- Music royalties are an interesting, unique, and complex alternative asset class that offers the potential for high yield, uncorrelated returns, and passive income.

- Most royalties are generated from music streaming services.

- Who gets paid, what amount they get paid, and how they get paid is complicated.

- Learning how this asset class works, the risks, and how to value assets is key to making successful investments.

- Introduction To Music Royalties

- Understanding The Asset Class

- Investing In Music Royalties

- Legal and Rights Management

- Digital Platforms and Music Royalties

- Tax Implications Of Music Royalties

- Comparison With Other Alternative Investments

- Risks And Challenges In Music Royalties Investment

- Impact Of Technology And AI On Music Royalties

- Conclusion

Introduction To Music Royalties

What happens when you stream a song on Spotify, Apple Music, or YouTube Music?

Depending on your background you might answer very differently. Some may list the technical aspects of delivering the audio stream to your device from a website. Others may respond with details about audio codec and speaker functions. Or perhaps the answer is as simple as how songs make you feel.

The piece that most people won’t mention is something that’s critical for artists and record labels – royalties are generated.

The exact calculations are complex, but Apple says that a single stream of a song on Apple Music generates about $0.01 in royalties for the rights holders. These payments accumulate as songs are streamed, with more streams meaning more revenue.

This revenue can make up a significant portion of an artist’s earnings. Berton Averre, who wrote the 1979 one-hit wonder “My Sharona,” reported he still earns between $100,000 and $300,000 yearly from the song during an appearance on the The Economics of Everyday Things podcast.

The sources of royalty revenue have changed over time. While at one point it was primarily driven by things like record sales, in today’s digital age it’s mostly about streaming. Spotify and streaming services have driven music earnings to new heights.

As an alternative investment, music royalties offer the potential for superior yield, passive income, and uncorrelated returns.

Understanding The Asset Class

Music royalty payments are a somewhat complex system that tries to ensure creators are compensated for the use of their (musical) intellectual property.

The distribution of royalties is governed by copyright laws, which give creators exclusive rights to their work. The complexity of royalty payments comes from the wide range of ways music can be used and the different rights attached to a single piece of music.

What Are Music Royalties?

Music royalties are payments given to rights holders (e.g. songwriters, composers, and recording artists) for licensed use of their music. These payments are made by companies and organizations who use the music commercially, such as TV and radio stations, streaming platforms, and live venues.

The 4 Types Of Music Royalties

Royalties are generated through different types of licensing and usage, including everything from physical media sales (vinyl, CDs, etc….) and streaming to public performances and synchronization with visual media.

Here is a quick breakdown of the four types of music royalties:

- Mechanical Royalties: Generated from the reproduction and distribution of copyrighted music. This includes physical copies, digital downloads, and streaming. These royalties get paid to songwriters, composers, and publishers.

- Public Performance Royalties: Created from the use of copyrighted music in a public setting. This includes radio, TV, live performances, and streaming services. These are collected and distributed by Performance Rights Organizations (PROs) like ASCAP, BMI, and SESAC.

- Synchronization (Sync) Royalties: Earned when music is used in “sync” with visual media, such as movies, TV shows, commercials, and video games. Both the copyright holders of the music composition and the master recording must give permission for use through sync licenses.

- Print Music Royalties: This is the least common type of royalty. It’s related to the use of copyrighted music that has been transcribed into print, such as sheet music. Payments are based on the number of copies made.

Music royalties represent the various streams of income that creators earn from the use and distribution of their music. These royalties are categorized based on the source of revenue, and each type has its own method of calculation and distribution.

These four royalty types generate income in many different formats. Here’s a list of different formats artists have earned from over the years (taken from the RIAA):

How Music Royalties Work

Music royalties are how creators get paid for their music. This process involves several steps and different types of royalties. Let’s break it down into simpler terms.

Earning Royalties

- Songwriters and Composers: They make money when their music is sold, played in public, or used in movies and ads.

- Performers and Artists: These parties earn when their music is played live or streamed online.

- Record Labels: They get a share from selling and streaming the music they help produce and distribute.

- Publishers: They help songwriters and composers manage their music rights and collect their royalties.

Distributing Royalties

Several organizations help collect and give out these royalties:

- Performance Rights Organizations or PROs (like ASCAP, BMI): They collect money when music is played in public places and then give it to the songwriters and publishers.

- Mechanical Rights Organizations: They deal with royalties from music sales and streaming.

- SoundExchange: This group handles money made from digital and satellite radio streams.

- Publishers: They also help collect money from sales and when music is used in movies or ads.

There are many steps and players involved in making sure everyone gets their share. Understanding this process is important for anyone interested in making investments in the music industry.

Investing In Music Royalties

Let’s put more context around what this asset class offers investors.

Unique Asset Characteristics

Music royalties offer investors regular payouts as songs are played over the lifetime of the term. Terms are often 10 years, 30 years, or lifetime of copyright. Payouts are usually made monthly, quarterly, or twice per year.

The lifetime of copyright is something very unique to royalties. It can provide earnings for a very long time:

As a general rule, for works created after January 1, 1978, copyright protection lasts for the life of the author plus an additional 70 years.

From copyright.gov

Are Music Royalties A Good Investment?

The positives make the asset class unique. If you’re looking for diversification through returns that are un- and less-correlated to traditional risk assets, music royalties fit that bill well.

On the downside, it’s hard to get started. This asset class has more in common with bonds than stocks, which is likely to make many less comfortable with them. There is a learning curve, and it can be difficult to tell how risky a potential deal is. Additionally, if you want to start off small, the options are pretty limited and come without liquidity.

Potential Returns

In general, a yield in the range of 5-10% is very achievable. Returns in the range of 11-14% are also quite possible as well, while anything beyond that (15%+) can happen, but it’s much rarer.

For reference, Royalty Exchange states that their offerings have had an average yield of 13.3% so far.

There can be a lot of variability in the performance of different assets though. It’s important to remember that returns are heavily influenced by the acquisition:

- How much did you pay for the asset?

- What fees are involved?

- How well did you understand what was driving the earnings (was it sustainable)?

Just as you can overpay for stocks, you can overpay here. An asset that had a brief, unsustainable spike in earnings may look like a steal – until the performance returns to earth.

In this industry, a multiple of the “last twelve months” (LTM) earnings is typically used.

Songs that are older and have more stable earnings tend to trade for higher multiples. Very new songs trade for very low multiples because everyone knows that listenership is going to drop off significantly after the first few quarters.

Beyond that, there are many other factors that can affect earnings over time:

- Changes in royalty payment agreements with social media platforms

- Updates to how streaming services calculate payouts

- Increases or decreases in the competitiveness on streaming services (how many other artists and songs are receiving payouts from digital media platforms)

- Whether an artist is continuing to create new music or go on tour

For this asset class, the hope is to achieve a higher yield that can also be consistent over decades.

How to Invest

To get started, try going through these six steps:

Steps 1 and 2 will help you decide on an investment platform. From there it’s mostly about learning the platform and starting to evaluate the available offerings. Once you’ve found the right opportunity, you can make an investment.

Music Royalty Investment Platforms

Next, let’s investigate which investment platforms to explore. Here’s a few to consider:

ANote Music

ANote Music is an EU-based platform that allows investors to purchase shares of music royalty assets for as little as €6. The platform is open to non-accredited investors.

Platform Link | Referral Link | Platform Overview | Our Coverage

Royalty Exchange

Royalty Exchange is the best platform for buying entire music royalty assets. Due to this, the minimum investment starts around $10,000, but is more commonly $25,000 or more. The platform is open to non-accredited investors. This may not be the best place to start for investors new to the asset class given the fees, high minimum investment threshold, and variety of bad deals available on the secondary market.

SongVest

SongVest has two types of music royalty offerings. There are auctions for owning whole assets. There are also fractional investment opportunities through their SEC-qualified SongShares offerings. The platform is open to non-accredited investors and SongShares’ have a minimum investment as low as $100.

Others

- Public.com has started to expand their alternatives offerings. They have had one fractional music royalty offering so far.

- There are also others that are more crypto and NFT-oriented, such as Royal. Though we do not recommend it as an investment platform.

- Lastly, accredited investors can keep an eye on sliceNote. They are the only platform to have explored a “fund” style offering.

Legal and Rights Management

Investors should also understand who is entitled to royalties and how the rights are managed.

Who Gets Royalties and Why?

Music royalties are payments made to various types of rights holders of music, including songwriters, composers, performers, producers, and investors.

- Songwriters and Composers receive royalties for the creation of the musical composition and lyrics.

- Performers and Artists are compensated for their performances recorded on tracks.

- Producers may receive royalties for their role in creating the final sound recording.

- Investors in music rights can earn royalties from the music they have invested in, depending on their agreement with the creators.

The distribution of music royalties is based on copyright laws and specific agreements between creators and other parties, such as publishers and record labels. These laws and agreements detail how royalties are split among the parties.

Legal Aspects

Copyright laws provide creators with exclusive rights to their music, including the rights to reproduce, distribute, perform, and display their work publicly. However, the rights for sound recordings are slightly different, with no public display right and limited public performance rights.

Rights Management Organizations

Organizations such as Performing Rights Organizations (PROs) and the Mechanical Licensing Collective (MLC) play a significant role in managing music royalties. They are responsible for collecting royalties from music users (like radio stations and streaming services) and distributing them to the rights holders.

- Performing Rights Organizations (PROs) like ASCAP, BMI, and SESAC in the United States collect performance royalties on behalf of songwriters and publishers.

- Mechanical Rights Organizations manage the licensing and collection of mechanical royalties for the reproduction of songs.

- SoundExchange focuses on collecting digital performance royalties for sound recordings.

Effective rights management ensures that creators are compensated correctly. This involves tracking music usage, negotiating licensing agreements, and managing royalty distributions.

Digital Platforms and Music Royalties

Most of us consume music through digital platforms like Instagram, YouTube, and Spotify. What is the impact of that and how do earnings work? We’ll help explain.

The Importance Of Streaming

According to the RIAA, in 2022 over 75% of recorded music earnings tie back to streaming services in some way.

This is dominated by Spotify. They reported paying over $9B in royalties in 2023, which some estimates place at 20% of earnings from copyrighted music worldwide.

Overall, streaming and the framework for legal, on-demand access to songs has brought the industry out of the Internet-fueled piracy slump it encountered in the early 2000s.

Streaming Royalties Explained

So, how do musicians earn royalties from streaming services?

We’ll use Spotify as an example, but many platforms use the same concepts.

Spotify pays a share of all its subscription earnings in royalties. The split is calculated after the company first removes some operating costs. Or, as they put it, money they don’t get to keep.

That royalty pool gets paid out to artists based on the following:

- The song is deemed eligible, meaning it:

- Was streamed more than 1,000 times in the last 12 months

- Is at least 2 minutes long if it is a track without music (e.g. sleeping sounds)

- A calculation of the “streamshare” for the individual songs

- In a given period of time, what percentage of all music streams were of those song(s)

Example

- There’s a $1M royalty pool (based on the split of revenue Spotify earns).

- In that period, there were 10 million total streams.

- Our song had 50,000 streams.

In this case, the royalty payout we would receive is $5K.

Here’s the mathematical steps in more detail:

- ([our streams] / [total streams]) * [royalty pool]

- (50,000 streams / 10,000,000 total streams) = 0.005

- 0.005 * $1M = $5000

Different platforms may have slightly different calculations. For example, Apple Music is adding 10% more weight to streams of songs recorded and mastered in their Spatial Audio.

Social Media And Music Royalties

The major social media sites do pay royalties, but not in the same way as streaming services. Apps like Instagram and TikTok pay synchronization (sync) royalties, which it negotiates with companies like Universal Music Group and Warner Music Group.

In other words, social media sites negotiate licensing deals to use copyrighted music. That means royalty payment rates can vary greatly from platform to platform. The way in which payments are calculated can also differ. For example, one form of payment could be artists getting a share of ad revenue.

In general, payments from social media are lower than streaming services. The payment rates for artists and copyright holders has been a point of friction with the music industry.

Public comments on Reddit suggest that Instagram’s rates might be as low as $1 for every 1.85 million streams.

Universal Music Group recently pulled their music off of TikTok due to a contract dispute over these payment rates, among other things. How low are payments? Here’s what Billboard found when talking to people within the music industry:

- <$5000 from 500K videos and billions of views

- $8 for every 1 million views

- $100 after being used in 60,000 video clips

- $350 after being used in over 80,000 video clips

Tax Implications Of Music Royalties

In general, royalty income will be taxed as ordinary income. You may receive a 1099-MISC form to report this, depending on where you are investing.

That means the rate at which these are taxed will vary greatly based on your existing income level, whether the asset is held by an individual or corporation, and what state you’re living in.

In 2024, the individual federal income tax rates range from 10%-37%.

It may also be possible to amortize the purchase price of the royalty asset. For anyone familiar with depreciation in real estate, the idea here is the same – except for non-physical assets. This can reduce tax liabilities on the royalty payments, boosting the total returns.

As always, this is not tax advice and it’s best to consult a professional to review your individual circumstances and perform your own due diligence.

Comparison With Other Alternative Investments

Music royalties’ yield-based and bond-like qualities differ from many other alternative asset classes. Here’s a simple comparison.

Music Royalties Vs Collectibles & Culture

There are some similar acquisition characteristics, but other than that, these assets are fairly different. They seek to achieve different things and the logistics of storing and selling collectibles are completely different than music royalties.

Music Royalties Vs Farmland

These two asset classes are quite different. Farmland has factors like water rights, climate change, inflation, and population growth that affect it. Outside of their differing return and risk profiles, there are some similar challenges around acquisition and liquidity.

Music Royalties Vs Private Credit

Private credit is the most similar alternative asset to music royalties.

They’re both yield based. Valuation is also based on both the amount of expected future payments and the perceived reliability of receiving those payments. Other than that, the underlying assets generating the yield and other investment characteristics diverge from there.

Music Royalties Vs Real Estate

Real estate is very different from music royalties. While they can share some acquisition traits, almost everything else is different.

The most important difference is how integrated real estate returns are into the broader economy. Everything from office space vacancy rates to apartment rents can be significantly influenced by the economic cycle, legal policy, and monetary policy (i.e. The Federal Reserve).

Music Royalties Vs Startups

These two asset classes are extremely different. Startups are an extreme bet on share appreciation, often resulting in a total loss of principal. Music royalties are yield-based investments that should present greater predictability of returns.

Music Royalties Vs Wine & Whiskey

As with collectibles, music royalties share limited similarities with wine & whiskey.

Wine, whisky, and spirit investments need to be properly stored and insured to preserve their value. Time generally causes the value of investment-grade wine to appreciate, which is the investment objective.

Music royalties share none of those characteristics. They are only similar in their acquisition characteristics and their scarcity.

The Role Of Music Royalties In A Diversified Portfolio

As we see above, this asset class is fairly unique, even among alternative investments. That makes them a useful portfolio diversification tool.

While most assets derive their returns from appreciation, music royalties offer strong returns through regular cash flow. This is a great source of passive income. It also allows access to the value of the investment throughout the holding period without having to sell it.

This periodic cash flow is a welcome addition to a diversified portfolio.

During times when other asset classes experience declines in value, this cash flow can provide some psychological and emotional relief. Beyond that, the periodic distributions can help prevent the need to sell other assets in poor market conditions. It can also be used to fuel portfolio expansion during these periods where other assets are cheaper to acquire.

Lastly, music listenership is not strongly correlated to broader economic trends or the behavior of other risk assets. People don’t stop listening to music because the price of Nvidia’s stock went down or the latest CPI reading was hotter than expected.

This can help to decrease the correlation of an investment portfolio to external factors like monetary policy and the ebbs and flows of the economy.

Risks And Challenges In Music Royalties Investment

The biggest risk to making successful investments is understanding how to value assets.

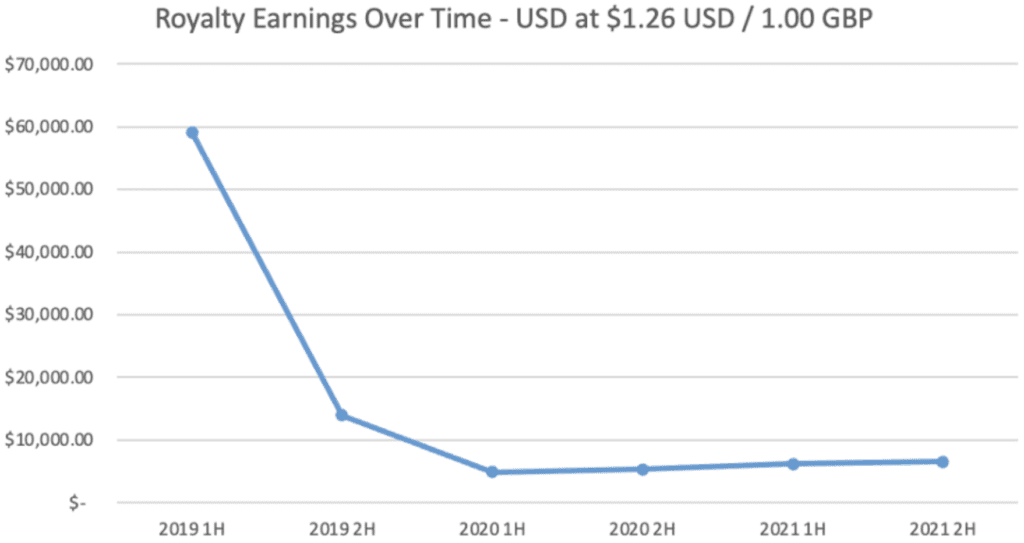

Generally, the earnings lifecycle of a song(s) looks a bit like an L.

When a song first debuts is usually when it’s played the most. It’s in the new songs rotations on radio stations and playlists. Fans are excitedly listening to the new releases on a regular basis. This popularity results in high earnings that later begin to drop-off.

After the song is no longer new, it’s on the radio less. People are over the initial fad of it being a new thing. Listening declines and earnings decline. Gradually, it increasingly settles into a more consistent range of streams and earnings.

Due to this, it’s the older songs that trade at higher multiples. The future drop-off is often somewhat baked into the valuation of newer songs.

There are other challenges as well. These include:

- Fees – Generally higher for buying and selling assets.

- Liquidity – Fractional offerings may lack liquidity options.

- Investment Minimums – Can be very high for whole assets.

- Dynamic Landscape – Royalty payment rates, artist popularity, and how streaming and social platforms calculate payouts can change over time – for better and for worse.

Impact Of Technology And AI On Music Royalties

Technology and music have had an interesting relationship.

In years past, new innovations made music more accessible and more consumable, helping to grow revenue. In 1973, music revenue was dominated by the 8-track and LP/EP formats as the industry earned about $2B (RIAA). By 1990, a total of nearly $8B in revenue was generated on the backs of the Compact Disc (CD) and cassette tape.

More recently, technology has challenged copyrights, complicating that relationship.

In 1999, revenues reached an amazing peak after 3 decades of growth – $14.6B. However, it wasn’t until 2021 that this was finally topped. Illegal downloads and streaming sites that didn’t offer royalties caused a decline to $6.7B in 2015.

Data is from the RIAA.

Legal streaming has driven the rebound in earnings. Now, technology has once again helped push music earnings to new highs – 15 years after the Internet revolution first took hold.

Artificial Intelligence is challenging things again.

Already there have been “deepfake,” generative AI “sound-alikes” and “dupes” of famous artists. In some instances, these songs have millions of views on social media before being removed.

Concerns around protecting artists from AI were one of the reasons Universal Music Group cited in their decision to pull songs from TikTok.

Not everyone is afraid though. Some artists are embracing the technology as a way to engage with fans and scale their output, while sharing royalties from the creations.

Conclusion

Music royalties are an interesting and unique alternative asset class. Taking the time to understand it can provide a valuable tool for portfolio diversification and passive income.

This overview gives a good foundation to build upon as you explore the asset class. Please see the rest of our music royalty content for more helpful resources.