What Is Vint?

Vint is an investment platform for wine and whisky assets.

The Vint team will source investment-grade wine and whiskey, create “collections,” qualify offerings with the SEC, and provide fractional investment opportunities on their platform. They’ll also handle insurance and storage for everything – no wine cellar needed.

Investment Platform Highlights

Performance

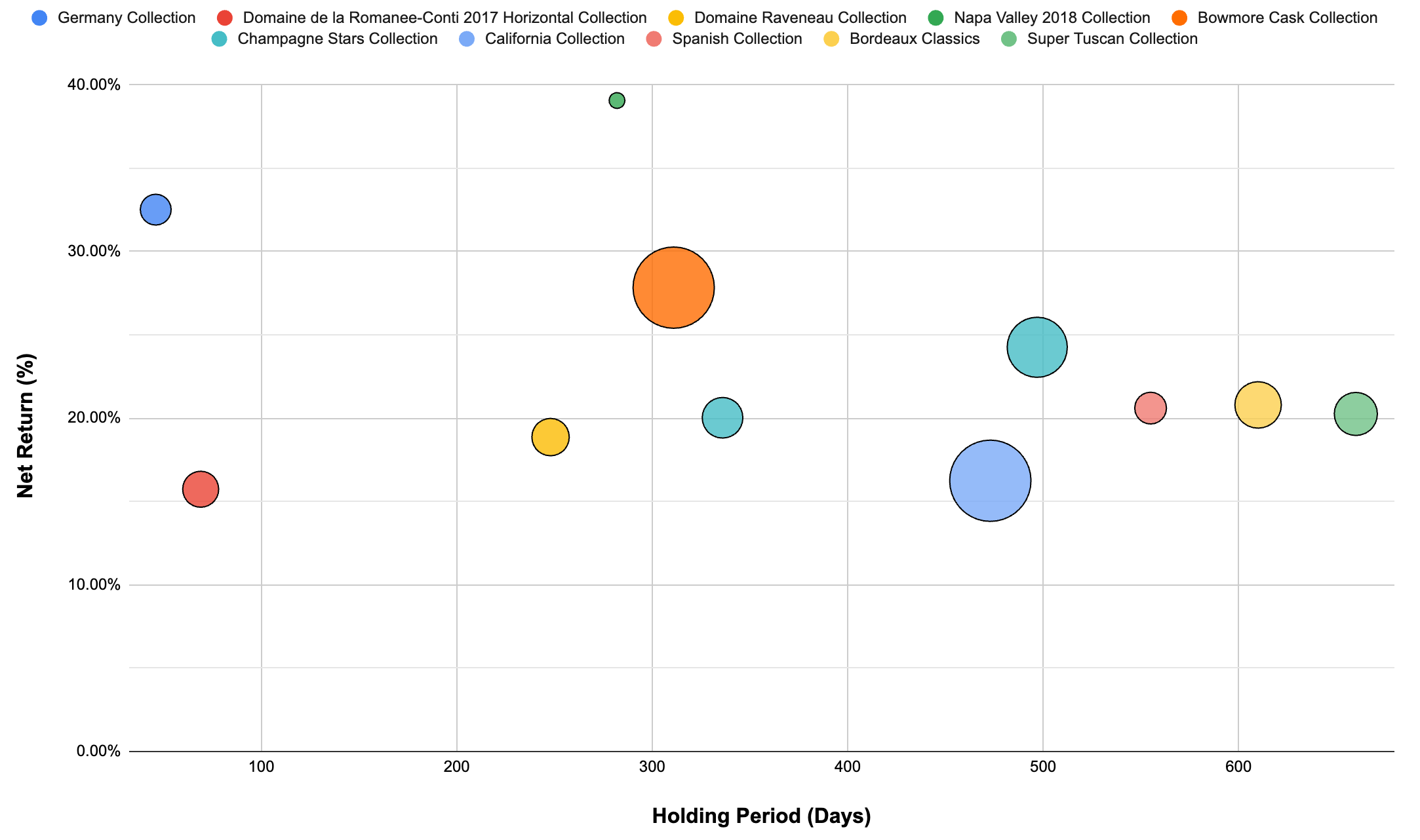

As we have previously covered, Vint has already been able to make at least partial exits on several of their collections. We have a chart below that helps to visualize this.

Each point on the chart is a different exit. On the vertical axis is the net return achieved from the exit. The horizontal axis is how many days the collection was held for before the exit occurred. The size of the circle represents what percentage of the collection was exited at that time.

For example, you can see the dark green bubble towards the top of the chart. That is the Napa Valley 2018 Collection. In that distribution, investors received a ~39% return after it was held for 282 days. However, you’ll note that the circle is quite small. That’s because only ~9% of the entire collection was sold.

Offerings

So far Vint has launched 80 collections for a total of ~$7.4M in offerings. Here’s a bit more insight into what those have been. The information is current as of July 6, 2023.

So far wine has been the dominant offering type on the platform, coming in just under 70% of total invested dollars on the platform.

Out of the wine offerings, France has unsurprisingly dominated:

Whisky offerings have been mostly balanced between two main regions:

Lastly, we have an interactive tree map of Vint’s offerings so far. It is categorized first by the asset type (Wine vs Whisky) and then the region.

Since France features so heavily in the offerings and because there are specific investment regions of France, we have broken those out. Specifically, Bordeaux, Burgundy, Champagne, and Rhone Valley are all a part of the French wine industry.

The color-coding is based on the returns so far. The assets on Vint have multi-year target holding periods, so it makes sense that there haven’t been many sales. Vint also does not provide theoretical share value updates.

Lastly, returns from the sale of small portions of a collection have been prorated. That is why you’ll see low numbers like 2.97% for SPAN. While the partial sale netted a strong 20.6% return, only 14.4% of the collection was sold.

Competitors

There are other companies providing investment opportunities for wine and whisky.

Vinovest

Potentially the most notable competitor is Vinovest. They provide both wine and whisky offerings as well, though the platforms operate very differently.

First, with Vinovest you actually own the individual bottles of wine or casks of whisky. However, they charge an ongoing management fee to cover costs like insurance and storage. That’s a withdrawal from your account every month.

With Vint, you have fractional ownership of the collection through an LLC. When you invest in a collection, the whole lifetime of fees are built into the offering.

Vinovest has an automatic investing offering, in addition to the ability to purchase individual bottles of wines. New bottles are infrequently added to the marketplace though. Purchasing and selling those bottles both come with fees as well.

Lastly, there are differences in the amount of money you need for an investment. With Vint, most collections are available for $50-$100/share. Vinovest’s automated offering requires a $1K-$2K investment to get started. Their individual wine bottles technically can be found for around $75, but most will require more than $100.

This is just a quick summary of some of the main points of differences between these two platforms. If you’d like to see more, we recommend taking a look at this article:

Ready To Learn More About Vint?

If you liked this summary, consider taking a look at our in-depth introduction:

Detailed Introduction To Vint

This article will explain what Vint is and how to access their fractional wine and whisky investments.

To support an ad-free experience, we may earn a commission from links on this page.