This story originally went out to newsletter subscribers on October 30th.

What Is reAlpha?

Let’s start from the beginning. reAlpha is a proptech company that we’ve primarily known for their real estate investment platform.

Specifically, they source vacation rental properties – like what you’d find on Airbnb – and create fractional investment offerings for them. Their app allows you to invest in these offerings for a relatively high minimum investment of $500.

If this doesn’t seem revolutionary, it’s because it really isn’t. Here was an early mover in this space, followed notably by Arrived Homes. Most other fractional real estate investment platforms are dabbling with these types of properties as well with both Ark7 and Lofty having a few listings recently.

So, what’s special about reAlpha?

Well, for one, they talk about AI a lot more. The reAlphaBRAIN is a machine learning model for analyzing prospective vacation rental investment properties. It seems similar to an in-house AirDNA.

Beyond that, they currently pitch themselves as a “fully integrated, AI-driven tech stack for real estate,” pairing an AI service to generate Airbnb property listings with the BRAIN and investment app.

Previous Funding

Clearly some have seen a lot of potential in the platform for years. We first heard about it when they were trying to draw attention to their equity crowdfunding raise.

According to Kingscrowd, they managed to raise almost $5M through this campaign with a staggering $375M valuation. The raise lasted from late 2021 through the end of July 2022.

Based on their S-1 filing for their fiscal year ending April 30, 2022, the company had just $230K in revenue from rental income. Their income for the most recently reported period was $37K for 3 months, or about $150K annualized.

The equity crowdfunding investors apparently weren’t the only believers in the company as they also secured a $200M financing facility in November of 2022, followed by a $100M capital commitment in December.

How The Direct Listing Went

On October 23rd, the company announced their direct listing on the NASDAQ exchange under the ticker $AIRE.

The first few days have been pretty wild.

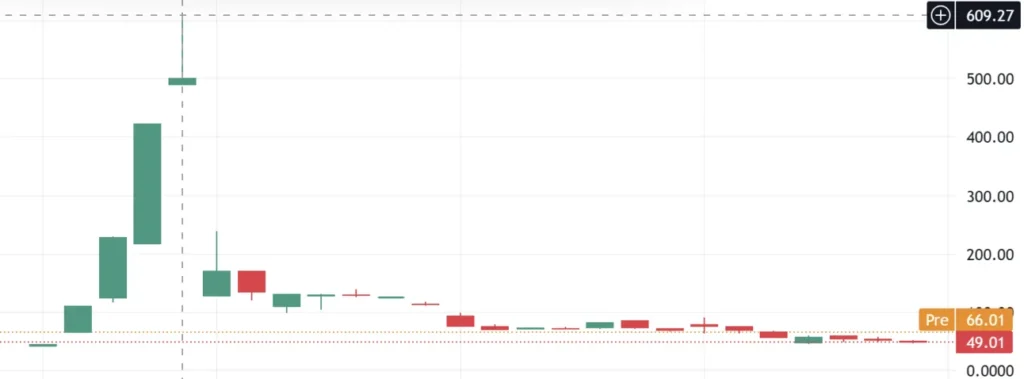

While TradingView has the stock’s high around $610, most outlets are tracking it as $575. A staggering number in either case. After a rapid rise, the price gapped down and has been steadily descending since.

Its October 26th closing price of $46/share gives the stock a $1.96B market cap. At peak, the market cap would have been nearly $25B.

Unfortunately, we haven’t heard any tales of equity crowdfunding investors getting rich here though.

Why It Seems Crazy

It seems like just a few months ago headlines were circulating about a major slowdown in Airbnb bookings. Actually, before seeing this news I was considering a story about the slowdown in vacation rental offerings.

Here never regained their momentum from late 2022 and has been dormant now for a few months. Even Arrived has had offerings more slowly recently. Smaller players like Fundhomes aren’t moving that much real estate either.

Also, as we already covered, reAlpha doesn’t have a huge portfolio of properties or significant revenue. In that context, even their $375M valuation from the crowdfunding round seems dubious.

Beyond any of that, there’s also the question of why such a small company would want to go public.

For years we’ve seen companies stay private for increasing lengths of time. Is the rise in interest rates and its effect on VC funding severe enough that younger, more speculative companies are once again turning to public markets? Was there a unique opportunity to capitalize on the AI buzz? Or is it something else specific to reAlpha?

Either way, it’ll be interesting to see how this plays out.