Investing in music royalties through SongVest may be the most accessible way to start generating passive income from this unique asset class.

| Potential Yield | 5-12% |

| Potential Appreciation | Little appreciation, depreciation is possible |

| Minimum Investment | $30 |

| Investor Requirements | No accreditation requirement |

| Liquidity | Extremely limited – No secondary market |

| Other Highlights | Life of copyright assets can produce yield for 70+ years |

If you’d like to learn more, we have a comprehensive overview of SongVest below.

What Is SongVest?

SongVest is a leading investment platform for music royalties. Their unique SongShares offerings are the only SEC-qualified option for fractional music royalty investment. SongVest also provides more traditional auctions of entire music royalties assets as well, for those with deeper pockets.

Deals that are offered on the platform are sourced from the SongVest team working directly with music rights holders.

How Does Investing On SongVest Work?

SongVest has two styles of offerings – auctions and VIP auctions.

Bidding Limit

Each account has a bidding limit. You cannot bid an amount that is higher than your bidding limit. A bidding limit increase can be requested from the settings page.

There is no guarantee the increase will be approved. The timing of an approval is also variable. So, if there’s an auction or VIP auction you want to bid on, submit your request for an increase early!

Auctions

Auctions provide an opportunity for investors to purchase an entire music royalty asset. The type of assets available in auctions are more diverse than the SongShare offerings available in the VIP auctions.

Asset Types

Auctions are typically royalties for a song or collection of songs for the lifetime of the copyright. Sometimes there are auctions for music royalty assets with a different term, such as 10 years or 30 years.

Occasionally, advances are also offered for auction. Rather than taking debt or selling control of their royalties, a rights holder can raise funds through an advance of future royalty payments. These deals are structured similar to a loan, but use the underlying cash flow from the asset to generate regular payments for a fixed time.

The Mook Boy Advance offering is an example of what this looks like.

How Do Auctions Work?

For the most part, auctions work as you would expect, but with one twist.

To get through the basics first, an item will typically be available to preview before the auction starts. Once the auction begins, bids will be accepted for a fixed period of time. At the end of the auction, the highest bid wins. Importantly, the winning bidder must wire the money to SongVest within 48 hours of the close of the auction.

Now, on to the twist.

Each auction has a reserve limit. This is a secret price that the bidding must meet for the asset to automatically exchange hands. If the winning bid does not meet the reserve price, the winner can submit their “best and final offer” for the asset. If the offer is accepted, the sale will proceed.

What Happens After Winning An Auction?

If a sale is proceeding, funds will need to be wired within a couple of business days. They will be held in escrow. Once that is done, a contract will be drafted for review and require a signature.

After the paperwork is complete between buyer and seller, the SongVest team will help the purchaser gain necessary access to files and accounts. They will help with transferring over the royalty payments to the buyer.

What Are VIP auctions?

VIP auctions serve two purposes.

First, they are a way for SongVest to gauge interest in a potential SongShare offering. The results of a VIP auction will heavily influence whether an offering appears on the platform for sale.

Second, they are a way for investors to reserve shares of an offering. If the offer does go live on the platform, winners of the VIP auction will be able to purchase up to the number of shares they bid for.

In simpler terms, VIP auctions basically let investors call “first dibs” on a set number of SongShares.

Assets in VIP auctions may or may not go on to become offerings available for purchase.

What Are SongShares?

SongShares are an investment structure that allows investors to have fractional ownership of a music royalty producing asset.

The SongShare offerings are technically fractional ownership of the royalty stream, not of the song. So, owning a SongShare does not grant any additional or special rights or privileges in regards to use of the song.

More information about SongShares can be found in the SongVest FAQ.

Fees

Each offering also has some level of fees associated with it as well.

SongVest pays $1,500 to Dalmore Group for each offering. That may not seem like much, but it can make up a significant portion of smaller offerings. For “Fear No More” this made up 10.7%-19.5% of the amount raised.

Here’s how fees have impacted the returns for investors from the Chippass offering, which has had 4 distributions so far.

How Much Do SongShares Cost?

For a given offering, the price will be determined by the results of the VIP Auction. Starting prices for SongShares in VIP auctions have recently ranged from $50-$100.

How Do VIP Auctions Work?

As with regular auctions, the VIP auctions have a start and ending time. The offering details will be available for preview before the start of the VIP auction.

While the auction is live, investors can bid for a number of shares at the current price. This bid is only to reserve shares if the auction succeeds and is offered for purchase. In VIP auctions, bids are not binding commitments and no payment will be taken.

What Happens If Not All Shares Are Reserved?

If only some of the shares in a VIP auction are reserved, then everyone who submitted a bid will “win” the auction. Remember – this is only for reserving shares.

What Happens When All Shares Are Reserved?

Once all shares are reserved, new bids will be accepted at a higher price level. These new bids will displace previous bids at the lower price.

Bids are displaced in the reverse order they were submitted. That means the first share reserved at a given price will be the last one to be displaced by a higher priced bid.

This cycle will continue until the auction time ends. At the end of the auction, the final sale price of the asset, as well as the VIP auction winners will be determined.

What Happens After The VIP Auction Ends?

The SongVest team will use the results of the VIP auction to inform their decision whether to launch a SongShares offering for sale.

If there wasn’t enough interest in the VIP auction, then they may decide not to move forward with an offering. This will be communicated to investors through email. Be sure to check your spam folder.

If they decide to move forward with an offering, then the “winners” of the VIP auction will have a chance to purchase SongShares 24 hours before everyone else. During this VIP sale window, the winners can purchase up to the number of shares they reserved.

For example, if 5 shares were reserved in the VIP auction, a winner could purchase 0, 1, 2, 3, 4, or 5 shares in the VIP sale, but cannot purchase 6 or more shares.

After the VIP sale, any unsold shares will be available for purchase. They can be purchased by any investor on the site, not just those that participated in the VIP auction.

After all shares are sold or the offering date ends, those SongShare can no longer be purchased.

If not enough SongShares are sold by the end of the offering, the offering date may be extended. It is also possible for the offering to be withdrawn entirely if enough SongShares are not sold. In that case, investors will receive a refund.

Understanding SongVest Listings

Both Auctions and VIP Auctions use a format for listings that is mostly the same. We’ll focus on the VIP Auction format used for SongShares since that is the most accessible investing option.

Listings are divided into 3 sections. The Summary and Bid Actions, Track Details, and Description.

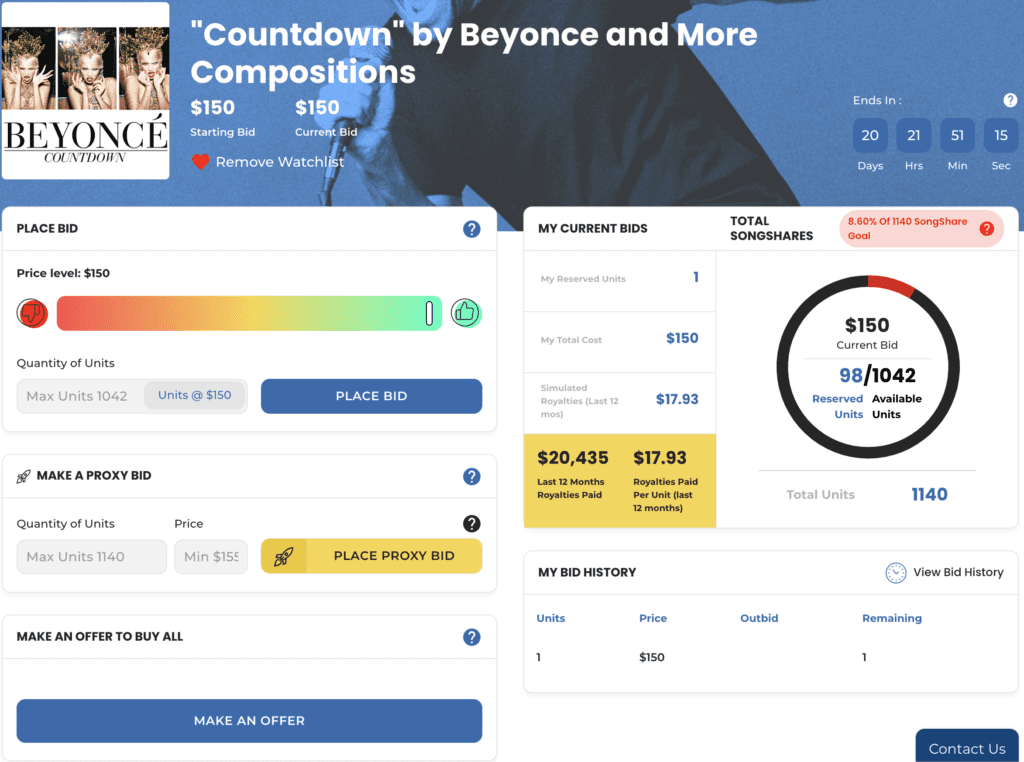

Summary And Bid Actions

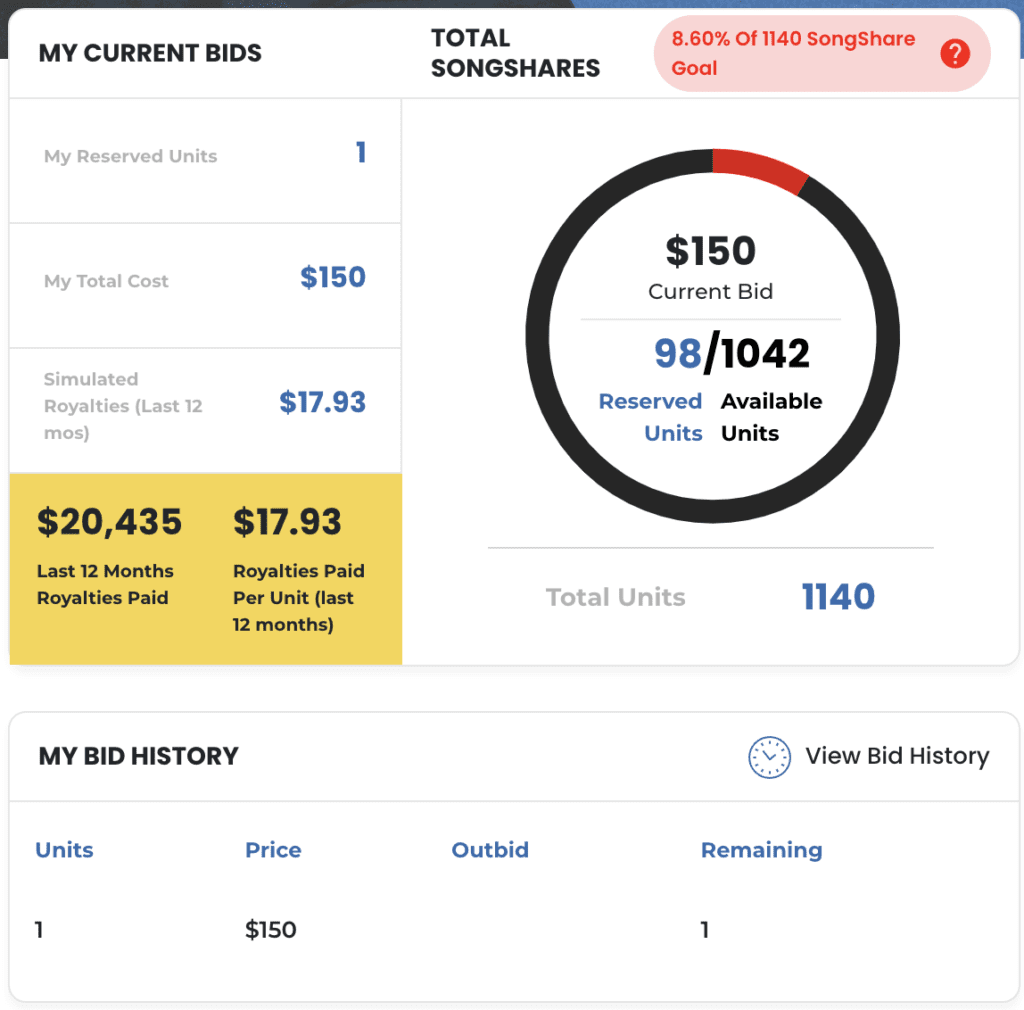

This part of the listing consists of important information about the status of the auction and some high-level metrics about the asset. It is also where you will make and understand the status of your bids. We’ll step through each piece individually below.

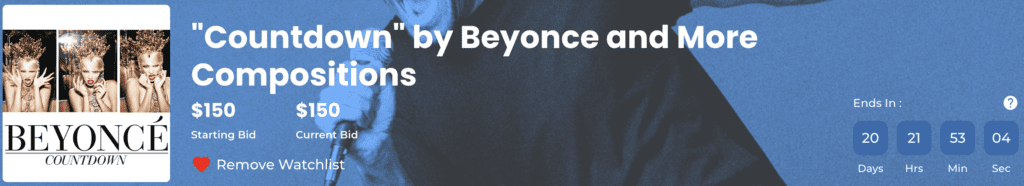

The first visible section of the listing provides the following information:

- The name of the music royalty asset being sold

- A thumbnail image for the asset

- The starting bid price

- The current bid price

- The amount of time remaining in the auction

Additionally, this section allows you to add an asset to your watchlist.

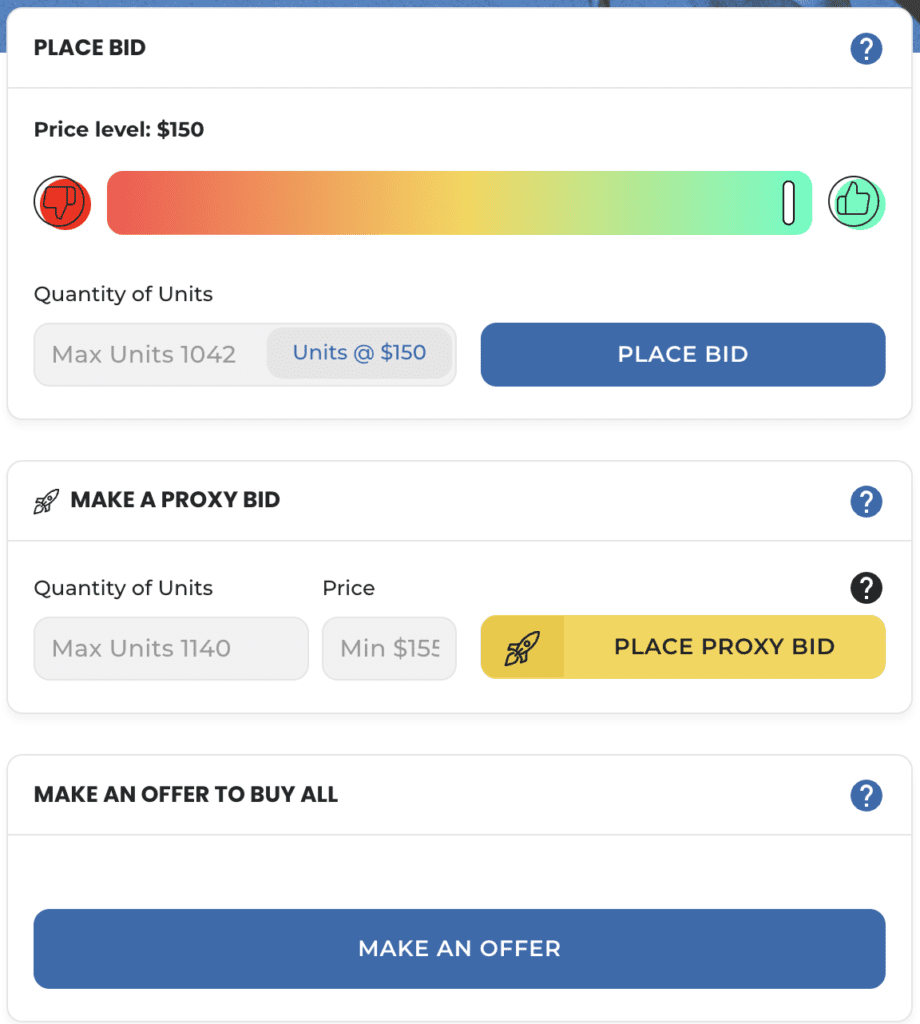

Underneath the header and on the left-hand side of the listing page is where you’ll find all of the bid actions. You can place a bid at the current price or place a proxy bid. You can also make an offer to buy the entire asset.

Placing a regular bid can be done by entering in the number of desired shares and clicking the “PLACE BID” button. Once the bid is placed, you’ll see the position of your bid.

Your bid position is displayed on a colored scale from red (on the left) to green (on the right). The size of your bid icon is relative to the portion of the asset that you have bid for. If all SongShares are bid for at the current price level, a new icon will be displayed starting from the list. That new icon will track the progress of bids being displaced.

Entering a proxy bid using the “PLACE PROXY BID” button will have the system place automatic bids up to your specified price if the price increases.

The most important piece of information here is the “Royalties Paid Per Unit.” This is based on taking the total amount of royalty payouts from the last 12 months and dividing it by the total number of units. Both pieces of that calculation you can find alongside the Royalties Paid Per Unit.

The Royalties Paid Per Unit, provides the trailing 12 month yield of the asset. Using “Countdown” as an example, the past 12 months would have resulted in a $17.93 of royalty payouts. At $150 a share, that would have been about a 12% yield.

For music royalties, the multiple of the last 12 month’s earnings (LTM) is typically used for valuation. 1140 shares at $150 each results in a total offering of $171,000. That’s about 8.4 times the $20,435 LTM.

This section also provides a few other important data points. This includes a list of your bid history, as well as the total number and percentage of available shares that have been reserved for so far. It will also show a model of the total number of shares, the total cost, and the previous year’s royalty payouts for shares you have bid for (and have not been outbid on).

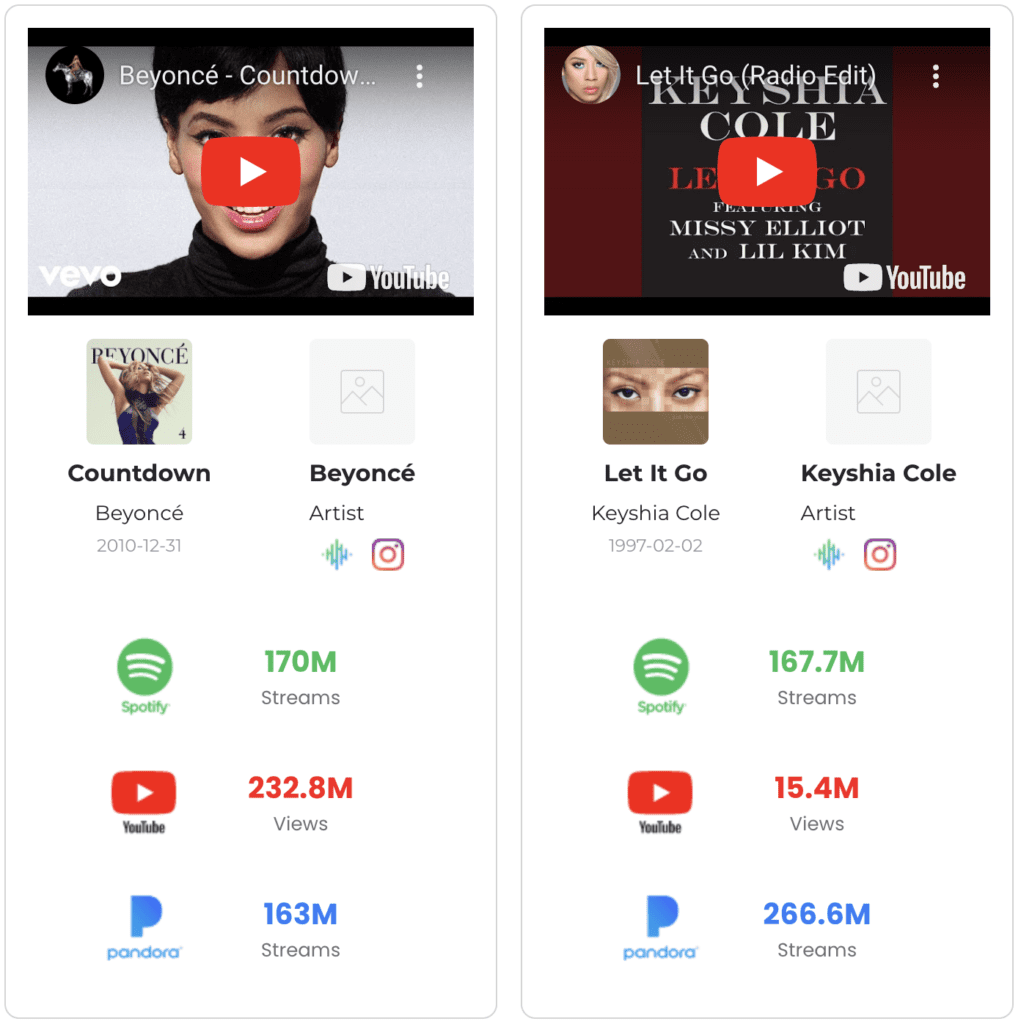

Track Details

The track details section shows high-level information about the major tracks in the offering.

In the case of the “Countdown” SongShares, the two main songs are “Countdown” by Beyoncé and “Let it Go” by Keyshia Cole. We can see embedded YouTube videos. There are also metrics about the artists’ streaming performance on Spotify, YouTube, and Pandora available.

Description

The description is the main body of the listing. There are a lot of sub-sections inside here, but we can broadly divide it into two sections – descriptive details and financial details.

Descriptive Details

The first part of the Description section contains the following set of details:

- The type of rights

- The type of income

- What organization royalties are paid by

- The term or length of time the asset produces royalties for

- Links to resources on VIP Auctions and how to bid

- The share of royalties

- The royalty payout frequency

- A CSV file you can download with detailed information about the royalty payouts

- A brief summary of the asset

- Summary, historical, and descriptive information, as well as streaming stats about significant songs in the collection. In this example, information for Beyonce, “Countdown” and “Let It Go” are provided.

- The terms of the royalty share agreement

Financial Details

The financial details can vary from listing to listing, but include information such as:

- The historical royalty payouts for the asset. For newer songs/albums there may be no historical payout information. However, for older assets, there might be years worth of historical data.

- The royalty payouts over time by individual song in the asset

- Highlight information for the top songs in the asset

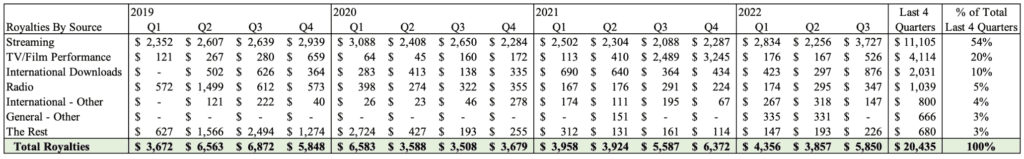

- Data about the sources of royalty payouts over time

Each of these sections may also have commentary provided by the SongVest team to help contextualize or call out specific data anomalies.

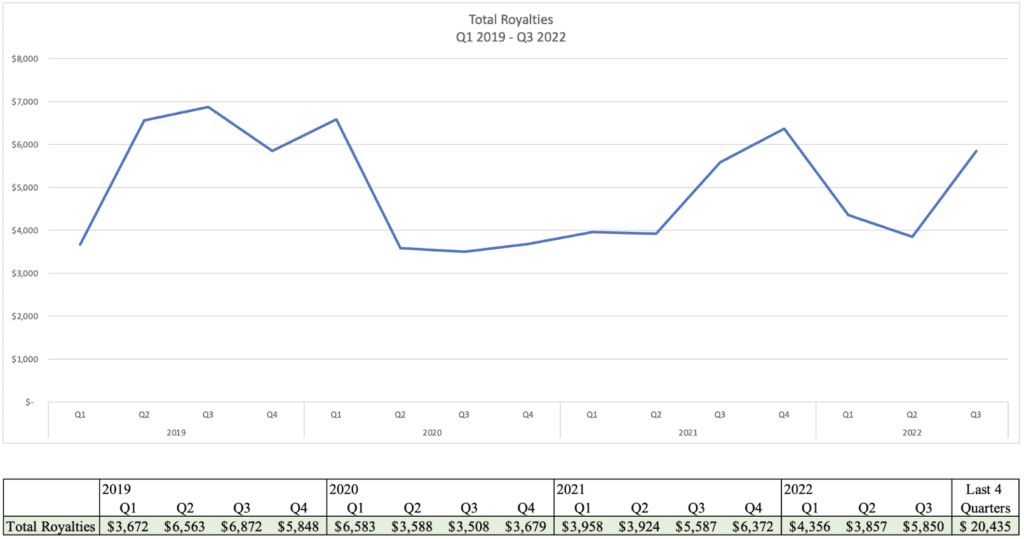

All of these can be valuable and important to understanding the potential risk and reward of the investment opportunity. One that is always worth reviewing is the total royalty payouts over time.

This provides a sense of how stable the royalty earnings have been. It also helps to identify how realistic it is to expect the last 12 months’ performance to continue.

In this particular example, there is a spike in Q3 and Q4 of 2021. There’s also an uptick in Q3 of 2022. The listing provides the necessary context to understand this:

Royalties for Q3 2021 and Q4 2021 were higher than for the previous five periods due to increased television performance royalties for one title. Q3 2022 royalties were higher than the previous two periods primarily due to higher royalties from one streaming service for one title.

– SongVest from the “Countdown” listing

The additional “Revenue by Source” table included in the listing clearly shows that spike in TV/Film royalties:

Another important factor to review is the age of the song(s) in the offering.

Royalty earnings for a new song usually peak shortly after the song is released, have a severe and rapid decline after the song is no longer “new,” and then reach a more stable baseline. Older songs are likely already at that baseline level and will generally have less volatility in their earnings.

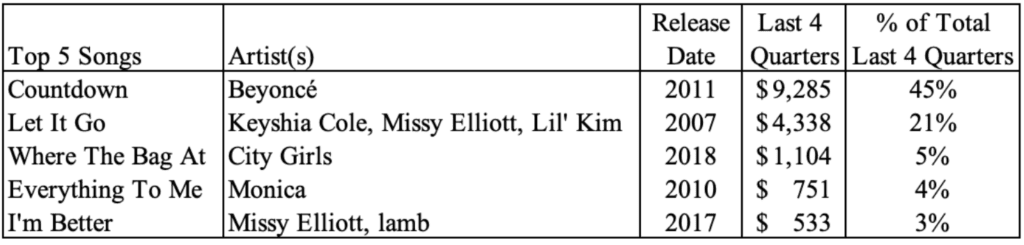

To help understand that, we are also provided with a table that shows the age of the top 5 songs. It also shows the portion of royalty earnings each of those songs represents.

Despite “Countdown” having more than 70 songs in the catalog, almost 80% of the royalty earnings come from the top 5 songs.

In addition to the information already shown here, “Countdown” also has an additional “Revenue By Song” table available and all the raw data in the CSV file (included in the descriptive details) for your analysis.

Frequently Asked Questions About SongVest

Yes, SongVest is a legitimate US business. SongVest’s SongShares offerings are all qualified by the SEC. This requires them to file information related to all their SongShares offerings with the SEC.

SongVest has also raised funds through equity crowdfunding. That required them to file their Form C with the SEC, which provides a lot of detail about the operation of the company and its business.

Where To Learn More

We have additional resources related to music royalties and SongVest:

To learn more about SongVest, you can check out these pages from their website: