Originally sent to newsletter subscribers on January 8th.

Does a population boom automatically translate into skyrocketing real estate prices? In our first data-oriented newsletter post, we’ll take a closer look.

All the data used in this analysis are from the US Census Bureau and Zillow covering the period of 2000-2023.

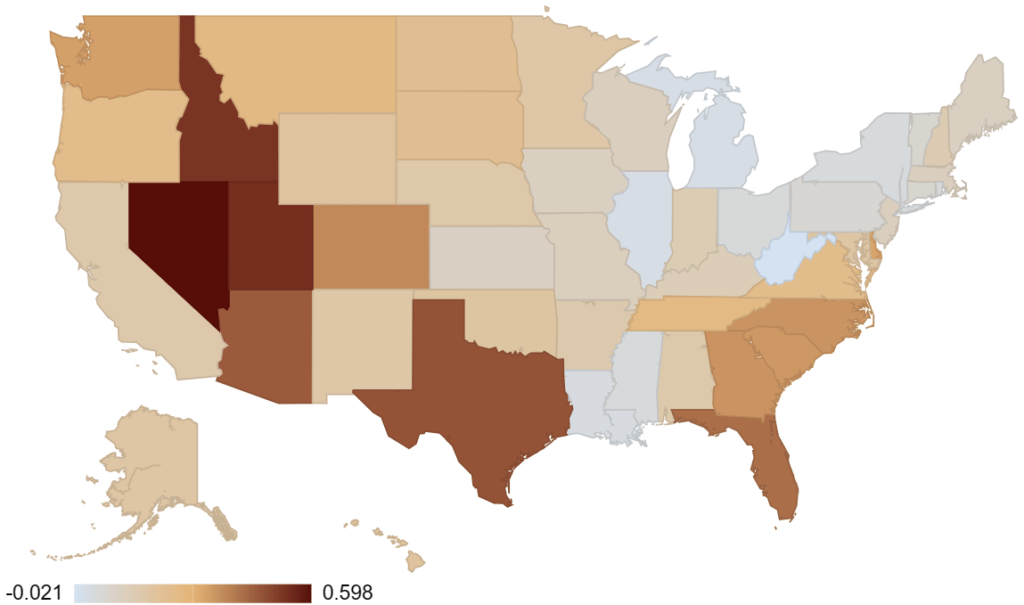

Population Hot Spots

Population has changed a lot over the past 23 years, but the effects are far from uniform.

- The Northeast and Rust Belt states generally saw anemic growth.

- The Sun Belt mostly saw strong appreciation. States like Nevada, Texas, Florida, Utah, and Arizona saw growth of ~36-60%.

- Louisiana and Mississippi bucked that trend though, growing less than 3.5% each.

- Idaho and some of the Pacific Northwest also saw moderate growth, though this is partially due to their lower population. The smaller basis makes it easier to show higher growth percentages.

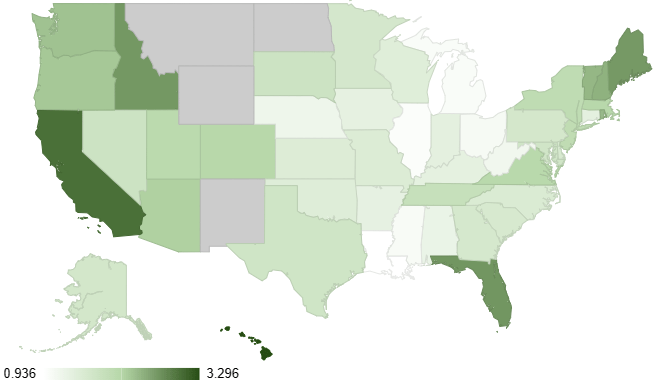

Appreciation

When we look at appreciation, we see a bit of a different picture. Many of the states that didn’t stand out for population growth seem to leap off the charts here.

Maine has one of the highest rates of appreciation? Seriously?

Also, whoa. Texas, Arizona, and Nevada collectively have below-average rates of appreciation.

Does any of this make sense? Is population growth just completely unrelated?

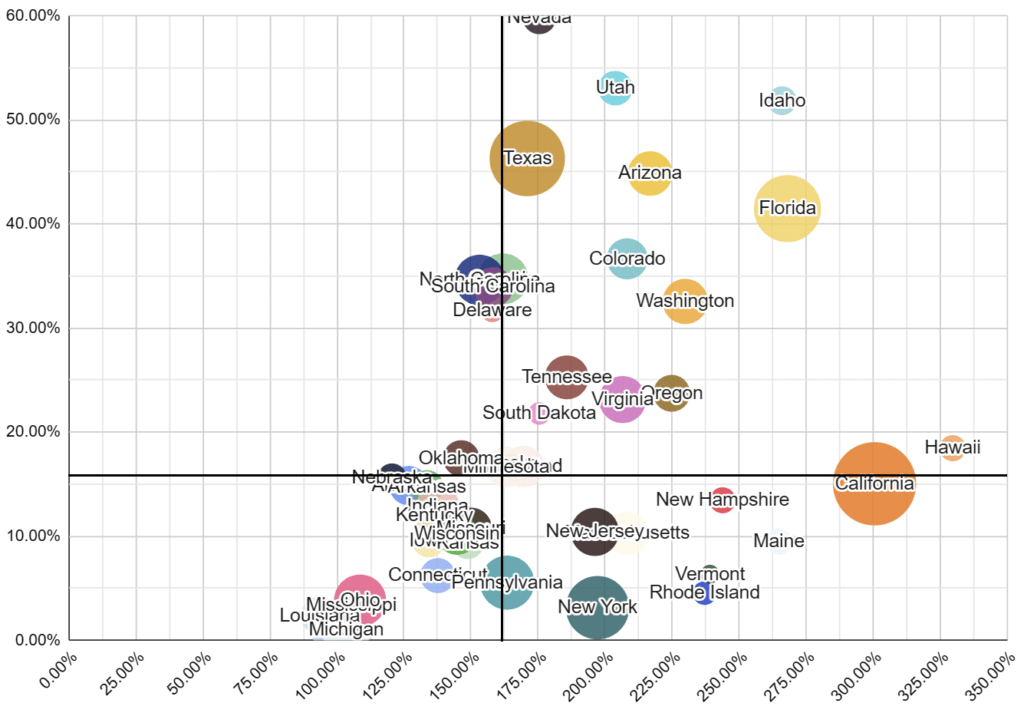

Population Growth Vs Appreciation

Let’s start by clearly saying that these two are related. The two black lines represent the median growth rates. Of the 25 states with above-median population growth, only 6 saw below median appreciation.

The more closely these two factors are related, the more we expect to see states clustered in the bottom-left and the top-right quadrants, which is mostly the case here.

States in the top-left and bottom-right quadrants are effectively our outliers, those bucking the expected trend. In the top-left quadrant, our deviants are still pretty close to the median, so I don’t think those are worth talking about too much.

What’s more interesting is the bottom-right quadrant. Here we have significant deviation from expectations. In fact, some of the strongest-performing states in terms of appreciation were ones we identified as having weak property growth earlier on.

Complex Relationships

Without getting into politics, those states from the bottom-right quadrant are mostly blue states known for higher costs of living. In some cases, many of the major metropolitan areas are already built or have laws that result in limiting the rate of housing construction.

This brings us to an interesting conclusion. While we might intuitively think that population growth is the cause and appreciating home values are the effect, the relationship can be the reverse as well.

Shelter is one of the main components of inflation and one of the largest expenses for most people. States with ample housing and the space and legislation required to continue building can offer a lower cost of living attracting new residents.

As housing costs continue to rise in other states, it drives some residents to try their fortunes elsewhere, suppressing population growth.

Conclusion

Population growth is absolutely correlated with the rate at which residential real estate appreciates. If you can forecast this accurately, you’re always in a better position than if you can’t.

However, as difficult as that may be, alone it’s not enough to find the best real estate investments.

Other factors need to be considered as well. Here are a few that come to mind for me:

- The rate of housing construction / housing starts

- The time required to complete a housing development project from start to finish

- The availability of land for future development near to major metropolitan areas

Basically, factors that affect how well and how quickly public and private parties can respond to population growth.

Limitations & Future Work

This is far from a perfect analysis. Here’s a few things I think would be good to focus on for future analysis:

- Location, Location, Location – They say real estate is hyper-local. So aggregating things at a state level can “hide” some potentially interesting insights. Doing the analysis based on county or MSA would be more intensive, but a lot more interesting.

- Population & Time – It’s possible that the effects of population growth on prices are lagged in some way. It might be interesting to see if stronger population growth results in higher rates of appreciation in the more distant future.

- Zillow & 2000 – Zillow is only a single data source, using a combination could provide a more accurate picture. Additionally, Zillow only provides data back to 2000, so an alternative source might allow for an analysis over a longer period of time.

- Property Type – It might be interesting to do the analysis across each type of housing individually (condos, multifamily houses, single family houses).