SongVest launch a record number of offerings this month. Three new offerings across several different music genres went live in November.

Let’s take a look at these upcoming offerings and see what we can learn. Plus, a look at one HUGE VIP auction that’s launching at the same time.

“Cross Me” SongShares Offering

Cross Me debuted in late 2018 from artist YoungBoy Never Broke Again.

This is a life of copyright asset. This means it will produce royalty yield until 70 years after the author’s death (source). YoungBoy NBA is still alive and at a relatively young age – just 23 years old. That means this asset could produce yield for more than a century.

Based on the royalty data provided by SongVest, Cross Me seems to follow the “L” curve we talked about in our Music Royalty overview (here). What exactly does that mean? Let’s explain.

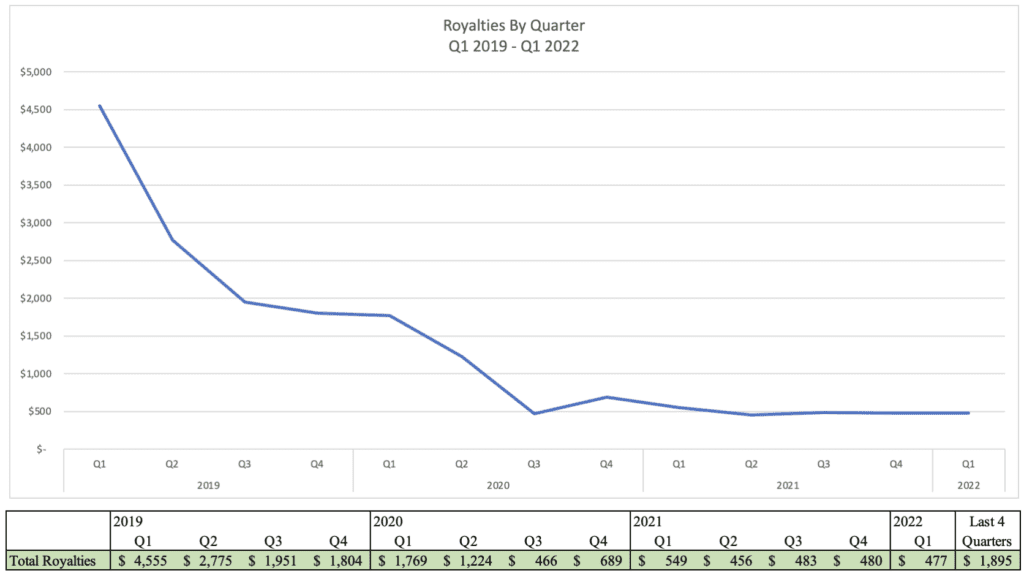

SongVest has provided 3 years worth of royalty payout data for this asset. Here’s the highlights:

- In the debut quarter (Q1 of 2019) it yielded $4555

- By Q3 of 2019, that was down to $1951

- Fast forward to Q3 of 2020 and that hit $466

- From Q3 2020 to Q1 2022, royalties ranged from $466 – $689

In one year, quarterly earnings fell $2786 or about 62%. In 18 months, earnings were down nearly 90% from the debut quarter.

If you’re used to looking at stocks, this might be triggering your “run for the hills” instincts. That’s understandable, but we have to remember that this is the typical arc of a song. New songs get a lot more attention just for being, well, new.

Songs or music catalogs are typically valued as a multiple of the last 12 months of earnings (sometimes noted as LTM). The LTM, from the data we have available, is $1895. At $100/share and 215 shares for sale, that’s a multiple around 11.3.

That’s a yield of 8.5-9% per share. That’s just from the last 12 months though. That has already happened and is not, what an investor in this asset would be paid on. Of far greater concern is the future earnings.

Since the “new song” phase ended, earnings hit a bottom in Q3 of 2020 and have been relatively consistent since then. Across 7 quarters (Q3 included) here are some key metrics:

- Minimum quarterly earnings – $456

- Median quarterly earnings – $480

- Average quarterly earnings – $514

- Maximum quarterly earnings – $689

“Fear No More” SongShares Offering

Fear No More was released in April of 2019 from the artist Building 429.

This is also a life of copyright asset and will receive royalties until 70 years after the author’s death (source).

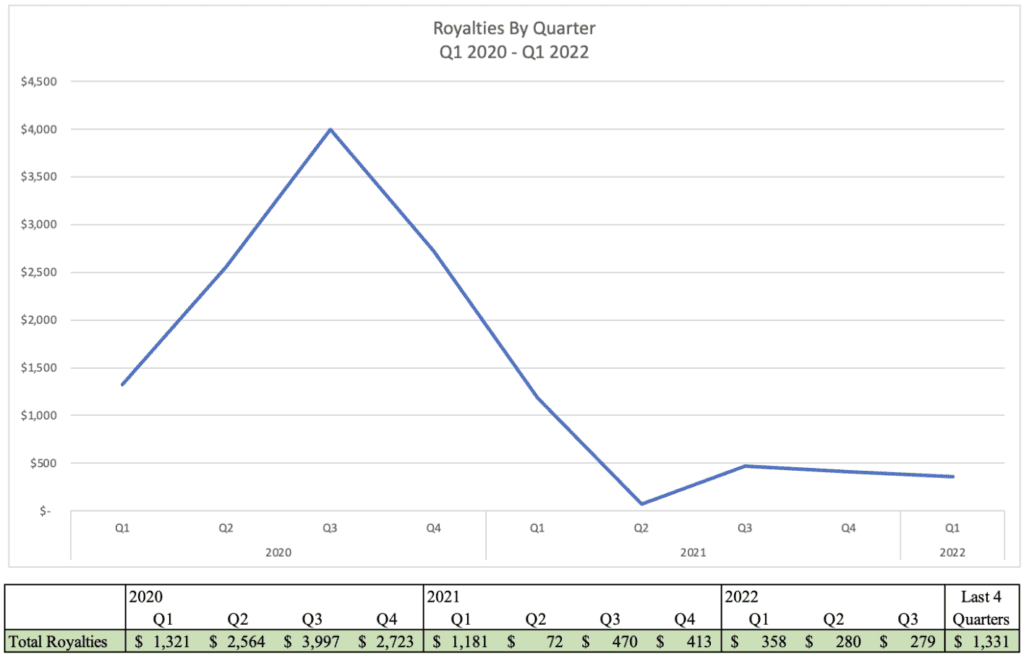

We can see that Fear No More follows a little bit of a different pattern than Cross Me.

In this case, the song royalties ramped up for a couple of quarters before peaking in Q3 of 2020. This was followed by a huge drop-off into Q2/Q3 of 2021. SongVest notes this drop-off was due to a reduction in earnings from radio royalties. The drop was driven by the song falling off of its chart peak and no longer being “new.”

Here’s the highlights:

- In the debut quarter (Q1 of 2020) it yielded $1321

- This ramped up to a peak of $3997 in Q3 of 2020

- By Q3 of 2021 earnings landed at $470

- Earnings have continued to decrease, dropping to $280 in Q2 of 2022

From peak, earnings have fallen about 93%. The past two quarters have nearly identical royalty payments – $280 and $279, potentially suggesting that earnings may be stabilizing.

In the last 12 months, earnings have been $1331. There are 140 shares for sale at $100 each. That gives us a multiple of 10.5 and a trailing yield of about 9.5% per share.

On initial glance, Fear No More seems like a better value than Cross Me. However, Cross Me has a longer track record and more stable recent earnings.

If earnings were to stabilize at ~$280/quarter, then we’d be looking at a 12.5 multiple and 8% yield.

Fear No More has received 64% of its royalties from Radio. That’s uniquely high among the offerings SongVest has had so far. As a point of comparison, Cross Me earned 70% of its royalties from Apple Music and YouTube.

“Runnin’ (Lose It All)” SongShares Offering

Runnin’ (Lose It All) was a fall 2018 track from artist Naughty Boy.

As with the previous two offerings, this is also a life of copyright asset and will receive royalties until 70 years after the author’s death (source).

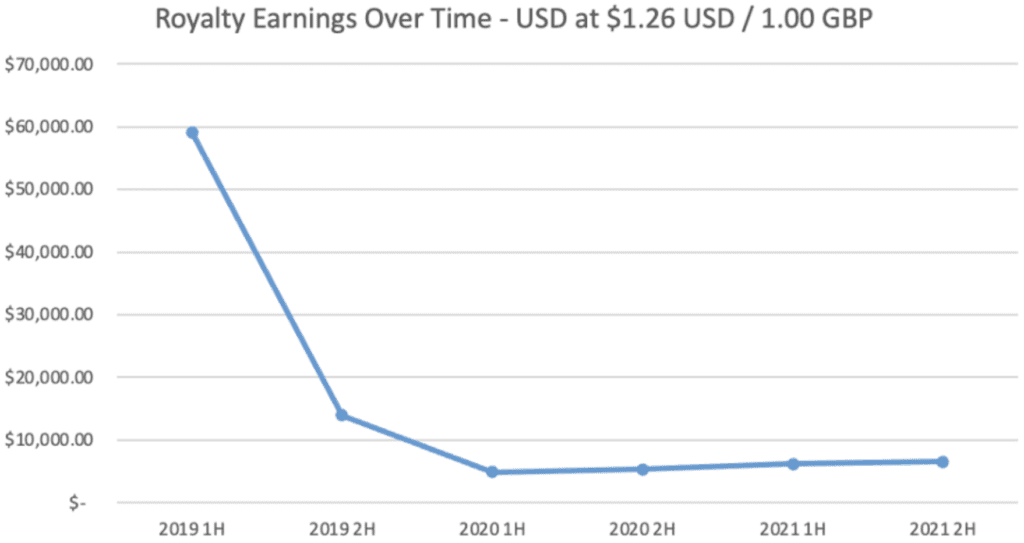

We see the “L” pattern in earnings, similar to Cross Me. Royalties for this asset are paid semi-annually (twice-per-year).

Here’s the highlights:

- In the debut period (H1 of 2019) it yielded £46,902 in royalties

- By 1H 2020, earnings were down to £3902

- After bottoming in the first half of 2020, earnings have been slowly climbing back up. They reached £5203 in 2H 2021.

You may have noticed the £ sign in front of the earnings figure above. It appears the asset earns royalties in GBP, which adds a currency exchange rate variable to the USD royalty payments we may receive.

In the SongVest materials provided, USD earnings were modeled based on a $1.26 USD to $1 GBP rate. At press time, this is down to $1.19 USD to $1 GBP. That difference would be the equivalent of reducing the last 12 months’ earnings by about $718, or just over 5.6%.

In the last 12 months, earnings have been £10111. There are a whopping 1066 shares for sale at $250 each. Using the currency adjustment mentioned above, we end up with a 22.2 multiple and around 4.5% trailing yield.

That is with some movement in the post-peak earnings period. We have 4 halves (2 years) worth of data from that period. Here are some summary metrics:

- Minimum quarterly earnings – £3902

- Median quarterly earnings – £4554

- Average quarterly earnings – £4553

- Maximum quarterly earnings – £5203

“Countdown” SongShares VIP Auction

This offering going up for VIP auction is a catalog of more than 80 songs. It is headlined by the song “Countdown” by the artist Beyoncé. You may have heard of her.

Items in the catalog are all for the term of the life of copyright. As with the others above, this means they will receive royalties until 70 years after the author’s death (source).

Countdown is very different from the offerings going live for purchase tomorrow. This is for two reasons.

One, this is a catalog with many different song compositions.

Two, the songs making up the body of this collection are all older. That means we’ll only be looking at data that’s from after those 70-90+% drop-offs in royalty earnings from the song’s debut and chart peak.

Let’s look more at the song mix. From the SongVest listing we see:

- The top song, Countdown, is 45% of the royalty earnings

- Let It Go is 21% of the earnings

- The next 8 songs are another 21% of the earnings

- The remaining compositions (70+) make up the remaining 12%

This is a top-heavy collection. There are a lot of other compositions to diversify the collection’s earnings, but the top two songs (66% of the earnings) will drive the performance. If everyone stops listening to Countdown, the royalty earnings will almost be cut in half.

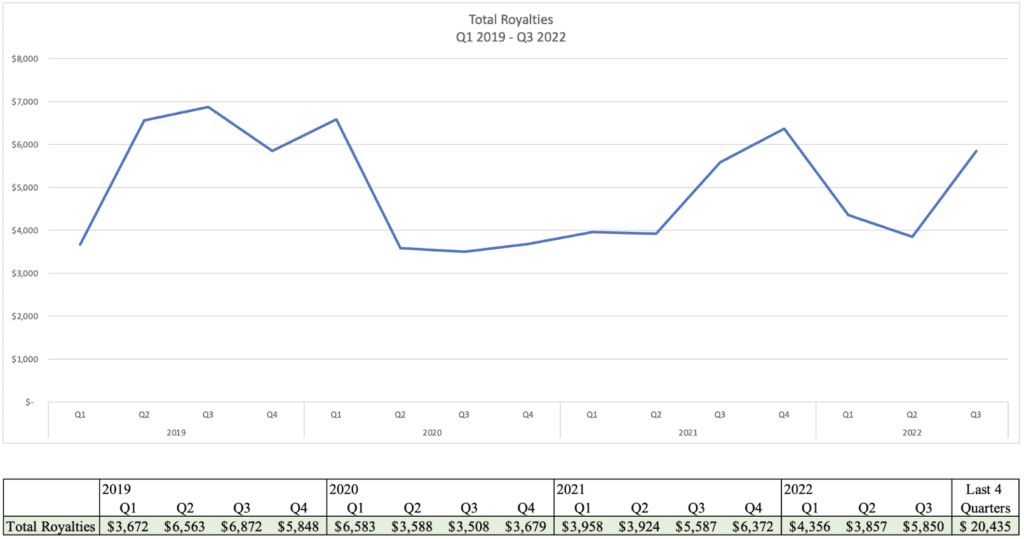

Interestingly, there is some noticeable variability in earnings, even with this collection driven by older songs. SongVest has data from Q1 of 2019 through Q3 of 2022. Here are some of the metric highlights:

- Minimum quarterly earnings – $3508

- Median quarterly earnings – $4356

- Average quarterly earnings – $4941

- Maximum quarterly earnings – $6872

There’s a pretty big spread between the minimum and maximum quarterly royalty amount. On top of that, both the min and max values notably deviate from the median and average earnings.

Why is that? I can’t say exactly, but there are some hints in the listing.

TV and Film Performance has been 20% of the last 4 quarter’s earnings from the catalog. Countdown drove a huge uptick in earnings for this category in Q3 and Q4 of 2021. In those two quarters, TV/Film royalties were $5734. It was $510 in the two prior quarters and $343 in the following quarters.

According to the listing, Q3 2022 also saw an uptick in royalty earnings from Countdown’s performance on YouTube.

Now that we understand the catalog better, let’s get to the valuation.

SongVest is putting 1140 SongShares up for VIP auction, starting at $150/share. The last twelve months earnings were $20,435. That’s a multiple of 8.4 and a trailing yield of about 12%.

That’s actually in-line with the 3 offerings discussed above. Given that older songs are generally more consistent and command higher multiples, that seems like it should be a surprise.

However, it is likely discounting some of the earnings volatility mentioned above. The LTM figure still includes a $3245 payout for TV/Film in Q4 2021. We can make a simple attempt to “control” for that. Let’s just assume a much more normal $245 payout instead. The LTM would adjust down to $17,435, the multiple would go up to 9.8, and the trailing yield drops to just above 10%.

That’s not a bad price to pay for a catalog of older songs.

Want To Learn More?

Introduction To Music Royalties

New to the asset class? No worries! Take a look at this approachable introduction to get started.