for a work to be reappraised.

Second, the timing and schedule of these reappraisals is not completely consistent. It’s possible for assets to go a year without any updated valuation, for example. That could mean that the account value shown is often lagging behind assets’ real-time value.

In addition to a performance summary and the account value over time graph, there are three buttons to toggle between different sets of additional information – “Summary,” “Detailed View,” and “Historical Activity.”

Summary shows a card for each artwork in your portfolio. The cards show a photo of the work, your initial investment size, and the appraised performance of the investment to date.

Detailed View shows a pie chart of your portfolio construction. This is a way for you to see how balanced or concentrated your investments are into individual works. Below the pie chart is a table showing information about each position in the portfolio. That includes details like the name of the work, the size of the investment, the performance, and the last appraisal date for the work.

Lastly, Historical Activity shows a table of all the investments made on the platform.

How Do Appraisal Updates Work?

One of the main reasons to go to the portfolio page is to see updated share and account values. Those don’t match the secondary market though, so what are they based on?

Within the filings with the SEC, Masterworks indicates that they will perform a quarterly appraisal of their offerings. These appraisals come with quite a few caveats though.

They are mostly along the lines you would expect – it’s hard to exactly determine which sales are comparable and what an offering would actually return on the open market. However, here’s one that caught our attention:

…favorable investment performance is helpful for Masterworks to solicit future investment and accordingly it has an inherent conflict of interest. Accordingly, there can be no assurance that Masterworks appraisals would reflect the same values that would be reported by a disinterested third-party appraisal firm.

Page 85 of the Offering Circular

Given that Masterworks is the one performing the evaluation, it’s not surprising. The appraisals should be conducted in accordance with process and procedures that help to minimize this inherent risk. Unfortunately we aren’t given a detailed view into how the internal appraisal process works.

In short, it’s always worth taking appraised values of artwork on the platform with a healthy dose of skepticism.

Masterworks Invitation & Referral Code

Technically speaking, opening a Masterworks account may require an invitation to the platform, an introductory interview, and a $15K minimum investment. That having been said, these requirements are frequently waived under different circumstances.

We have an invitation and referral code. This will allow you to join the platform and you may receive up to a $200 bonus to invest on the platform – after making your first investment.

If you’re considering investing, we’d recommend taking a look at the parts of the article covering Masterworks’ controversy and Masterworks’ Fees first.

Frequently Asked Questions About Masterworks

Is Masterworks Legitimate?

Yes, Masterworks is a legitimate business headquartered in New York City in the United States. Their investment offerings are also qualified with the SEC before being added to the platform.

However, Masterworks has been the subject of some concerning reports and has relatively high fees. Our article provides more details about each of these.

Being a legitimate business does not automatically mean it is a good investment platform for YOU.

Does Masterworks Have An App?

Yes, Masterworks has an app. You can find it in the Google Play Store and Apple’s App Store.

Who Can Invest On Masterworks?

A large variety of people can invest on Masterworks. Their offerings do not require investors to be accredited. Additionally, the platform is also open to investors from some non-US countries as well.

Does Masterworks Have A Secondary Market (Is There Liquidity)?

Yes, Masterworks does have a secondary market for added liquidity options. Offerings are typically added to the secondary Trading market 90 days after closing.

Does Masterworks Charge Fees?

Yes, Masterworks changes fees. There is an ongoing management fee of 1.5% per year and at least a 20% stake in the future profits. The fee structure has other complexities to it, so we would recommend reading our article for more details on what fees could look like over a 10 year investment.

How Does Investing On Masterworks Work?

Masterworks constantly reviews artwork that is put up for sale. They select a subset of them to purchase and launch on the platform. After the work is purchased, Masterworks creates an SEC-qualified offering for fractional investments. Then the work launches as an IPO for $20/share until all shares are sold out.

Are Masterworks’ Offerings Qualified By The SEC?

Yes, Masterworks’ offerings are qualified by the SEC under Regulation A.

Where To Learn More

To learn more about this contemporary art investing platform, you can take a look at their FAQ, their articles about art and artists, or the how it works page.

You can also take a look at the other coverage we’ve done of the platform.