Royal has since closed their investing platform. For anyone holding one of their NFTs, this article explains how to claim any future royalty payments.

Royal is a developing music NFT investing platform for streaming music royalties and exclusive perks. This is the best music investing platform for crypto enthusiasts and NFT lovers, but it is also accessible to those without any experience with cryptocurrency.

| Potential Yield | 1-10% |

| Potential Appreciation | Unclear appreciation, depreciation is possible |

| Minimum Investment | $50 |

| Investor Requirements | No accreditation requirement |

| Liquidity | Good – Secondary market available |

| Other Highlights | Life of copyright assets can produce yield for 70+ years |

If you’d like to learn more about investing in these music NFTs, we’ve got you covered. Check out our comprehensive overview down below to learn everything you need to know to get started.

What Is The Royal Music NFT Investing Platform?

Royal is a new music royalty investing platform, having launched just over 1 year ago. It is built on top of the Polygon blockchain. Offerings on the platform are sales of NFT tokens referred to as Limited Digital Assets, or LDAs.

Holders of these tokens will earn royalties from a particular song, music catalog, or album. Token holders may also receive other exclusive fan benefits. This can include exclusive merchandise, video calls with the artists, and VIP concert tickets.

Effectively, Royal allows artists and people from the music industry to sell their future royalty earnings for cash now. In exchange, investors receive passive income and fans have a chance to collect exclusive perks.

What Are LDA Offerings On Royal.io?

New LDA listings (a.k.a. “drops”) will periodically arrive on the platform. Each listing is a sale of a portion of royalty earnings for a particular asset.

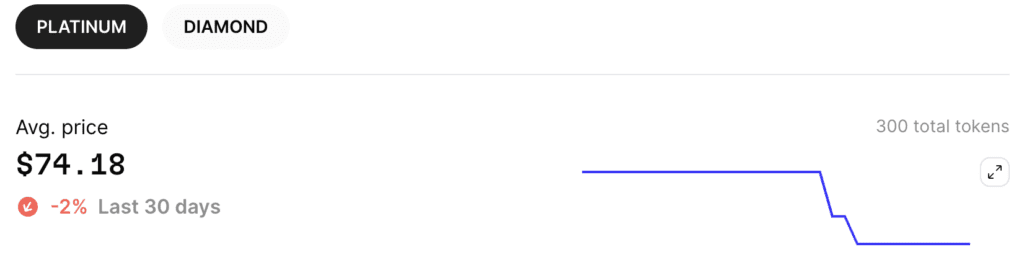

For example, the artist could be selling 50% of their royalties in the drop. That 50% will be split up across multiple tokens. Drops often divide tokens across up to 3 different tiers – Gold, Platinum, and Diamond.

LDAs will provide streaming royalty payouts at least twice per year. Typically, payouts have been quarterly. There is sometimes a delay in receiving the initial quarterly payout for a new asset. Royalties accrued during that period will be paid in the subsequent quarter.

What Are The Differences Between Token Tiers?

The prices, perks, and value of tokens vary greatly between token tiers:

| Gold NFT Tokens | Platinum NFT Tokens | Diamond NFT Tokens | |

| Price | Cheapest | Balanced | Most expensive |

| # of Tokens | Largest | Medium Amount | Smallest |

| % of ownership | Smallest | Middling Amount | Largest |

| Streaming Royalty yield | Lowest % yield | Medium % yield | Highest % yield |

| Amount of perks | Least perks | Middling perks | Most perks |

| Liquidity | High | Good | Potentially Limited |

Key Takeaways

There are a few important things to understand from the table.

Diamond Tier Tokens Can Be Very Hard To Acquire

This is due to a few reasons. First, the supply is extremely limited. In the case of the “Break My Heart Again” drop, only 1 Diamond token was issued. Second, the cost can also be very high. For the “Rare” drop, Diamond tokens sold for $9,999 each.

They can even be difficult to acquire in the secondary market as holders do not list them often.

For New Drops, Higher Tier Tokens Are Always Better Value

Higher tier tokens provide more perks and better yield. This is true in both absolute terms, as well as per dollar invested.

Since that may not intuitively make sense, let’s take a look at an example below.

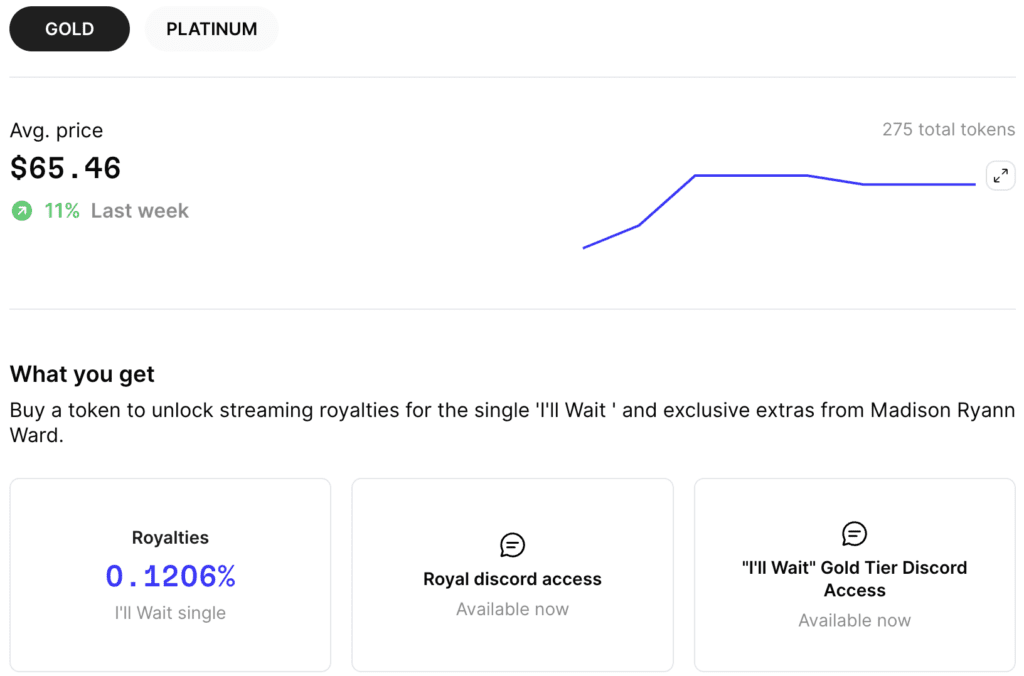

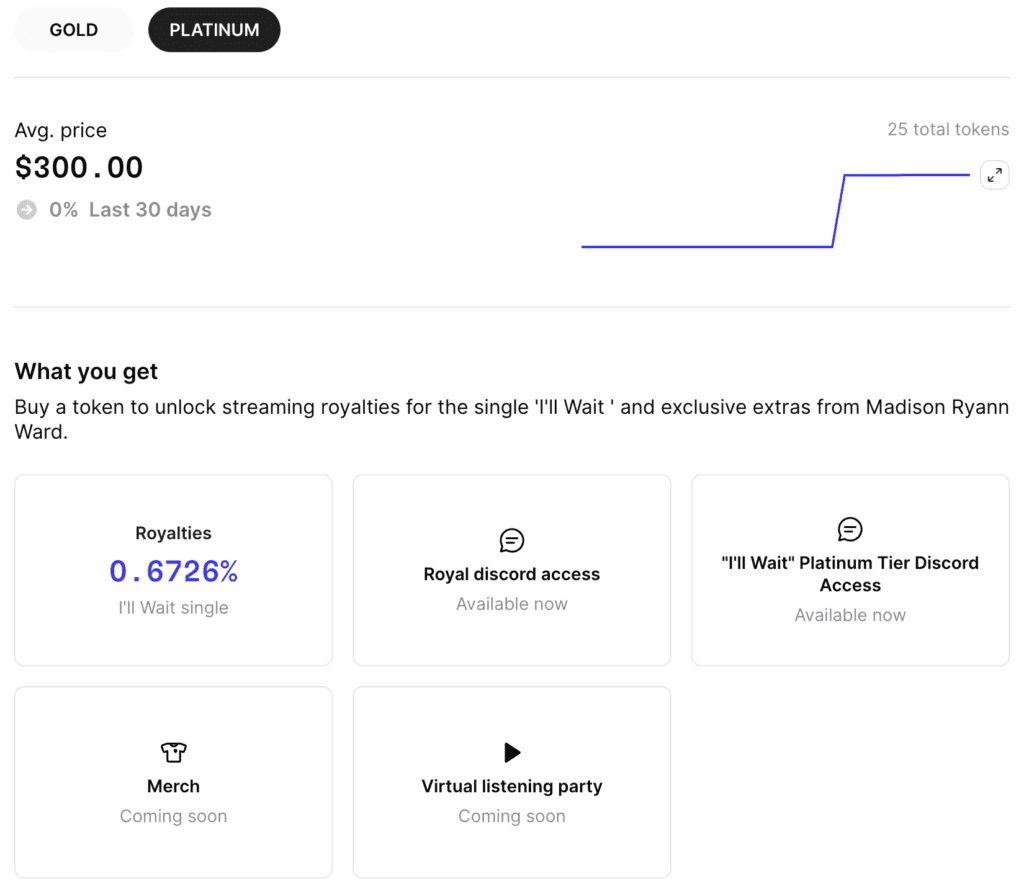

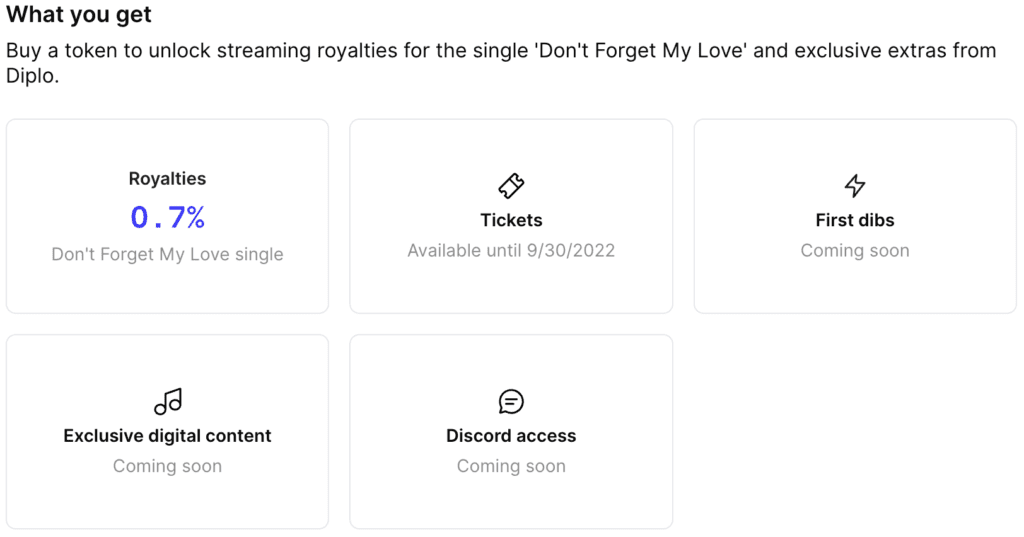

“I’ll Wait” was a recent drop. Two tiers of tokens were made available – Gold and Platinum. The Gold token dropped at $59 and the Platinum token dropped at $300. Here’s what was available for each token tier:

Gold

Platinum

For the cost of 1 Platinum tier token ($300), you could buy 5 Gold tier tokens and have $5 left over. Gold tokens provide 0.1206% of the streaming royalties, whereas Platinum tokens provide 0.6726%.

Five Gold tokens would only provide 0.603% of the streaming royalties. That’s about a 10% smaller share of the royalty earnings for about the same cost. To put that in dollar terms, at 2.5 million streams, 5 Gold tokens would provide $53.20 vs $59.34 for 1 Platinum token.

On top of the lower yield, the Platinum token provides a Merch and Virtual listening party perk that Gold tokens do not.

For more examples of how the yield has differed by token tier, take a look at our analysis of the first $100K in royalty payouts from Royal.

Understanding The Listing Page

There are 8 sections on every listing page. They are:

- The banner

- The token tiers and pricing

- A listing of what you get with the token

- A streaming earnings simulation

- Streaming metrics

- The history of royalty payouts on the Royal platform

- A section about the artist and the drop

- The collectors leaderboard

We don’t cover the sections in italics above in any further detail. They are either self-explanatory or not relevant for investing decisions.

NFT Token Tiers And Pricing

Just under the listing banner is a menu to toggle between the different tiers of tokens for the listing. Each listing can have up to 3 tiers, but many only have 2.

Toggling between token tiers will cause some sections of the listing page to update.The pricing information, listing of what you get with the token, the streaming simulator, and the historical royalty payouts will all update when switching between token tiers.

Underneath the selection for the token tiers is the token pricing information. For a new drop, this will be the “original” or “launch” price of the tokens. For something that has already been dropped, the price information will be based on the most recent trades on the secondary market.

There is a clickable icon with two arrows on the right-hand side of the price graph. This will expand the graph and give the ability to select the time period shown – 1 week, 1 month, 3 months, or 1 year.

This section also includes the total number of tokens that were released at the selected tier. It can be found on the right-hand side, above the price.

What You Get

This section displays two key pieces of information.

The first is the set of perks available from the token. This could be as limited as Discord access, but it could also include things like VIP tickets and exclusive video chats with the artists.

Streaming Earnings Simulation

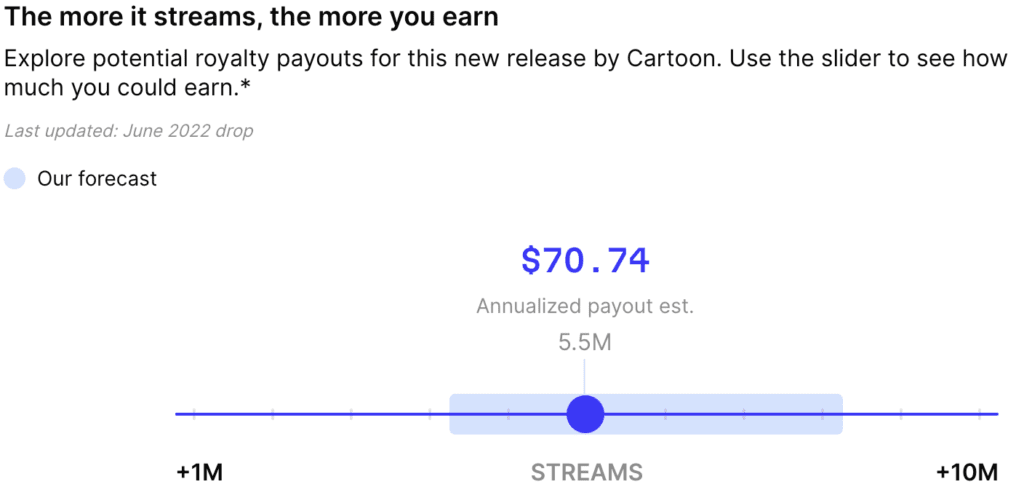

Understanding what the potential earnings could be is one of the most important factors for a potential investment. The simulator can help to understand what that could look like.

The simulator is a simple slider. On the right side is more streams and on the left side is less streams. In a portion of the middle is a light blue box. This is Royal’s estimate of the payout.

Within the light blue box is a dot. You can click and drag this dot left or right to see how that affects the estimated payouts. This allows you to see the range of outcomes within the estimates.

Across different listings, you can see that the range of Royal’s projections differ greatly in size. This is largely due to the age of the asset. Older songs potentially have years of data available on their performance. In comparison, trying to guess the popularity of a brand-new or unreleased song is much harder.

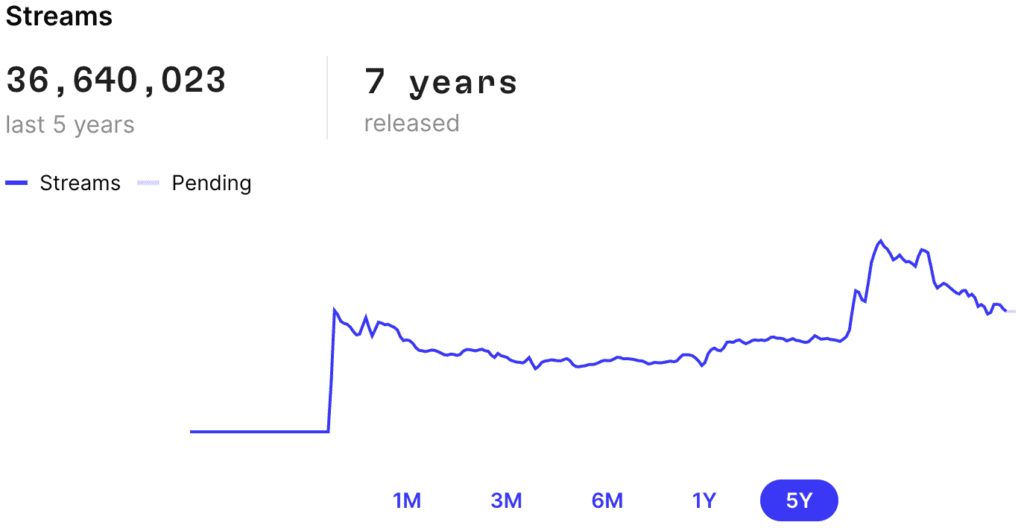

Streaming Metrics

In this section, you can see a high-level summary of the streaming performance. That includes the total number of streams over the selected timeframe and how long the asset has been released for.

You can also see graphs of the number of streams over a selected period of time. This can help you understand the stability and trajectory of streaming earnings.

The History Of Royalty Payouts On The Royal Platform

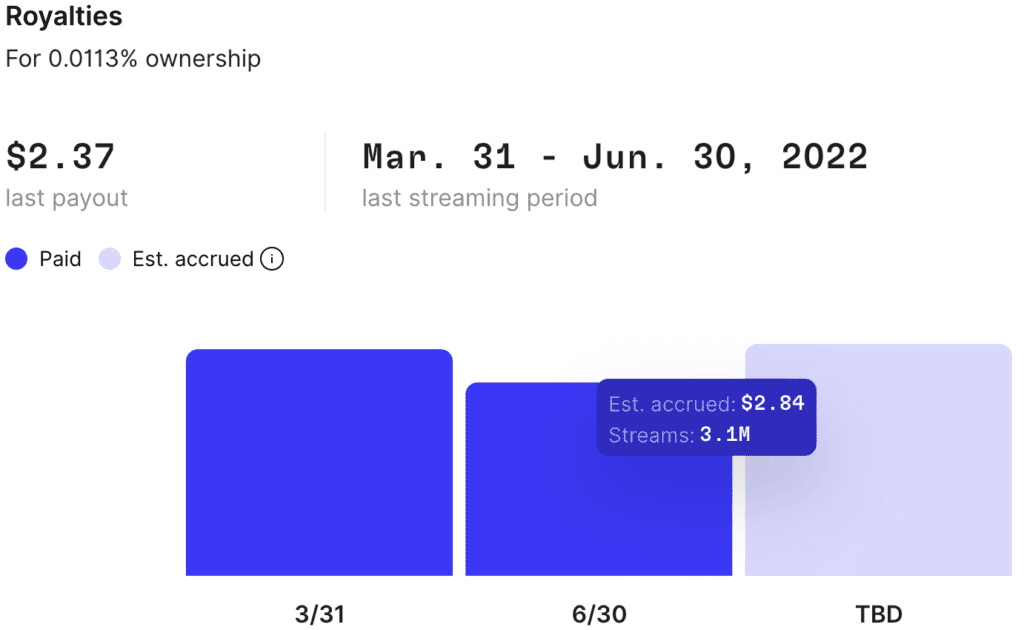

For assets that have been on the platform long enough to receive royalty payouts, the historical payout information will be available.

On the top, there is a high-level summary of the last payout. This payout, as well as previous payouts and an estimate of the future payout is depicted in a bar graph below. You can hover over any of the bars to see more information. This is especially useful for the “TBD” bar for the next quarterly payout.

How Do Royal Music NFT Drops Work?

The Royal platform periodically has new drops from a variety of different artists. Prior to the drop going live, it will be announced on social channels and through email. It will also be advertised on the discover page.

Before the drop is live, investors will be able to preview the listing page. This includes seeing the tokens being sold, the price of the tokens, and the projections for the streaming royalty payouts.

Once the drop is live, investors will have a limited amount of time to enter the drop. Since tokens are limited and demand is high, investors enter for a chance to purchase their desired token(s). You can enter a drop up to 5 times.

In order to complete the entry, you must select your desired payment type. Holds or pending transactions may show up on credit cards from this process. Investors will not actually be charged unless they win the drop.

At the end of the entrance window, winners will randomly be chosen.

How Does Trading On The Secondary Market Work?

From the discover page, you can access the listing page for any previous drop. You can click on a listing in trending or recent releases. You can also click “View all ->” underneath Recent releases and above Learn to select from the full list of NFT offerings.

There are two types of orders.

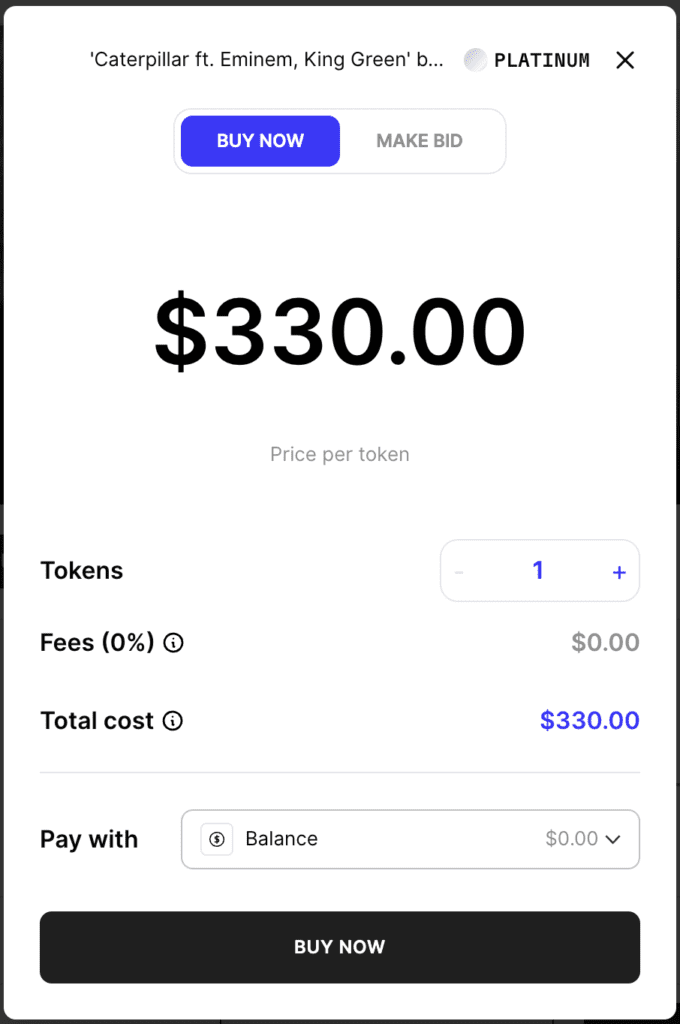

Buy Now & Sell Now Orders

The Buy Now and Sell Now options are effectively market orders.

Buy Now orders will be matched to the lowest priced seller in the order book. Sell Now orders will be matched to the highest priced buyer in the order book.

This allows for the fastest transactions, but may provide less desirable prices.

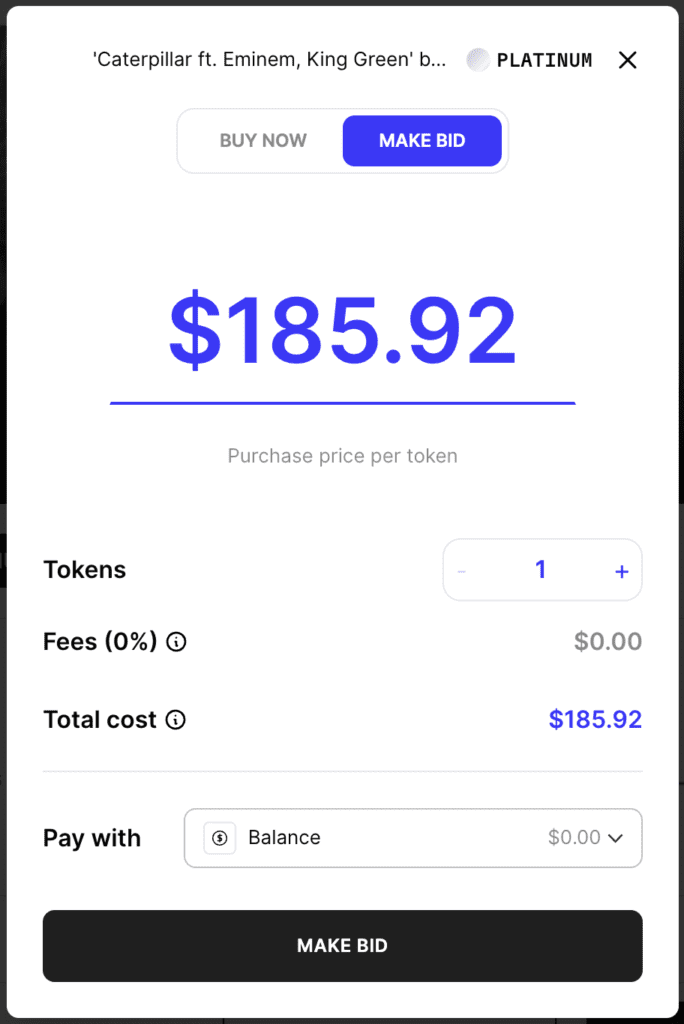

Make Bid & Set Price Orders

The Make Bid and Set Price orders are basically limit orders.

Make Bid orders allow you to set the maximum price you are willing to pay for an asset. This is typically used to specify a price below the Buy Now price. As more sell orders are submitted, the Royal platform may be able to fulfill your order.

Set Price orders are used to specify the minimum price you would accept to sell the asset. This is typically used to specify a price above the Sell Now price. As buy orders are submitted over time, the Royal platform may be able to fulfill the order.

These order options allow for more desirable prices, but slower transactions. It’s actually possible that these orders are never fulfilled. For example, submitting a set price sell order of $1,000,000 for a $1000 token is unlikely to ever be completed, even after years of waiting.

What Happens When A Secondary Market Order Completes?

For buy orders, you will receive the token and funds will be removed from your wallet. For sell orders, the token will be removed from your wallet and funds will be deposited.

You will be notified through email when these transactions complete.

Are There Fees For Using The Secondary Market?

Until 2023, there are no fees for buying or selling NFTs on the Royal platform. After, there will be at least a 2.5% fee which will be paid to the artists. The announcement of the availability of secondary market trading does not specify whether there will be any additional fees in the future. You can also see their official announcement.

Frequently Asked Questions

Why Are There LDA Listings On OpenSea’s NFT Marketplace?

The Royal platform first launched as a minimally viable product (MVP). This is a common strategy among startup companies. It allows companies to get their product in front of customers to get the business started and to get important feedback and usage information. This can then be used to iterate and refine the product offering.

Launching as an MVP meant starting with limited functionality. Until the launch of the website redesign in November of 2022, secondary market functionality was fulfilled by OpenSea. You can still see Royal music NFT (LDA) listings on OpenSea.

Do You Need To Understand Crypto To Use Royal?

For the most part, no.

For new drops, Royal music NFTs can be purchased with a credit or debit card. Funds can also be added to your wallet from a linked bank account. Buy and selling of LDAs on the secondary market can be done entirely within the Royal platform.

One exception is when it comes to receiving royalty payouts. These are delivered as USDC on the Polygon blockchain. Getting these into a bank account will require some understanding and familiarity with cryptocurrency. In the meantime, these funds can be used to purchase additional LDA assets from the secondary market. The ability to deposit royalty payouts directly to your linked bank account is a planned feature addition.

Are Royal’s NFT Drops Qualified By The SEC?

No, the LDA NFT assets on Royal are not a part of an SEC-qualified offering.

Where To Learn More

To learn more about the asset class, please see our overview on music royalties. The article provides an introduction to the asset class, as well as links to additional third-party resources for a more comprehensive understanding.

To learn more about the Royal platform, you can check out these resources from Royal: