EquityMultiple provides a simple platform for accredited individuals to invest in commercial real estate for as little as $5000, with a range of products serving several different investment objectives.

| Potential Yield | 0-12% |

| Potential Appreciation | 0-10%+ |

| Minimum Investment | $5K-$20K |

| Investor Requirements | Accreditation requirement & U.S. Tax Identification Number |

| Liquidity | Good to None, varies based on investment pillar |

We have a comprehensive walkthrough for you below, if you’d like to learn more.

What Is EquityMultiple?

EquityMultiple is a crowdfunding investment platform for accredited investors. They specialize in sourcing quality commercial real estate opportunities, but also feature real estate based private credit offerings.

Minimum investments vary based on the investment product but range from $5K for “Keep” opportunities to $15K-$20K for “Earn” and “Grow.”

Investment Opportunities at EquityMultiple

EquityMultiple structures investments into three pillars – Keep, Earn, and Grow.

Keep – Improving Cash Yield

Keep offerings are for those looking for more yield without having to sacrifice liquidity.

These offerings are delivered in their “Alpine Notes.” These short term notes come in 3-, 6-, and 9-month terms.

The proceeds from these Notes are used to pre-fund investments offered on the platform. Basically, these are loans given to EquityMultiple. Those funds are used to secure an investment opportunity (e.g. equity in a multifamily apartment building) before the company can raise money from investors.

Alpine Notes also have some nice features. There are no fees for investors. You can configure automatic rollover of notes. Additionally, you can exit your Note investment as early as 30 days after your investment completes.

Earn – Short-Term Debt

Offerings in the Earn pillar are private credit opportunities within commercial real estate. These debt-based investments are a middle ground between Keep and Grow.

Earn is based on providing investors with competitive and exciting yield, in exchange for a greater level of risk, higher fees, and lower liquidity than Keep offerings.

All Earn offerings we reviewed were backed by real estate collateral, and steps were taken to try to minimize the likelihood of a loss of investors principal.

Grow – Long Term Growth

Grow is more focused on equity, though offerings also commonly project to return yield as well. These investment opportunities are across a wide array of commercial property types including Hotels, Multifamily Housing, and Industrial storage.

There is greater potential reward in the Grow pillar, in exchange for more risk and a longer holding period. From what we have observed, somewhere around 3 years tends to be fairly typical.

Keen observers will note that 3 years is actually a relatively short holding period for real estate. That is because many of these offerings are about executing a value-add to the underlying properties in order to exit at a positive return.

This is not simply buying the properties, waiting and hoping for appreciation for 10 years, and then trying to sell for a profit.

For example, one opportunity we reviewed was equity in a larger master-planned community with over 200 homes. In exchange for the equity, the sponsor will get important cash that is required for completing the development of these homes and the community.

As you might imagine, a fully built community of 200+ homes is more valuable than a big plot of land with unfinished roads and half-built homes. Hence the idea of the value-add leading to the positive returns for investors.

Now, this is also where more of the risk comes in. Even value-add projects that look good on paper don’t always pan out. Miscalculations in things like the expectations of costs, timelines, and market conditions can result in the project missing its target returns. Of course, with all investments there is also the risk of loss of principal as well.

Investor Suitability for EquityMultiple

Now that we understand better what this platform has to offer, who should consider it?

Who Can Invest On EquityMultiple?

Investors must meet the SEC’s definition for accreditation. In simple terms, that roughly translates to meeting one of the following:

- A net worth over $1M (excluding primary residence)

- A yearly income of $200K for the past two years ($300K for married couples)

- You are an investment professional with a qualifying license

Additionally, you must have a US Tax Identification Number. In most cases that means you’re either a US citizen or a legal permanent resident. This will mostly come in the form of an SSN for individuals or an EIN for companies/legal entities like an LLC.

It is also possible for LLCs, Trusts, and Joint Accounts to invest on the platform. You may also invest with some self-directed IRA providers as well.

For more details, the FAQ page is a good place to start.

Ideal Investor Profile

Is EquityMultiple right for you? Assuming you meet the criteria above, it could be an interesting option.

Let’s take a deeper look, starting with alternative investments in general:

The reality is simply that alternative investments are generally perceived to carry more risks than traditional assets. That includes lack of liquidity and the chance of losing your entire principal.

In summary, EquityMultiple is likely a good fit for you if:

Understanding Fees on EquityMultiple

Fees vary based on the investment pillar. In some cases, there is also variance from deal-to-deal, but here’s a general idea of what to expect from each pillar:

Keep Fees

There are no fees for investors!

Earn Fees

Lastly, as more complex investments there are fees associated with these. Across the two examples above we see an annual fee of 1-1.25% and some flat expenses per investor for the Asset Income Fund.

Grow Fees

In general, a fee of 1% of invested capital paid annually and a flat fee of $10K (for the entire offering – NOT per investor) for administrative expenses (like LLC filing fees) seemed to be the common.

Many deals also have what we like to refer to as a “performance fee” or “profit sharing” structure. After a certain return threshold is reached for investors, subsequent profits are shared between investors and other participants in the offering.

For example, 100% of returns are distributed to all equity holders, based on their share of the investment up until a 10% IRR is reached. Beyond that, investors receive 80% of additional profit while EquityMultiple and the Sponsor receive a 20% share of those additional profits.

That having been said, each deal is a bit different, which means that fees can also vary from offering-to-offering.

Comparing Fees with Industry Standards

The pairing of a flat annual fee with a performance fee (or “carried interest” in financial jargon) is so common that there are actually nicknames.

For example, here’s an entire Investopedia article about the term “two and twenty.” That refers to the fee structure of a 2% annual fee (typically calculated based on assets under management) and a 20% profit share.

We’ve seen this same structure across many different types of assets within the alternative investing space as well.

This leaves EquityMultiple’s fees well within the normal range for the industry. If anything, there are cases where the fee structure is more advantageous to investors than average – such as no investor fees for Keep offerings.

Potential Returns & Liquidity with EquityMultiple

The last important financial pieces to understand are what the potential returns for investing are, as well as what liquidity and exit options look like.

Potential Returns

Potential returns differ greatly based on the investment pillar, so let’s jump in.

Keep Target Returns

The yield for each set of note offerings adjusts over time based on market conditions but should offer higher target returns than a savings account or certificate of deposit.

The current targets range from 5.84% – 7.16%, with the low end reaching up to 6% annualized with the power of compounding.

Earn Target Returns

As with keep, the potential yield returned from Earn offerings will vary between offers and can change significantly over time due to market conditions and interest rates.

At the moment, Earn opportunities offer target yields ranging from 11-13%. These do have risk associated with them though, so there’s no guarantees that those target ranges will be hit.

Grow Target Returns

As the name suggests, investments in the Grow pillar are seeking larger returns. The specifics vary between deals, but from what we have seen, Grow typically carries a target net IRR of 20% or higher.

This IRR can consist of varying degrees of yield and appreciation. In some cases, targets may have more yield delivered throughout the duration of the holding period and a lower rate of growth for the invested principal. In others, there may be no yield, but a much higher target for the profits upon exit.

Liquidity and Exit Strategies

Liquidity varies significantly between investment pillars. Here’s a breakdown of what you can generally expect for each.

Keep Liquidity

The short-term nature of the Alpine Notes provides good liquidity by itself. However, there is also an ability to (in most cases) redeem your investment after only a 30-day holding period.

That’s very good liquidity, especially for alternatives.

Earn Liquidity

Liquidity here is still decent, but not nearly as flexible as Keep.

Two offerings we reviewed had target holding periods of 17 and 24 months, respectively. The second offering, the Ascent Income Fund, allows redemptions as early as 12 months after the initial investment, but with a 4% penalty. Holding for 24 months or more allows penalty-free redemptions.

A holding period of 17-24 months is relatively short. This is especially true when compared to investing in physical real estate, which can involve holding periods as long as 15 years.

Grow Liquidity

Grow offers the least liquidity of the three pillars. There’s not a way to exit early from any of the investments. The target holding periods are also longer than the other tiers. However, they are still relatively short at around 3 years.

Of course, different offerings can have longer holding periods and targets are just targets. But this does generally mean that capital isn’t expected to be locked up for 7-15 years, as is often the case with many other equity-based real estate offerings.

Navigating the EquityMultiple Platform

Your investment experience with EquityMultiple begins with registering an account. You’ll have to go through many familiar processes to get started – providing information for KYC and AML requirements, as well as verifying your accreditation.

After you’re registered, you can dive into the platform and its opportunities.

Understanding Investment Opportunities

From the Invest link on the website header, you can see all of the open investment opportunities across all pillars. Clicking on any one of them will open up a detailed view.

We’ll walk you through the different sections of an investment listing in detail below. In some cases, some of the names for these sections change, but the general purposes are largely the same.

Landing

The first things you’ll see are:

- An image for the investment

- The name of the investment

- The table of contents

The table of contents will “stick” to the top right, so you can use that to jump between sections at any point in time.

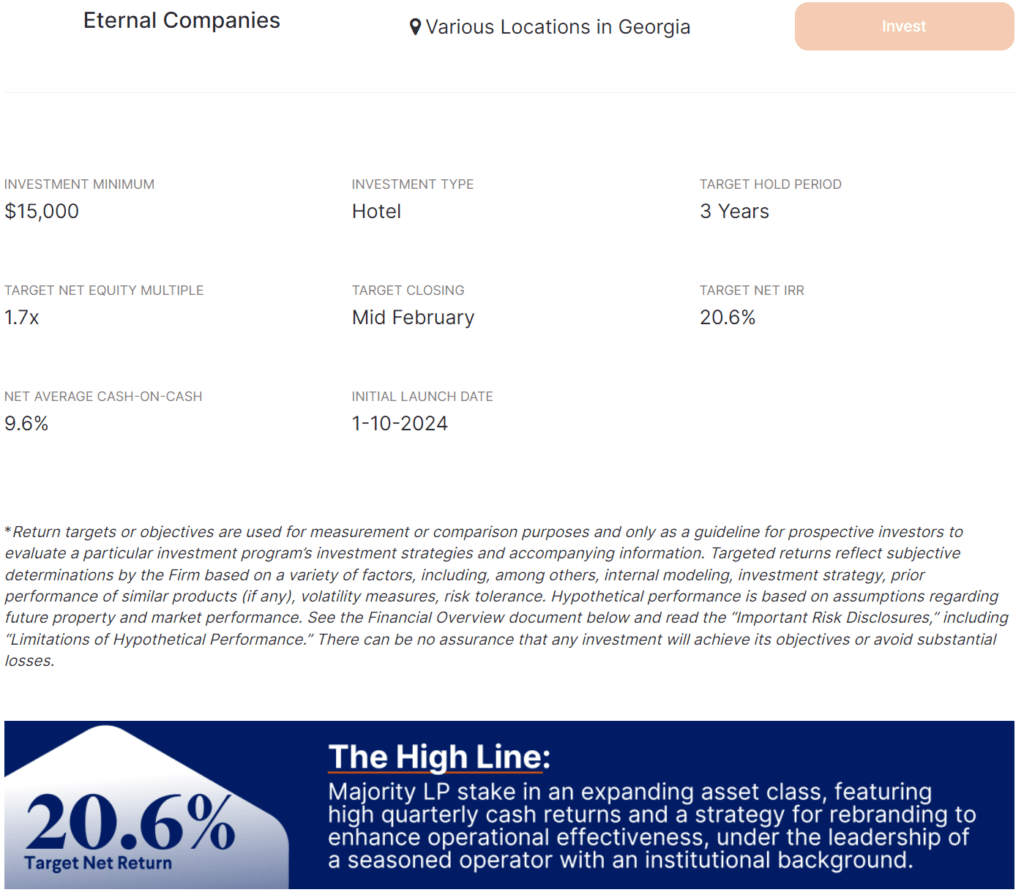

High-Level Summary

The next section is where we start getting into the details of the opportunity.

Right off the bat we can see the name of the sponsor and the location of the assets. You can sometimes hover over the location for more details.

After that we have other important summary information for the investment:

- The minimum investment amount

- What type of investment it is (something more detailed than the pillar)

- The target holding period

- Targets related to the overall financial return (IRR, net equity multiple, interest rate, etc…)

- Information around the launch and closing of the opportunity

This may also include some video content as well.

Executive Summary

The next section you’ll encounter is a few introductory paragraphs that provide greater context to the investment. At this point you may already have an idea if you’re interested in the opportunity or not.

The next sections are where we really get into the details.

Investment Highlights

The purpose of this section is to expand on the summary. It calls out some critical aspects of the opportunity, with some supporting bullet points. These can be financial in nature (such as a good acquisition price) or can highlight things like the sponsor’s past success and elements of the business plan.

Here’s a couple of examples:

Favorable Acquisition Basis

An excerpt of Investment Highlights from an Earn offering

- The Property purchase price of $17,500,000 is an 32% discount to the September 2023 as-is appraised value of $26,500,000.

- The Investment’s last dollar basis of $14,500,000 represents a 44% discount to the as-is appraised value and a 56% discount to the stabilized value of $33,350,000.

Repeat Seasoned Sponsor

An excerpt of Investment Highlights from a Grow offering

- To date, Larson Capital Management has acquired over $565M in commercial office and industrial space, totaling 3.7M SF. LCM also developed $300M of properties including 1,700+ units and 300K SF of office space.

- Larson Capital Management are regionally/locally based and have extensive experience in the market.

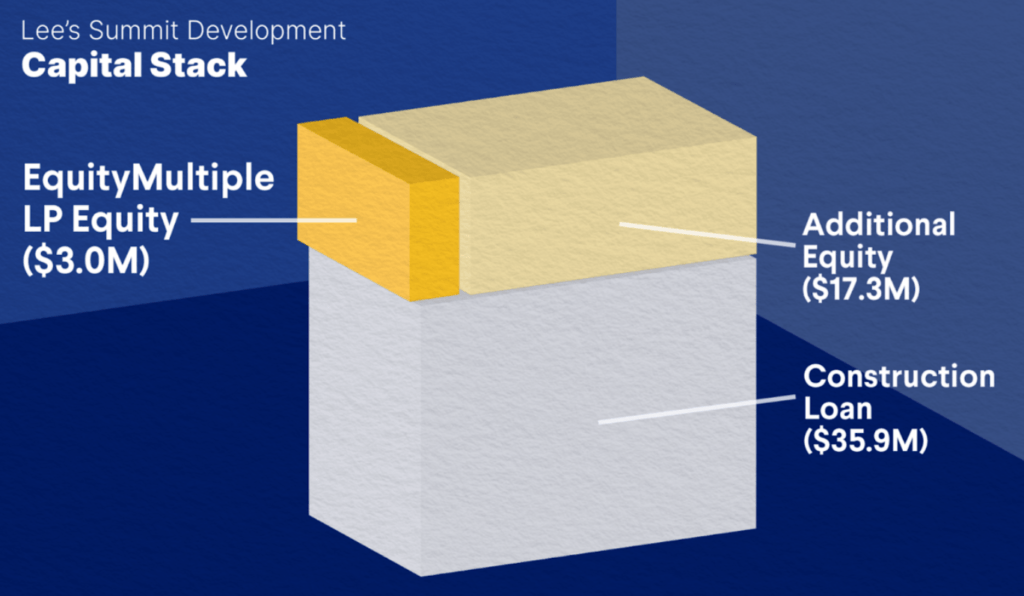

Financials and Structure

Next, we’ll get into some numbers. This section will have information on things like the capital structure, hypothetical investment returns, details on distributions, information on fees, details on loans, and information on expenses.

This section is usually a mix of tables, figures, and text all trying to explain the costs, structure, and upside for the opportunity.

Disclosures

This is the most important section to review. That’s especially true if you are new to alternatives, real estate, or commercial real estate investing.

This is a longer section that is going to detail out the major risks associated with the opportunity.

Some of them will likely be more obvious, such as “Real Estate Market Risk.” Future returns from any real estate project have at least some connections with the overall real estate market’s direction and health.

Other risk factors might not immediately come to mind when reviewing the overviews. Here’s a partial excerpt from a Grow opportunity. This is only a subset of information provided to investors about this specific risk factor.

Limitations of Property Comparables: Recent property sale and lease transactions are frequently used in real estate to help estimate market value for similar transactions. These comparables come from a variety of sources, including project sponsors, publicly available reports and market data, and subscription-based third-party data and research firms. Due to the opacity of the real estate market, comparable transaction data has a number of inherent limitations… [Truncated]

Partial excerpt from the Risk Disclosures of a Grow opportunity

Documents

At the very end of the list page is a list of attached documents. These will contain many more details about the investment and are very important to review. This can include further financial summaries, as well as detailed investor packets covering topics like the subscription agreement.

Portfolio Page

The portfolio page contains important summary information about the investments that you’ve made so far. That includes the balance and returns of your current investments. You can also see a record of returns for all exited investments as well.

Beyond that, there are sections that provide a breakdown of earnings for the current year and diversification. The diversification can be viewed between both Offering Type and Property Type.

My Activity & Communication

In addition to the portfolio, you can also see an activity stream of updates on all your investments on the platform. The My Activity page houses all these asset management updates. Investors will also receive a next steps document after their first investment on the platform, outlining what they can expect going forward.

Beyond the activity feed, each investor has a dedicated representative on the Investor Relations team that can be reached through phone.

Concluding Thoughts on EquityMultiple

EquityMultiple offers accredited investors commercial real estate opportunities across a variety of risk levels and time horizons. Additionally, the lower minimum investment thresholds can also make it easier to get started in the asset class.

On the whole, this platform is worth a look for anyone interested in building commercial real estate holdings as part of a diversified portfolio of investments.

FAQ About EquityMultiple

To support an ad-free experience, we may earn a commission from links on this page.