AcreTrader offers strong deal flow and a variety of different fractional farmland investment opportunities for accredited investors.

| Potential Yield | 2-6% |

| Potential Appreciation | 2-6% |

| Minimum Investment | $15,000 |

| Investor Requirements | Accreditation is required |

| Liquidity | Extremely limited – No secondary market |

| Other Highlights | Row crops and permanent crops have very different return profiles |

If you would like to learn more, we have a full overview of AcreTrader down below.

What Is AcreTrader?

When you start investigating how to invest in farmland, AcreTrader will be one of the first names you come across. It’s a leading platform for creating fractionalized investment opportunities for farmland assets of various types that are sourced from across the US.

The platform has historically had strong deal flow with multiple investment opportunities available each month. The most common type of offerings so far have been for row crops, but they also have permanent crop and timberland offerings as well.

They also recently became a broker-dealer with FINRA. In a webinar in February, they indicated that becoming a broker-dealer would likely allow them to expand the types of offerings and the investment structures available on the platform. So it is possible that we will start to see more interesting and innovative deals in the near future.

You’ll have to be an accredited investor to use the platform and a realistic minimum investment is around $15,000, though this will vary based on the deal.

Investment Process – How Does AcreTrader Work?

For most offerings, things move fairly quickly. It starts with an announcement email, which will include the opportunity name, the time it will launch on the platform, some basic information about it, and a link to preview the offering on the site.

At this point, you’ll be able to see all the information in the offering listing and review the available documents. There may also be a webinar or additional information provided prior to the investment going live, but that is not always the case.

For the example we will use in this article, the announcement email went out on the morning of Friday April, 7. On April 11 there was a live webinar and Q&A session before the offering went live a few hours later. As far as we are aware, within less than 12 hours, the ~$4M offering was fully subscribed.

Once you’ve made an investment, there will be some time for money to transfer and the investment will be pending closing. The closing period is not immediate, so don’t be alarmed if an offering is still pending closing for 1-2 months after being fully subscribed.

What Do You Actually Own?

For their investments, AcreTrader uses a tried-and-true approach to fractionalizing alternative assets. The underlying farm and its title are owned by a legal entity, which is almost always an LLC. However, it has occasionally been different. For example, several offerings from the state of Minnesota were structured as LLPs.

What investors are then purchasing on the platform, and have ownership of, are basically shares of that legal entity.

AcreTrader Fees

When we’re looking at alternative investments, there’s pretty much always fees. AcreTrader is no exception. The specific types of fees and the parameters around how they are calculated and what the rates are can actually vary significantly from deal-to-deal. This means that, for a given opportunity, you will always need to review the listing and the documentation they provide to understand the specifics for that offering.

That having been said, we can still help give a general framework on what to expect.

First, we have to understand that these opportunities generate money in two broad ways – appreciation and sale of the land and yield paid from income.

Second, different opportunities can vary greatly in the details of how these work. In the case of simple row crop offerings, the income is mostly from a fixed rent payment and is not likely to be that high. Most of the gains will come from the sale of the property at the end of the deal. Other offerings can have more complex structures like crop sharing agreements and flex leases, especially for permanent crops.

With that context in mind, here are some different types of fees that you may see:

- Farm/Timberland Management Fee

- This has typically been collected as an up-front fee as a portion of the offering price. From a few sample offerings we reviewed, we saw 0.75% being used.

- Asset Under Management (AUM) Fee

- The AUM fee is paid annually and, based on our review of past offerings, is intended to match with 0.75% of the land’s value.

- Note that this does mean if the land appreciates and that increased value is reflected in an “occasional” appraisal that is performed, then the AUM fee will also increase.

- Carried Interest

- This is a fee that we sometimes call a performance or incentive fee because it’s a bit easier to understand.

- Basically, up until a certain point (“hurdle”) 100% of the returns will go to the investors. After that point is exceeded, then the excess returns are split between the investor and AcreTrader.

- It is typical for the split to be either 90/10 or 80/20 with the former being the investor’s share of profits exceeding the target.

- Revenue Share

- We’re using this as a bit of a blanket term, but the general idea is that the platform can take a certain percentage of gross revenue.

- This would be similar to if you hired a property manager for an investment property. In exchange for their services, they’ll keep 8% of the rent payments.

Offerings So Far

You may be wondering what type of farmland offerings you can find on AcreTrader. While we don’t know what the future will bring, we can take a look at the past as a guide. Below we have some breakdowns of offerings that have been available so far.

The offerings so far have been mostly row crops, with some presence from their newer timberland offerings. The states and crops that have been available largely align with that focus.

Understanding Investment Listings On AcreTrader

From the Invest page, you can see open and upcoming farm and timber opportunities. Clicking on one of them will bring you to the listing page.

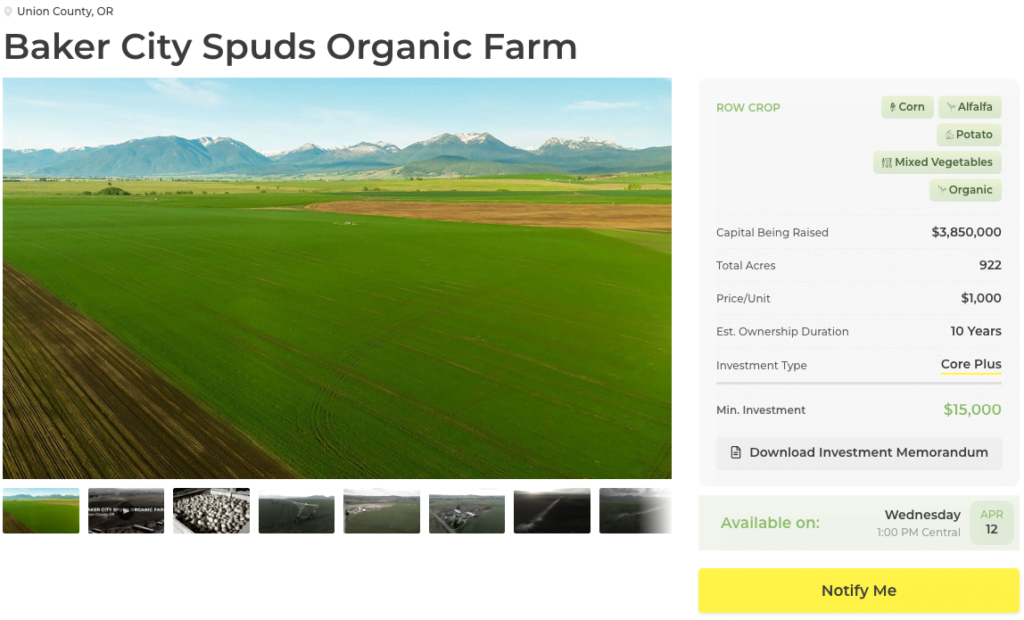

Offering Landing Page

When you first click into a listing, you’ll see a landing page that will give you a lot of high-level information very quickly.

Within this landing page you’ll see the featured image for the listing. Below it you’ll also find other images and any recorded video content, such as a webinar, for your review. If a “Highlights” video is available from the list, it is almost always worth a watch. They are typically short, 5-ish minute videos that provide a ton of information about the farm and can help answer a lot of potential questions.

Alongside the image and video content is a list of important, high-level information about the opportunity. This includes the location, the type of crops being grown, the size of the offering, the total acres of the farm, the price per unit (think “share”), the estimated holding period, the investment type/risk profile, the minimum investment, and when the investment will be available.

Overview

After getting oriented with the landing page, the next section of the offering you’ll find is the overview. This is a text-heavy section that will lay out a lot of important information.

The first section will cover a lot of the type of information included in the “Highlights” video. It’ll walk you through things like aspects of the opportunity, the history of the farm’s crop production and water usage, available water resources, climate, soils, available infrastructure, and more.

After all that information comes the Investment Highlights section, which breaks down key points about the opportunity into a few short bullet points.

Lastly, this is followed by the Additional Details and Risk Factors and Disclosures sections. We would never discourage you from reading any part of the offering information, especially the risks.

That having been said, these two sections are more in-line with disclaimers. The risk factors listed are the two most obvious and generic – there’s no guarantee that the investment will perform and loss is possible, as well as the fact that the investment is illiquid. From there they do have a link to a document that provides a much more detailed explanation of the risks, but it is the same document linked in each offering.

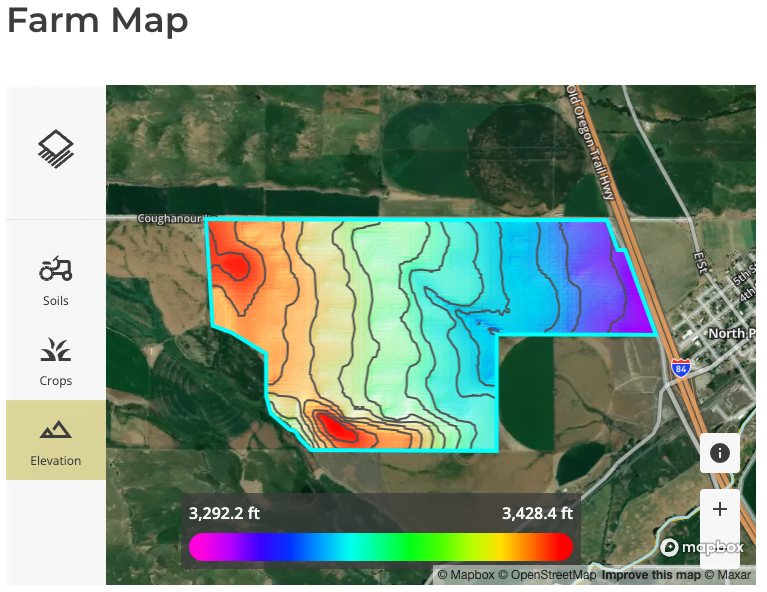

Maps

The Maps section provides information about the farm from their Acres tool. It will have the property in the offering highlighted and you’ll have the ability to click through different layers.

On the map, you have layers for soils, crops, and elevation. In the example above you can see two sections of the parcel that have higher elevation in the north and southwest corners from the elevation layer. The crops layer provides a visualization for which crops were recently planted in which parts of the farm. Soils provide a view into which types of soils are in which areas of the property.

Financials

The information available for the Financials tab helps to explain where money is going to or coming from for the investment. In our example offering it allows us to see things like, how much the closing costs were, what the sponsor’s equity is, and the estimated rent payment per acre.

In most offerings, this is also the area where you’d be able to see the expected yield from the offering. How that yield is earned can vary significantly between deals, so this could sometimes just be a simple annualized rate (e.g. 2.3%) or a table showing the expected yield in each year of the investment.

In the case of our example and another more recent sponsored deal this information hasn’t been included in the Financials tab and requires digging into the documents to learn more.

Documents

The last section contains a variety of attached documents to help you understand the terms and details of the offering. The amount and type of documents vary between offerings, but here’s a rundown of what we saw across several recent offerings:

- Memorandum

- When present, this is a document to prioritize reviewing. The easiest way to explain this is that the offering page introduces and summarizes figures and information, but the Memorandum explains it in far more detail.

- The memorandums are confidential, so we are somewhat limited in what we can share.

- As an example of the types of details available, in the memorandum for our example Baker City listing, there are about 3 pages of additional information about the history of which crops were produced in which volumes over the past 5-10 years on the farm.

- Articles of organization

- Copy of a legal document or record demonstrating the formation of the relevant legal entity to the offering, such as the series LLC.

- EIN application and confirmation

- A copy of a document from the IRS showing the receipt of an EIN for the legal entity in the offering, which will be required for things like opening bank accounts.

- Financial Model

- A spreadsheet with a variety of different financial information.

- This includes things like the cost assumptions, lease information, and carried interest projections and calculations.

- Operating agreement

- When you invest on AcreTrader you are purchasing shares of a legal entity. This document sets up a framework for the operation of that entity.

- It includes some basic information like the name of the entity, but also defines things like the rules and procedures of the entity. This is where you would find the more legal-oriented details about how distributions will work, for example.

- Subscription agreement

- While the operating agreement is about the legal entity, the subscription agreement is about your investment.

- This document also sets out some rules, procedures, and agreements as it relates to the investment.

- It does include agreements from you if you choose to invest. For example, that you promise to give AcreTrader the money that you committed to when you made your investment.

- Recorded Deed

- A copy of a legal document recording the acquisition of the land/property in question for the offering.

- Webinar Slides

- A PDF document with the slides from a previous webinar.

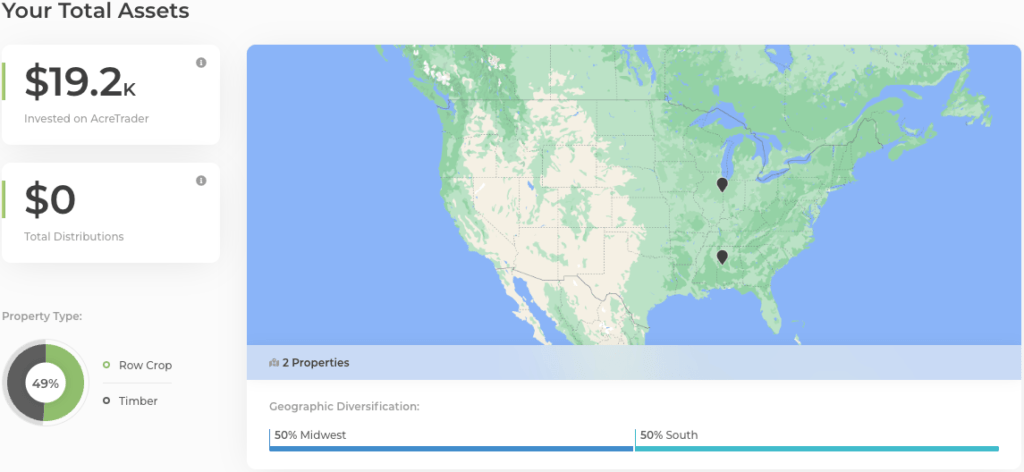

AcreTrader Portfolio Page

The Portfolio page is where you can see a summary of all the investments you have made. This includes investments that have not yet closed.

When you first arrive on the portfolio page, the “Overview” tab will be active. This shows the total amount you’ve invested on AcreTrader, the distributions you’ve received so far, where your farmland or timberland properties are on a map, and your diversification for both geographies and property type.

A small note that investments will only appear on the map after they have been closed.

In addition to the graphics, there is also an investment summary, which provides a table of the investments you’ve made. You can also get a more filtered view of your investments by clicking the “Funding,” “Active,” or “Exited” tabs at the top of the page. Since relatively few offerings have been exited, you are unlikely to see anything there.

Frequently Asked Questions About AcreTrader

Is AcreTrader Legit?

Yes, AcreTrader is a legitimate US business and investment platform. They are a registered broker deal with the Financial Industry Regulatory Authority (FINRA) and a member of SIPC.

What Is AcreTrader’s Minimum Investment?

AcreTrader’s minimum investment varies significantly between offerings. On very rare occasions, it is possible to invest with less than $10K. Some offerings are available in the range of $12K-$15K, while others can feature minimums as high as $35K.

Is AcreTrader A Good Investment?

Whether AcreTrader is a good investment or not depends on your individual goals, circumstances, and risk tolerance.

Farmland and timberland have historically been a lower-volatility asset class with reasonable returns that is not correlated to other major risk assets. While AcreTrader makes it much easier to invest in them, they also charge additional fees, which can impact investment returns over time.

Who Owns AcreTrader?

AcreTrader is a private company, so their ownership structure isn’t exactly known. However, it is reasonable to assume that their founder and CEO, Carter Malloy, and other employees at the company have a significant stake in the business. Additionally, they have raised more than $80M in funding according to Crunchbase. That means that the venture capital firms listed on their Crunchbase profile have some ownership stakes as well.

Does AcreTrader Charge Fees?

Yes, AcreTrader charges fees for all their offerings. The type of fees and amount can vary between each offering, so it is best to review the offering documentation carefully. You can also check out this section of our overview for more information about the types of fees you’ll see on the platform.

Where To Learn More

If you would like to learn more about AcreTrader and farmland, their resources center is a great jumping-off point to find additional information.

You can also take a look at some of our other resources:

Introduction To Farmland

New to the asset class? This is a very approachable introduction with links to other resources.