Energea allows you to earn passive income from sunshine around the globe for as little as $100.

| Potential Return | Target IRRs range from 6-16% |

| Minimum Investment | $100 |

| Investor Requirements | No accreditation requirement |

| Required Holding Period | 3 Years |

| Liquidity | Limited – No secondary market, possible exit after 3 year holding period |

| Other Highlights | Solar energy provides a chance for passive, uncorrelated returns |

If you’d like to learn more, we have a comprehensive overview down below.

What Is Energea Global?

Energea Global is a crowdfunding platform that allows investors to purchase shares of solar energy portfolios. These portfolios are organized based on the region that the solar projects are deployed in.

Currently there are portfolios open for investment with solar assets in the USA, Africa, and Brazil. Each portfolio is an LLC that holds the assets from the various solar projects within the overall portfolio.

Energea also serves as the project manager for all the solar projects within the different portfolios. They provide monthly email updates on the status and performance of each portfolio.

How To Invest On Energea

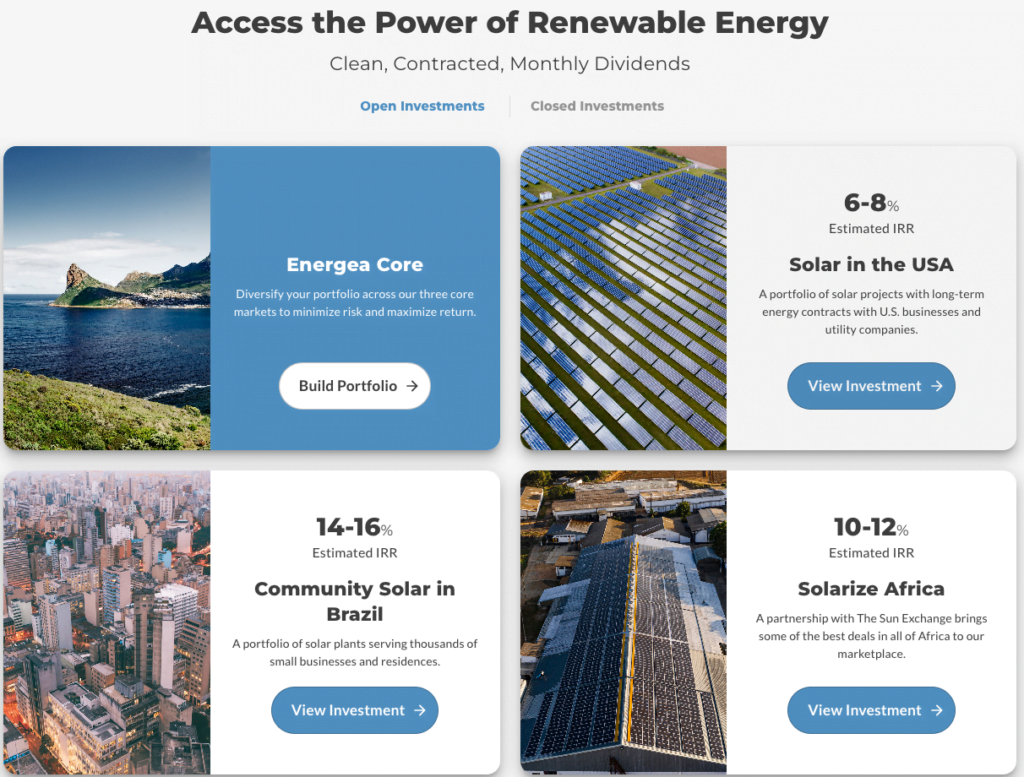

On the marketplace page, you can see all the open and closed investment opportunities.

There are currently 4 options available:

- Energea Core

- Solar in the USA (6-8% estimated IRR)

- Community Solar in Brazil (14-16% estimated IRR)

- Solarize Africa (10-12% estimated IRR)

If you click on any of the individual portfolios, it will bring you to the listing page. We’ll cover the listing pages in more detail in the next section.

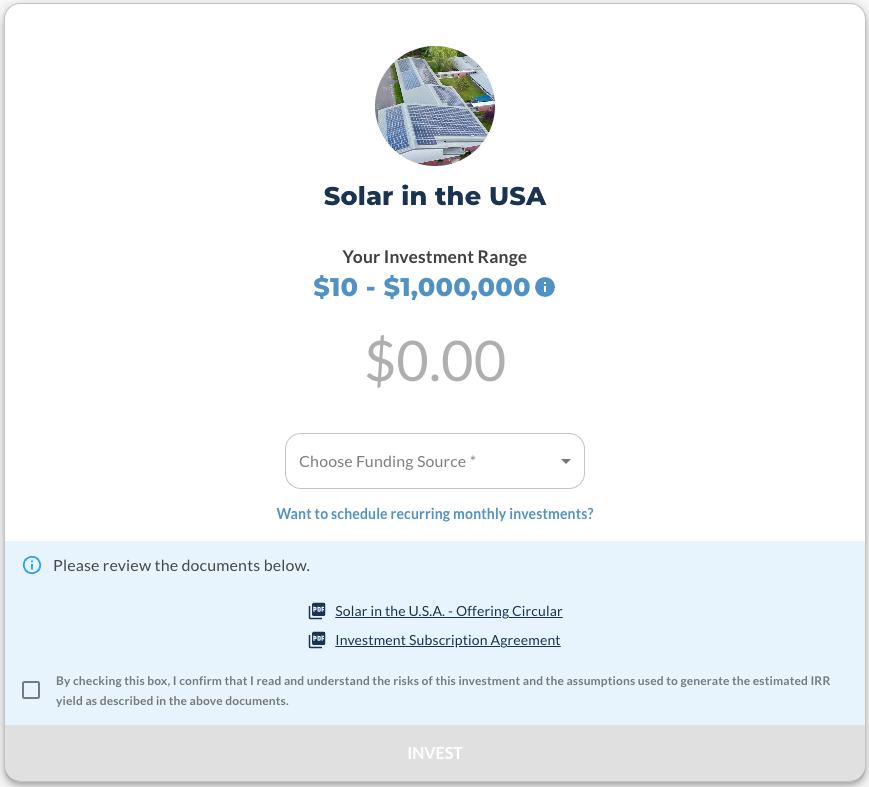

From the listing page, you can invest as little as $10-$100. If you haven’t already met the $100 minimum for the portfolio, then $100 is the smallest investment you can make. Once that minimum has been reached, future investments can be as small as $10.

The investment page also provides links to the Offering Circular and Subscription Agreement.

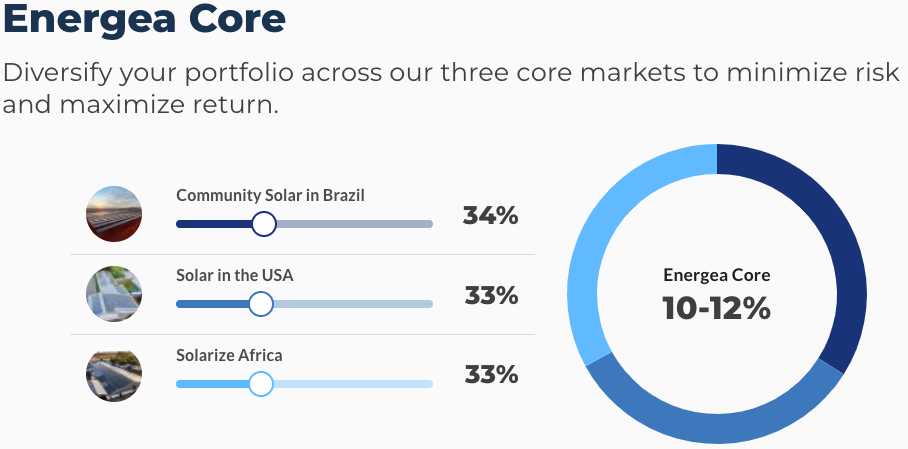

Energea Core works differently, however.

When you click on Energea Core, it brings you to a page to customize your investment. You can configure what percentage of your investment you want to be made in each of the open portfolios. As you adjust the sliders, the percentage in the center of the pie chart will update. This shows the anticipated IRR of the portfolio mix you’ve chosen.

If you click next, you’ll be asked to specify the investment amount, funding source, and whether to make this a recurring monthly investment. This is how you can still invest the minimum $100 while dividing that into smaller pieces across multiple different portfolios.

Recurring Investments

When making individual investments, there is a link present to configure a recurring investment. If you miss that, you can set one up by clicking the profile icon in the top right-hand corner of the page and selecting “Auto-Invest.”

From there, click “Schedule Auto-Invest.” This will bring up a dialogue that allows you to choose the portfolio (including Energea Core), the funding source, and the day of the month the recurring investment should happen. After, you’ll have an opportunity to specify how much to invest, review important documents and agreements and schedule the monthly investment.

Understanding Investment Listings

The listing page contains an initial landing page with an image and very high level information about the portfolio. That includes the portfolio name, a brief description of the portfolio, a video introduction to the portfolio, and a button to make an investment. Just below that, are several sections of the investment listing with more information.

The Investment

This section provides a more detailed overview of what the investment is, how it works, what the holding period is, and what investors should expect. This section doesn’t really change between portfolios.

While we would encourage everyone to read for themselves, there isn’t anything too surprising here. Here’s the rough outline:

- You’re buying shares of an LLC that owns solar projects.

- The projects produce electricity and that’s where revenue comes from.

- After operating expenses are paid, there is a monthly dividend to investors.

- Energea is the manager and will try to maximize returns, which includes potentially selling some or buying more assets in the portfolio.

- The holding period is 3 years. After that, Energea will make an attempt to help you sell the shares, but there’s no guarantee they can be sold.

- The portfolio was qualified by the SEC under Reg A.

Why We Like It

This section provides a very brief pitch on why the opportunity is interesting.

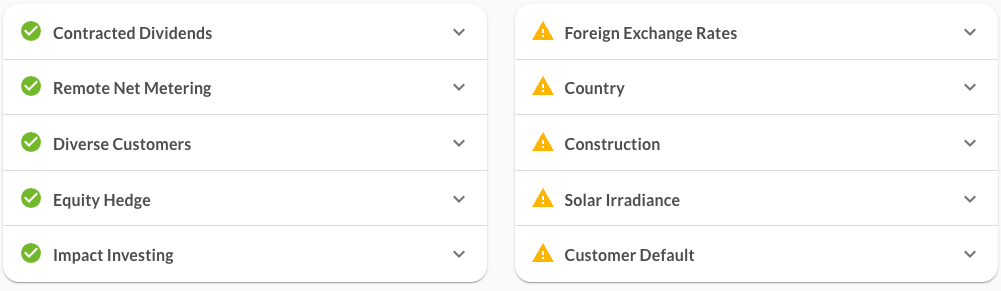

Upsides / Risks

The pitch from “Why We Like It” then leads into a section that outlines both risks and upside of the investments.

It’s important to note that the risks cited here are not all the risks for investing. They are a summary of some of the key risks. The full list of risks is available through the Offering Circular documents in the “Investment Documents” section of the listing.

It’s worth noting is that the risks differ between portfolios. In general, portfolios that have a higher target IRR also have a greater number of risks.

Across the different portfolios, the risks listed are:

- Foreign exchange rates

- Risk of returns being affected due to a local country’s currency exchange rate with the United States dollar

- “Country”

- Doing business in a foreign country is inherently more risky. Some examples cited are unexpected fees or delays.

- Construction

- A project could experience delays or unexpected costs during construction

- Solar Irradiance

- Historical weather patterns could change in a way that results in lower amounts of sunshine and power generation

- Customer Default

- This is unique to the community solar arrangement for the Brazil portfolio. Effectively, if enough individual utility customers canceled their participation in the community solar arrangement, the consortium renting the projects may be unable to provide Energea with adequate payment.

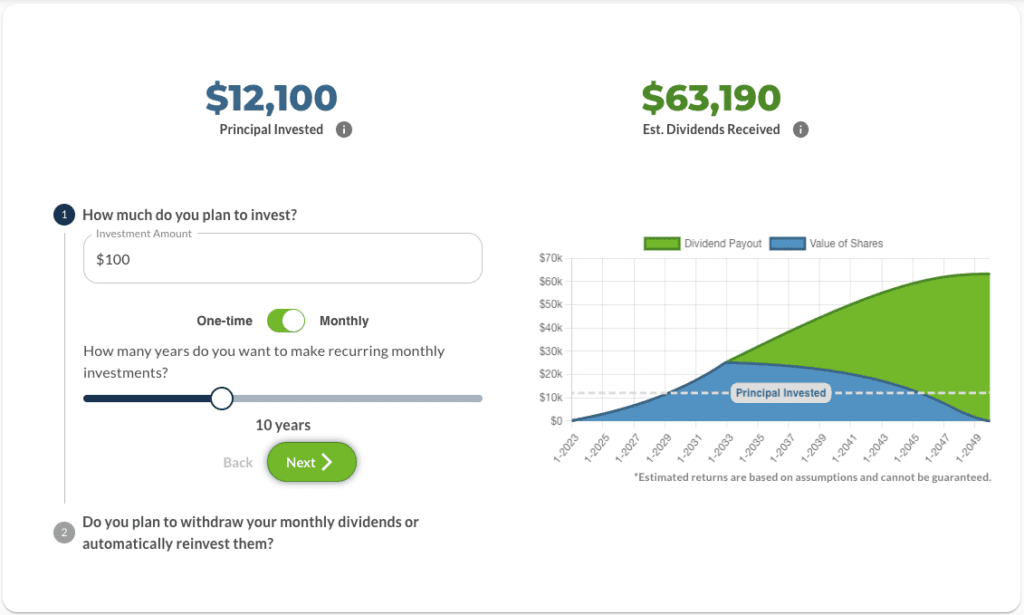

Returns Calculator

The return calculator allows you to adjust various inputs and get a simulated view of what the investment would return.

It allows you to model the investment amount, whether the investment is made once or monthly, and how many years a recurring monthly investment is made for. It also allows you to control whether dividends are withdrawn or reinvested and how many years dividends are reinvested for.

The example screenshot shows a $100 monthly investment for 10 years with dividends also being reinvested for 10 years in the Community Solar in Brazil portfolio.

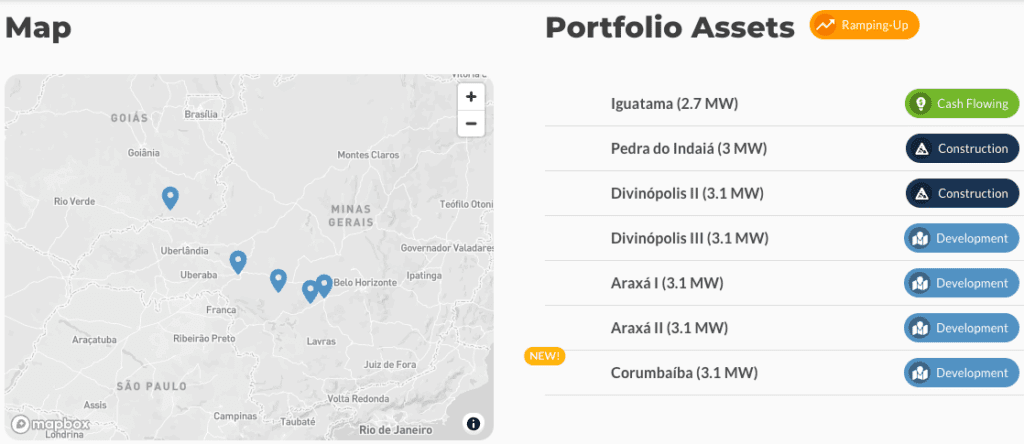

Map & Portfolio Assets

The next section provides an overview of what’s in the portfolio and where it is.

From the map, you can zoom in, zoom out, and pan around to see the locations of all the different projects in the portfolio.

To the right of that, you can see a list of all the portfolio assets. Each asset has a name, followed by the power generation capacity, and the status of the project. You can also click on each asset to see a picture, a very brief description, and the total project cost.

In the example above, we can see that the majority of the assets are in Development or Construction.

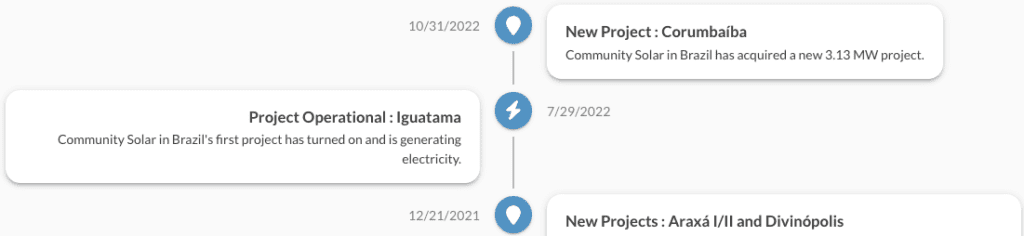

Portfolio Timeline

After the Map and Portfolio Assets, there is a section that provides more context for the timing and milestones of the projects in the portfolio. You can see when new projects were added and when projects were completed.

Investment Documents

This section contains a variety of important documents about the investment and how it will operate. For each portfolio, there is a Portfolio Memo, Offering Circular, and Operating Agreement available.

Additionally, there are sections for Project Documents and SEC Documents. Each project in the energy portfolio will have a project document available.

Energea Fees

Energea has two types of fees. One is an asset management fee. The other is effectively a performance fee. Once the performance exceeds a certain benchmark, Energea will take a share of the profits in excess of the benchmark. All projected or realized returns on the website are net of fees.

The asset management fee ranges from 1-2% and the “Promoted Interest” fee (as it’s called in the Offering Circular) is 20-30%. Here’s what the fees are for each of the current offerings:

- For Solar in the USA…

- 2% asset management fee.

- Promoted Interest starts after a 6% IRR is achieved. The fee is 20%.

- From pages 32 and 53 of the Offering Circular PDF.

- For Community Solar in Brazil…

- 2% asset management fee.

- Promoted Interest starts after a 7% IRR. The fee is 30% for this portfolio.

- Taken from pages 28 and 56 of the Offering Circular PDF.

- For Solarize Africa…

- 2% asset management fee.

- Promoted Interest after a 7% IRR. The fee is 30%.

- This is from pages 34 and 57 of the Offering Circular PDF.

Energea Referral

Investment Dashboard

Clicking the “My Dashboard” link will bring you to the Investment Dashboard page. This provides a variety of information about your investments, organized into different sections.

The initial screen of the Investment Dashboard provides a lot of metrics:

- The market value of your account

- Your cost basis

- The amount of dividends reinvested or paid

- The total dividends received

- The internal rate of return

- The change in market value and total dividends in the last 30 days

Additionally, this initial screen shows a graph of your account value. You can view data across 1 month, 3 months, or all time. You can also click to see what your projected future account balance is.

Portfolio Breakdown

The Portfolio Breakdown card allows you to see metrics about your investments in individual Energea portfolios. You can see the weight of each portfolio investment in your Energea account. You’ll also see the IRR, total dividends received, the market value, and the cost basis for each energy portfolio you’ve invested in.

Additionally, you can click the “Add Funds” button to invest more money into a given portfolio, directly from the Investment Dashboard. This is also where you can configure whether dividends for a particular portfolio are reinvested at the end of each month or deposited into your wallet.

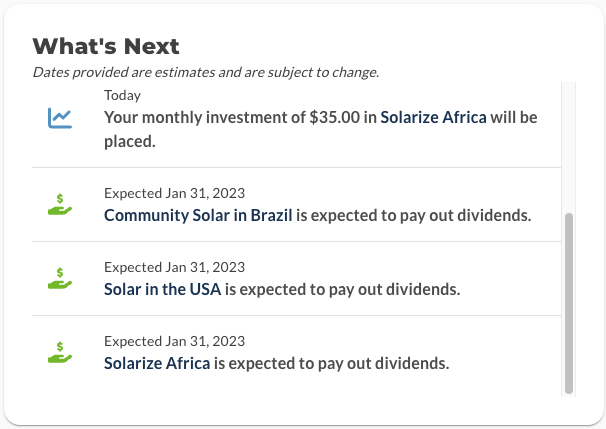

What’s Next

This section shows all the upcoming events related to your investments. For the most part, this shows upcoming recurring investments and dividend payouts.

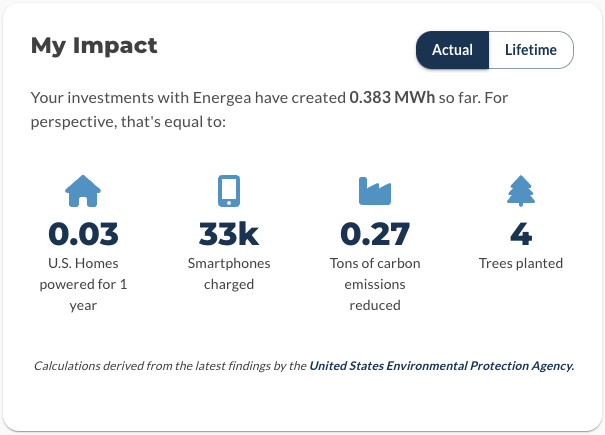

My Impact

This card helps to understand the energy and climate impact of your investments. It states your share of power generated and what that equates to in terms of things like trees planted.

You can toggle between the actual results that have happened so far and the projected impact it will have over the lifetime of the investment.

Asset Map

Lastly, the Asset Map shows the location of all the energy projects you’re invested in. If you’re invested in multiple portfolios, this effectively just aggregates the maps from the individual listing pages into one view.

FAQ

Yes, Energea has generous referral rewards. If you register and make your first investment using our referral link, you can earn a $50 bonus to your account.

Where To Learn More About Energea

The Energea FAQ page and Investor Relations page have a variety of useful information to supplement this article. The Investor Relations page includes links to quarterly webinar videos, podcast episodes, and annual reports from each portfolio.