FarmTogether offers a variety of ways to invest in farmland on a simple and accessible platform. A $15,000 investment allows you to get started in this asset class offering both yield and appreciation.

| Potential Yield | 2-6% |

| Potential Appreciation | 2-6% |

| Minimum Investment | $15,000 |

| Investor Requirements | Accreditation is required |

| Liquidity | Extremely limited – No secondary market |

| Other Highlights | Row crops and permanent crops have very different return profiles |

If you’d like to learn more, we have a comprehensive overview of FarmTogether below.

What Is FarmTogether?

FarmTogether is an investment platform exclusively focused on farmland offerings. They have multiple different ways for accredited investors to invest in farmland. Both row crops and permanent crop type offerings are available on the platform.

Ways To Invest On FarmTogether

FarmTogether has four investment products.

Crowdfunded Farmland Offerings

The crowdfunded offerings allow for investors to purchase “shares” of an LLC holding a farmland investment. This offering style is the most accessible with a $15,000 minimum investment. These are long-term investments with a target hold period of 8-12 years.

New crowdfunded offerings will periodically launch on the platform. After reviewing the details, you can choose whether or not to invest in the offering. This process of selection allows for investors to customize the farmland portfolio they build.

Crowdfunded offerings feature both permanent and row crop offerings. Additionally, FarmTogether’s crowdfunded offerings tend to be on the larger side, which can make it easier to purchase shares of a desirable offering.

Sustainable Farmland Fund

The Sustainable Farmland Fund allows investors to diversify across a variety of farmland properties with a single investment. The fund is an “evergreen” fund meaning that it will continue to accept new investor capital and update the holdings of the fund on an ongoing basis.

The fund is heavily focused on permanent crops on the West Coast of the US. Only 10% of the fund is dedicated to row crops and Oklahoma is the East-most growing region in the fund.

The minimum investment for the Sustainable Farmland Fund is $100,000 for class A shares. Investors in the fund are subject to a two year lockup period.Additionally, a unique requirement of the fund is that investors must be “US persons.”

Sole Ownership Bespoke Program

Do you have at least $1M you’d like to invest into farmland? If so, the Sole Ownership product may be of interest to you. Effectively, this option allows deep-pocket investors to enlist the FarmTogether team to help source and support a farmland investment deal.

There has been at least one listing for sole ownership so far.

1031 Exchange

A 1031 exchange is somewhat unique to the world of real estate investing. If you sell a real estate property and use the proceeds to purchase another within a certain period of time, no taxes are owed on the gains from the first property sale.

FarmTogether requires a minimum investment of $1M for 1031 exchanges. It is possible to role these funds into fractional ownership through crowdfunded offerings or into a Sole Ownership Bespoke offering. For more details, you’ll need to schedule a call with the FarmTogether team.

Crowdfunded Offerings So Far

FarmTogether has had a variety of crowdfunded offerings on the platform so far. For anyone that is curious what you might expect to see in future offerings, here’s what’s been available so far:

The offerings so far have generally been permanent crop offerings centered around the West Coast of the US. That is likely due to the focus on specialty crops like almonds, which are exclusively grown in California.

Understanding Crowdfunded Farmland Offerings

Of FarmTogether’s product offerings, we will only dive deeper into the crowdfunded offerings.

There are a couple of reasons for this. First, at a $15,000 minimum investment, these are by far the most accessible offerings on the platform. Second, investment choices are self-directed. Individual investors and/or their advisors will have to review the offerings and make a determination of whether to invest or not.

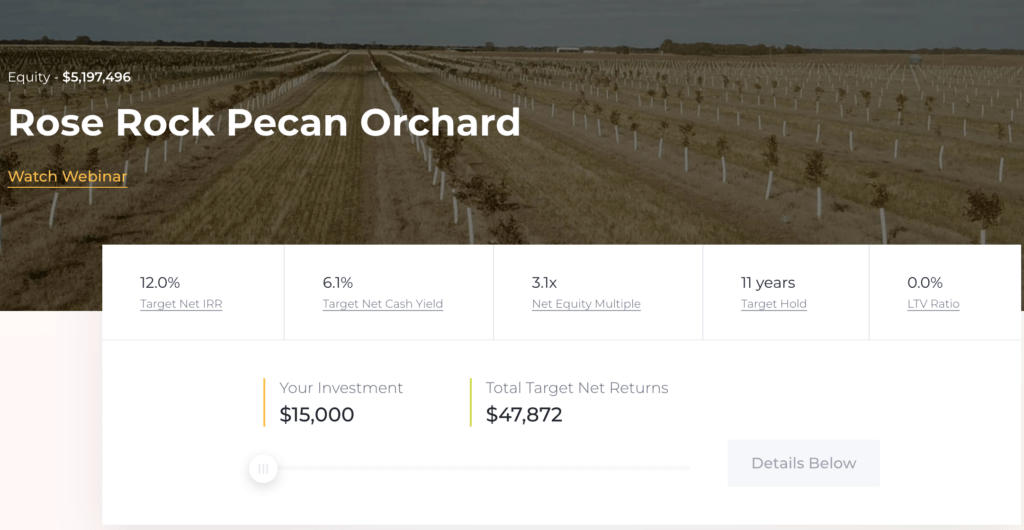

Offering Landing Section

When you first click on an offering, there is an initial summary section displayed. It shows the name of the offering, the size of the offering, and an overview of the financials. It also includes a link to the webinar.

Overview

After the initial landing section, investors will see a variety of summary information about the offering. There are three tabs in the overview section – Launch Schedule, Overview, and Operator.

Launch Schedule

This section outlines when information is visible and when investments can be made.

On many investment platforms, once an offering is live, it’s a complete free-for-all. FarmTogether has one very important difference. The offering launch is split into two phases.

During phase 1, returning investors have 24 hours to buy shares. Collectively, they can buy a maximum of 50% of the shares. After the 24 hours passes, phase 1 closes. Shortly after, phase 2 begins. During phase 2, only new investors can purchase shares. Again, they can collectively buy up to 50% of the shares.

If there are remaining shares after phase 1 and phase 2 close, then the offering is opened up to all investors in phase 3. This allows anyone that missed the earlier investment windows to purchase shares. It is also possible to increase the size of an existing investment in the offering.

Overview

This section provides a written summary of the offering. This often includes information about the location of the land, the amount of acres in the offering, who the management partner is, and an overview of the business plan.

In the case of our example Rose Rock offering, there are nearly 300 acres in Oklahoma that they plan to develop into a pecan farm. The first 5 years of the target 11 year holding period will be to develop the farm and let the trees mature.

Cash yield won’t begin until 2025 when the trees begin to produce pecans. Cash yield will be made up of both a flat land rental rate as well as a crop share agreement. So, the yield is projected to increase after 2025 as more trees begin to generate pecans.

As you can see, the overview section has very important details about the opportunity!

Operator

The operator tab provides more information about the third-party company that will be farming and developing the land. They often highlight the experience of the operator, as well as any past experience the FarmTogether team has working with them.

Documents

This part of the offering page provides links to a variety of important documents about the investment opportunity.

In the case of our example offering, the documents available are:

- Project Information

- Operating Agreement

- Incorporation

- Subscription Agreement

- Private Placement Memorandum

In a general sense, these describe the investment opportunity, the investment structure, and the “terms and conditions” of the investment and the platform. There may also be supporting documentation, such as the Incorporation documentation, that demonstrate the formation of the LLC for the investment.

Additionally, if there is a deep dive webinar available for the offering, it will be viewable here.

Offering FAQ

The FAQ section of the offering page provides additional information about both FarmTogether, as well as the offering.

An example of a question covered about the FarmTogether platform is “How do you determine the deal target hold period?” The offering-specific questions cover things like “What is the expected productivity lbs/acre?”

Why We Like This Deal

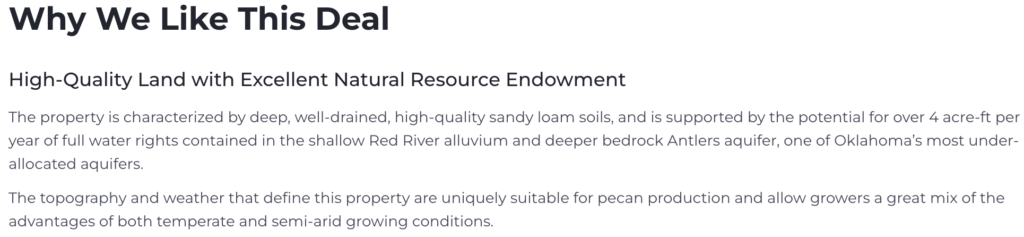

The FarmTogether team reviews many potential deals, but only launches a limited number onto the platform. This part of the offering page highlights the key characteristics that differentiated this opportunity.

There are many reasons why a particular deal could stand out. This could include the location, the quality of the land, the price of the farmland, and their long-term outlook on the type of crop being grown on the property.

Financial Summary

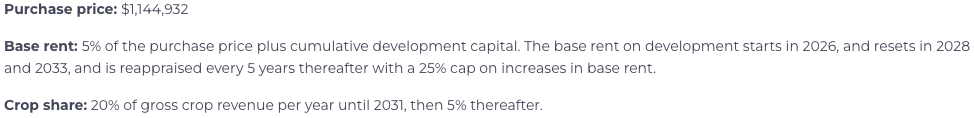

The financial summary provides an overview of the financial agreements of the deal. It also provides some basic projections about potential returns on the investment.

This is where you can find a quick overview of the target hold period, IRR, average annual cash yield, and return on investment.

Beyond the initial overview of the return profile, there are more details about the financials of the deal. In this case, we can see the total purchase price, the base rent, and the crop share agreement (if applicable).

Permanent and row crops have very different return profiles. In general, row crop offerings aren’t likely to have crop share agreements as part of the returns. Since this offering is for pecans (a permanent crop type), we do see the crop share agreement.

There are also important details about how the rent and crop share agreements will change over time. In this case, the base rent is 5%, but it only starts in 2026. The rent will reset in 2028 and every 5 years after with a maximum increase of 25% of rent. The crop share agreement starts off at 20% of gross crop revenue until 2023 and then resets to 5% afterwards.

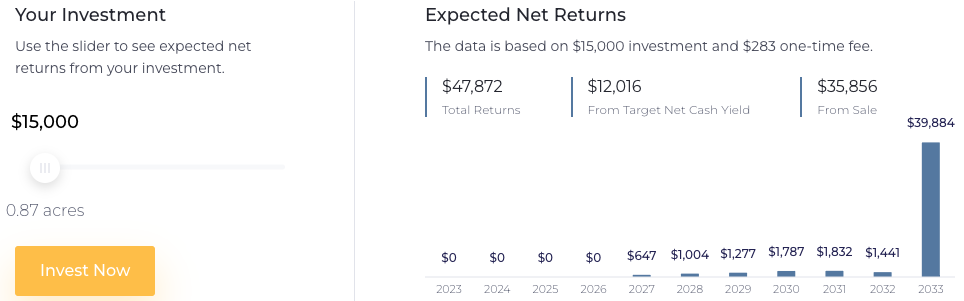

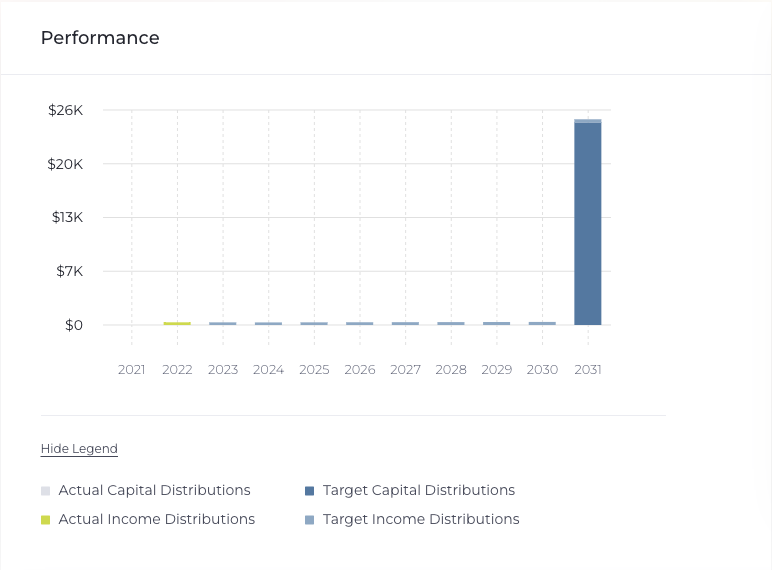

In addition to these text descriptions, the offering page also provides a visualization of the simulated net returns based on a customizable investment amount.

At a high level, we can see that for a $15,000 investment, we expect to see almost $48,000 in returns over the course of the 11 year target holding period. This is made up of about $12,000 in cash yield and nearly $36,000 from the sale of the developed, productive farmland.

Importantly, we also see how those anticipated returns are distributed over time. In this offering we can see there will be now cash flow payments from the earlier years of the farm. Then, we see payments start in 2027 and ramp up significantly from the initial levels.

This visualization is very helpful for understanding how the different moving pieces affect when and how much investors will see in returns. In the case of this example deal, for the first few years after the deal closes, the farm is effectively under development. The land is not producing any crops, nor any revenue. Thus, the deal is structured as having the operator pay no rent for several years. That is why FarmTogether anticipates that investors will receive no returns at all until 2027.

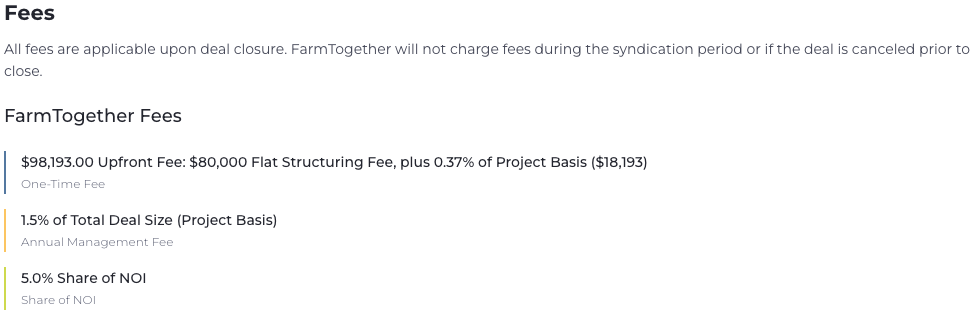

Fees

After the financial terms and potential returns from the investment, the offering page details the fees that will be charged.

Fees can vary from deal-to-deal, but there are two main types of fees – one-time and ongoing.

The one-time fees are paid at the time of investment. In this example, the one-time fee is around $95 per $5000 invested. That results in fees ranging from $283 for a $15,000 investment and $9,446 for an investment of $500,000.

Ongoing fees are paid on a regular basis. In the case of this offering there are two types of ongoing fees. One is an annual management fee of 1.5% of the total size of the offering. The other is an ongoing share of 5% of the net operating income of the Rose Rock LLC.

The projected cash flow amounts in the previous section are net of the ongoing fees.

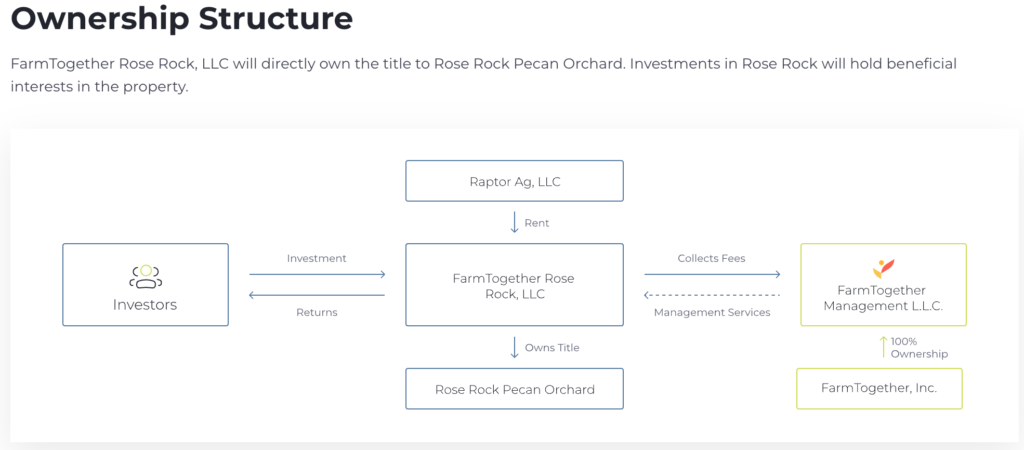

Ownership Structure

This section helps to visualize how the deal is structured. It also shows the relationships between the different parties – Investors, FarmTogether, and the farm operator.

The Rose Rock Pecan Orchard offering has a relatively common structure for FarmTogether offerings, as well as for investing in alternatives in general. There’s not really a sane or scalable way to carve out and manage the 292 acre farm as a series of individual $5000 chunks. Instead, the entire farm is owned by an LLC and investors own shares of that LLC.

We can also see that The Rose Rock LLC will receive rent payments from Raptor Ag, LLC (the farmland operator) and those payments will be split between fees to FarmTogether Management LLC (owned by FarmTogether Inc) and to investor returns.

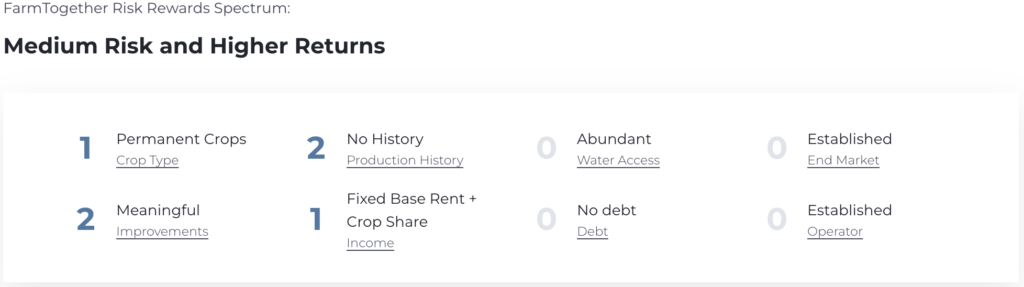

Risks & Ratings

The last part of the offering is another area to review carefully as it’s all about the risks. There are a few initial paragraphs in this section that outline general risk levels and provide links and references to information in the Private Placement Memorandum, as well as their underwriting framework.

After that is a breakdown of the risk levels across different risk areas.

In general the risk areas considered are:

- Crop type

- How intensive the planned/required property improvements are

- Past history of crop productivity for the farm

- The income agreements

- Availability / accessibility of water for the farm

- Debt associated with the deal

- The end market for the crop(s) being grown

- How new or experienced the operator is

In this offering, we see all risk areas received ratings ranging from 0-2. A 0 indicates it is not considered as a risk factor. Higher numbers indicate a greater level of risk or uncertainty.

For example, the fact that this property has no history producing pecans is a significant risk. On the other hand, the lack of debt present in the deal means there’s no risk related to the financing or burden of the interest payments.

Portfolio Page

The FarmTogether platform provides an aesthetically pleasing overview of your investment portfolio with a variety of different information.

The first portion of the portfolio view shows several high-level metrics about your overall farmland investments on the platform.

At a glance, you can see the overall value of your equity in the farmland, the income distributions received this year, and the cash yield received this year. You can also see the total income distributed and the overall yield received since the beginning of your investments on FarmTogether.

Active Investments

After the overall portfolio metrics is a summary of all your active investments on the platform. There are three different sections of information.

Performance

The performance section shows both the actual and target distributions over time. If you invest in an offering, the information from the offering’s Financial Summary section will be used to build the performance graph.

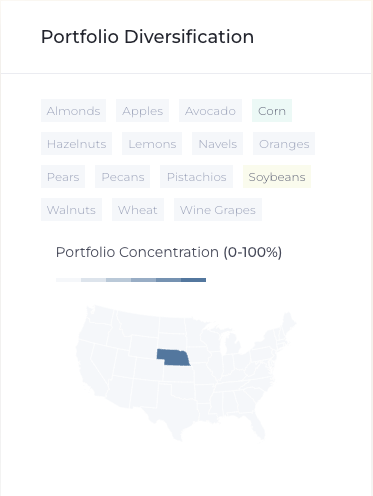

Portfolio Diversification

The portfolio diversification card provides a visualization of the geographic concentration of investments. States are color-coded based on the percentage of portfolio investments that have been made in the state. The darker the color of the state is, the larger the percentage of the investment portfolio it represents.

Additionally, this card shows crop diversification as well. There are a series of tags listing different types of crops. The tags are colorized as investments into those crop types are made.

Investment List

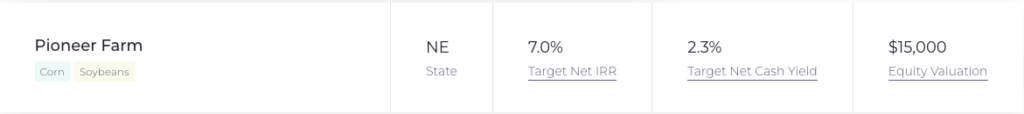

The final piece of the portfolio page is a list of active investments. This list shows the offering name, the crop types grown on the farm, the state the farm is located in, as well as metrics about the target net IIR, target cash yield, and current equity valuation.

FAQ About FarmTogether

Yes, FarmTogether is a legitimate US business. They are an investment platform specializing in farmland investments.

Where To Learn More

There are several good resources to learn more about FarmTogether. First, take a look at their learning center to find a variety of white papers, webinars, videos, and more! Their How We Invest page also provides a more detailed explanation of the selection criteria they use for farmland properties. Lastly, there is the FAQ page to help answer commonly asked questions.

You can also take a look at some of our other resources.