Farmland is an exciting alternative asset class that has provided solid returns for decades. Its intrinsic value has been recognized by Warren Buffet and Bill Gates. We have a list of the most interesting farmland investing platforms to help get you started.

Farmland Investing Platforms (Summary)

While alternative assets have become more accessible, farmland still has more limitations than other assets. Here’s our list of farmland investing platforms to consider:

We’ll cover each in more detail below.

AcreTrader

AcreTrader is one of the most well-known platforms in the space due to their solid flow of deals and increasing track record. They’re also well-funded, raising over $60M in a Series B funding round in 2022.

Highlights

- Accessibility: Accredited Only

- Minimum Investment: $15K

- Investment Products: Crowdfunded offerings

- Investment Types: row crops, permanent crops, timberland, international

- Fees: 0.75% standard management fee, some offerings have additional

AcreTrader offers primarily row crop farms on their platform. Of 127 offerings we reviewed, 113 were for row crops. However, they have recently started to feature permanent crops on the platform through sponsor-managed offerings.

AcreTrader has also boasted some unique offerings. The semi-frequent appearance of Timberland is something not offered by any other platform. They’ve also had international offerings (avocados in Australia) and a land banking fund.

FarmTogether

FarmTogether is another popular choice for farmland investing. Their diverse range of investment products can support a range of investment goals.

Highlights

- Accessibility: Accredited Only

- Minimum Investment: $15K – $3M

- Investment Products: Crowdfunded offerings, 1031 Exchange, Investment Fund, Bespoke offerings

- Investment Types: permanent crops, row crops

- Fees: Varies significantly. May feature one-time fee, yearly AUM fee, and revenue sharing fee

FarmTogether is a place to watch if you’re interested in permanent crops. Of 40 crowdfunded offerings, we saw only 6 (15%) that were for row crops. The focus on permanent crops does differentiate the platform, but it also concentrates their offerings in a few states. A total of 30 (75%) are in just 3 states – California, Oregon, and Oklahoma.

They also have a range of investment products, most of which will appeal to those with more money to allocate to farmland. Their bespoke product has a minimum investment of $3M to find a farm just for you.

Steward

Steward is a platform for lending to regenerative farmers. This smaller, lesser-known platform is highly accessible, but does not provide equity investment opportunities for farmland.

Highlights

- Accessibility: All investors

- Minimum Investment: $100

- Investment Products: Regenerative capital fund, individual opportunities

- Investment Types: loans / private credit

- Fees: None

Steward is a very different platform than the others on the list. It’s a B corporation that exists primarily to support regenerative agriculture. While you can “invest” in the loans on the platform, they are not seeking to maximize investor returns. It’s looking to provide a fair loan to farmers with a reasonable return to lenders.

Its accessibility and the potential to make an impact investment may appeal to some that want to invest in the space.

Harvest Returns

Harvest Returns is a lesser-known platform that has investment offerings across the agricultural spectrum.

Highlights

- Accessibility: (Mostly) Accredited Only

- Minimum Investment: $10K – $100K

- Investment Products: Crowdfunded offerings

- Investment Types: equity, debt, funds

- Fees: Varies, see each deal for details

Harvest Returns is basically a platform for investing in all things agriculture. This can range from high-yield debt for a buffalo farm, to equity crowdfunded raises for agtech companies, or to equity in a vineyard.

The range of offerings on the platform is interesting, but the quality and success of these is less clear. The company reports having delivered about a 17% net IRR from 10 loans that were fully repaid. That’s only a small portion of the total offerings on the platform though.

With fees, investment minimums, and the type of investments varying so much it’s a lot of complexity for investors to grapple with.

Farmfolio

FarmFolio is a unique platform for fractional farmland investing. They focus on South American farms with specialty crops like coconuts. Additionally, they fractionalize through a tenement-in-common structure rather than proportional ownership of an LLC.

Highlights

- Accessibility: Accredited Only

- Minimum Investment: $30K-$3M+

- Investment Products: Crowdfunded offerings, whole ownership

- Investment Types: specialty permanent crops in South America

- Fees: Varies, see each deal for details

Farmfolio is an interesting platform for those looking to get exposure to international farmland. Given its focus on South America, its offerings always fit the bill.

However, they provide very limited information publicly about exactly how everything works – including their fees. We expect most of these details will be contained in the offering documentation prior to committing to an investment.

Additionally, they also have a unique structure. When a fraction of a farm is sold, the investor directly owns that “lot” of land and can pursue sale as or when they wish. That gives Farmfolio the best potential liquidity options amongst fractional investment platforms.

Other Ways To Invest

Outside of these 5 farmland investing platforms, there are other ways to invest in farmland. There are other platforms we’re aware of and some ways to invest through public markets as well.

Other Farmland Investing Platforms

- AcrePro – Browse, purchase, and bid for whole farmland properties.

- FarmFundr – A farmer-owned investment platform focused on California.

- FarmlandLP – Farmland investments on the West Coast, with a focus on sustainable land management practices.

- Iroquois Valley – REIT and Note investments for sustainability-focused farms mostly located in the Northeast and Midwest.

- RAD America – A new private farmland REIT.

Bonus – You can use Acres to perform land research and analysis. This will be most helpful for those looking to purchase an entire farm.

Investing In Farmland Through Public Markets

There are two publicly traded farmland REITs:

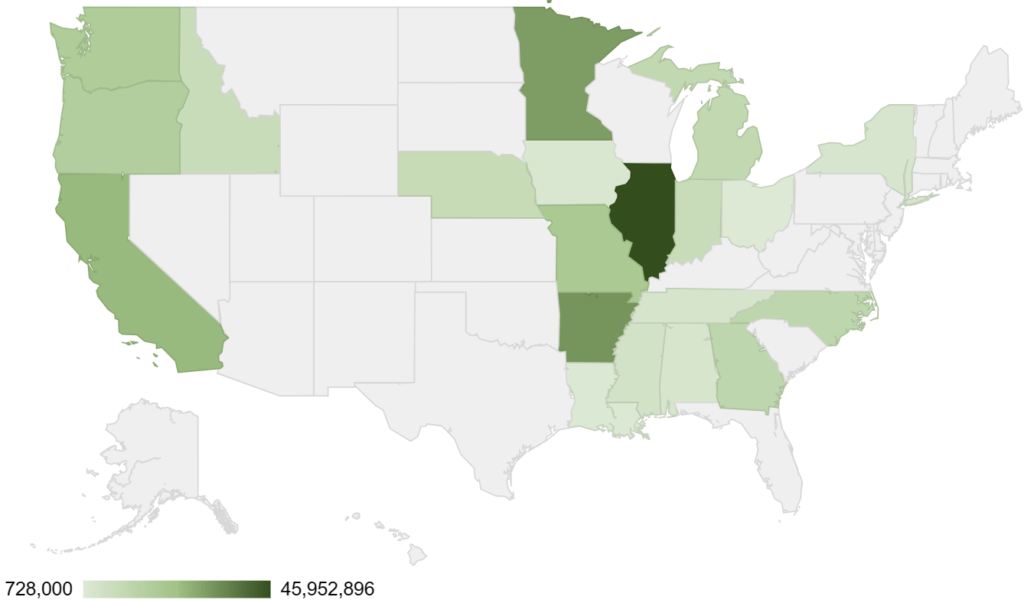

- Farmland Partners Inc ($FPI) – FPI owns almost 180K acres of farmland across 20 states. They’re listed on the New York Stock Exchange under the ticker symbol FIP.

- Gladstone Land Corp ($LAND) – Gladstone owns about 115K acres of farmland across 15 states. They’re listed on the NASDAQ under the ticker LAND.