Royalty Exchange has a large library of music royalty assets and a strong flow of new listings. If you can afford to pay for ownership of assets that routinely cost $25,000 or more and don’t mind the fees, Royalty Exchange can be a great place to build passive income from music royalties.

A high-level overview of some important characteristics of Royalty Exchange. Please keep in mind that some aspects are related to the characteristics of the type of assets available on the platform.

What Is Royalty Exchange?

Royalty Exchange is one of the first names you’ll come across for investing in music royalties. It’s also one of the oldest, dating all the way back to 2011. There are two sides to the Royalty Exchange platform.

On one side, it’s a place for artists and music rights holders to evaluate and make sales of their music rights. On the other side, Royalty Exchange allows investors to buy and trade music rights to earn passive income from the royalty stream.

Royalty Exchange stands out from its peers for its regular deal flow, successful auctions, and robust secondary market. However, the lack of fractional investing options makes Royalty Exchange the least accessible music royalty investing platform for smaller investors.

Royalty Exchange Investment Products

Technically, there are 3 different products for the asset class on Royalty Exchange:

- Auction House

- The eXchange

- Private Syndications

However, the eXchange is the only one of those with regular activity.

From the first page of listing on the Auction House, this NFT auction from June 2021 is the most recent one. The Auction House was quite active as recently as 2020 though.

There are only three listed Syndications. Both the Cage The Elephant and Dire Straits offerings date back to 2018. It sounds like the planned Eminem offering didn’t happen and there haven’t been any further syndications since.

Because of that, we’ll be focusing on the eXchange exclusively for this article.

What Is The eXchange?

The eXchange is both a primary and secondary marketplace for buying music royalties. Unlike other platforms that we have covered, you can’t buy fractional shares of assets on the eXchange.

The marketplace is similar to eBay. Some items have a “buy now” price, while others do not and accept bids. In most cases, listings will sell based on bidding rather than directly paying the listing price.

The eXchange has three main types of royalty assets available – 10-Year, 30-Year, and Life of Rights. This is specifically referring to the duration the asset will produce music royalty income. A 10-Year asset will only produce royalty payouts for 10 years. After that time has passed, the asset has no value.

A Word Of Caution For Those New To The Asset Class

The eXchange is a marketplace. It is not an investment platform with curated offerings at prices analysts at the company feel are good deals for investors.

You can absolutely overpay for an asset here and end up with a very bad deal. While you should always know what it is that you’re buying or investing in, it’s especially crucial with Royalty Exchange.

If you haven’t already, you should take a look at our introduction to music royalties. Also take a look at our news article about SongVest’s new offerings from November. It has several real examples of what the earnings curve of music royalty assets look like, with some analysis and commentary.

If you don’t feel confident in your ability to assess the music royalty deals on the eXchange, there are some other investing platforms to consider.

ANote Music lets you invest fractionally, has very low minimum investments, and has a secondary market. However, everything on the platform works based on Euros. We have an ANote Music overview to help get you started with the platform.

SongVest also allows for fractional investing in SEC-qualified offerings. It has higher minimum investments, but at $100-$150, they’re still very accessible compared to Royalty Exchange. We have a SongVest overview available as well.

These will be much safer spaces to explore the asset classes. Deals on both platforms have a higher degree of curation (it’s still possible to lose money though, as with all investments) and much lower minimum investments. Making a mistake on a $100 investment is much easier to learn and recover from than the same mistake on a $15,000 investment.

Primary Market / Featured Listings

The “Featured Listings” section of the eXchange is where you can find the primary market. This is where all new assets debuting on the platform will be listed for sale.

Items listed in the primary market often have a lot of activity and transactions can happen very fast.

Secondary Market / Other Listings

The “Other Listings” section of the eXchange is the home of the secondary market. Every asset listed here was previously sold on the primary market. One consequence of this is that 10-Year and 30-Year assets will not have the full term remaining. The portion of the term remaining may heavily influence whether the price for the asset is a good deal or not.

Unless otherwise noted, after an offering is sold on the primary market, it is automatically listed in the secondary market.

As someone that already made an investment on the platform, having your asset on the secondary market always allows for someone to discover it and give you an offer. It’s possible that leads to an exciting exit opportunity you would have missed otherwise.

For someone looking to purchase an asset on the platform, there are 3 main consequences of this practice:

- Many assets don’t have a list price. They may also have limited bid activity, so it’s harder to understand what might be required to acquire the asset.

- Owners of older assets are often inactive. This could mean that even if you submit a reasonably priced bid, you get no response and no counteroffer.

- Some assets have list prices that are horrible deals. This is generally a practice that allows the asset owner to communicate they’re not interested in selling. Only if you pay a completely unreasonable price will they part with the asset.

Payment Requirements For An Asset You’ve Won

If you win an asset, you are required to send the funds within two business days. ACH and bank wire transfer are the two accepted payment methods.

Any bids placed on the eXchange or through standing orders are considered binding. The same is also true if you win an asset by agreeing to pay the list price.

Does Royalty Exchange Charge Fees?

Yes, there are fees for transacting on the eXchange, unless you have the All Access Membership. We will cover the membership in a later section.

Buyers will have to pay 1% of the final auction or purchase price as a fee, with a $500 minimum.

This may be one of the reasons that there are not many lower-priced assets available on the platform. If the sale price were $5,000, the buyer would owe 10% of the investment as a fee. That would likely be enough to wipe away any potential gains.

Sellers are also subject to fees, though an exact amount is not explicitly specified. Their FAQ states that the fee will be negotiated prior to listing an asset for auction. That appears to be for listings on the primary market. Based on an example included in the All Access Membership page, we can compute that there is a huge 15% fee for sales on the secondary market.

Navigating The eXchange

The eXchange is where you can browse listings and learn more about what’s happening on the marketplace.

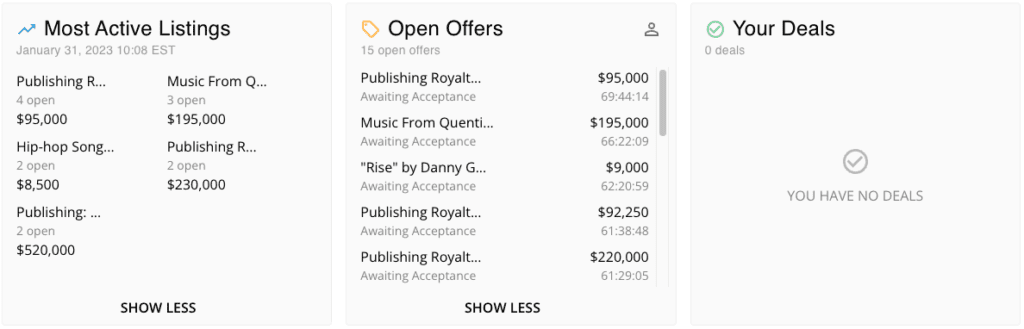

When you first open the eXchange there are 3 tables. The Most Active Listings, shows offerings that are generating the most engagement and offers. These are usually new listings on the primary market. Next, Open Offers shows a list of all the offers that haven’t been accepted, rejected, or withdrawn. There’s also a Your Deals table. Clicking the offerings in these tables will pull up the asset preview.

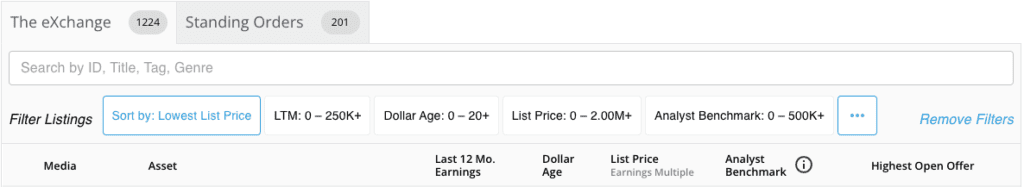

Next, is the control panel of the eXchange. Everything here will affect what asset listings are shown in the tables below. Standing Orders are discussed in the All Access Membership section below.

There are a lot of assets listed on the eXchange. The options under Filter Listings will help narrow things down. Here’s a brief overview of some of the key options:

- LTM

- This is the last 12 month’s earnings for the asset.

- Music royalties are a yield-producing asset, so this is kind of like the total amount of dividends payed out by a stock.

- Dollar Age

- The dollar age is a common metric across all listings. It attempts to control for the age of the songs in the catalog by applying a time-weighting to each song’s LTM earnings.

- Why? Songs have an important life cycle of earnings. For a typical song, the best quarter is almost always its first quarter. It’s downhill from there before eventually reaching a period of relative stability several years later. This is an important factor to be aware of when valuing an asset.

- This is covered in greater details in this article introducing the asset class.

- Royalty Exchange also has a blog article about Dollar Age if you’d like to learn more about the calculation.

- List Price

- The list price is similar to the “Buy Now” price on eBay. If you pay that price, the asset is yours.

- Analyst Benchmark

- This is a data-based estimate of a “reasonable price” for the asset. It’s based on identifying similar assets and their valuations they sold for.

In addition to the main criteria, hitting the three dots after analyst benchmark will display a few additional options. They allow you to show or hide different types of listings:

- Life of Rights listings

- 30-Year listings

- 10-Year listings

- Only saved listings

- Filled listing

- Pending listings

- Listings with an active owner within the last 30 days

- Listings with an active owner within the last 7 days

Understanding Asset Listings

When you click on any of the listings in the eXchange, a new window will pop up with more details. In this section we’ll break down each section so you know what to expect.

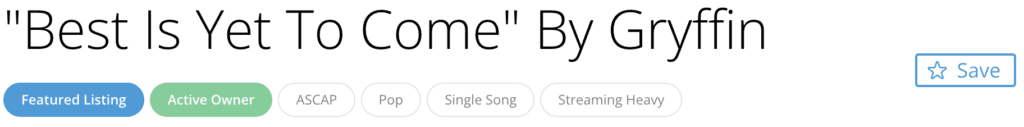

Asset Headline

The first thing you’ll see is the name of the asset, some labels, and the ability to save it.

The labels shown beneath the asset name will vary from listing-to-listing. The Featured Listing label indicates that this is an offering on the primary market. The Active Owner label tells you that the owner of the asset has been active on the site recently. This is not always the case.

The remaining labels provide other contextual information like the distributor, the song genre, how many songs are in the asset, and where the song earns the majority of its royalties from.

Asset Summary

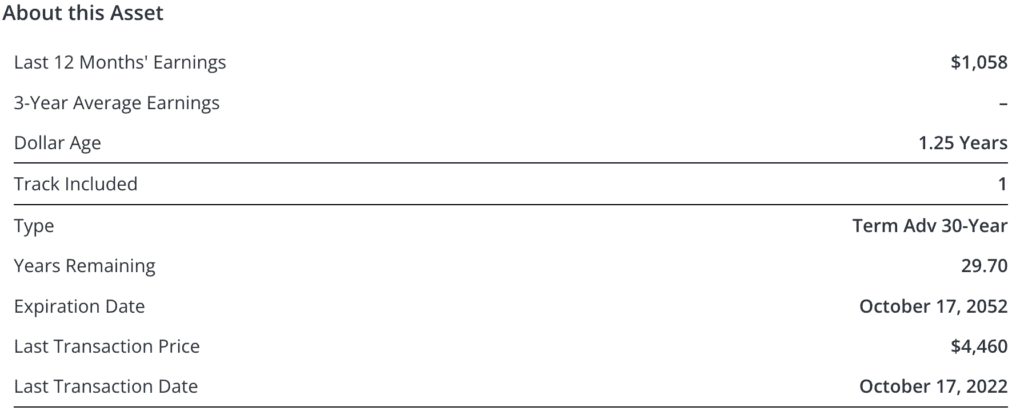

After the introductory information, Royalty Exchange introduces other important aspects of the listing. This next section focuses mostly on financial information.

The first pieces of information available are the asset’s earnings. The Last 12 Months’ Earnings (LTM) is the amount of royalty payments the asset has earned in the last year. The LTM value is one of the most common metrics music royalties are valued based off of.

There is also a 3-Year Average Earnings metric for assets that have been producing royalty earnings for at least that long. While assets typically valued on the LTM, the 3-Year Average Earnings, will help you easily spot deviations from recent trends.

Is the LTM way higher than what it averaged the past 3 years? That could be a good thing, but it’s important to understand how likely the most recent performance is to repeat.

In the case of our example, this is a single song (easily spotted from the Track Included metric in the table) that has been earning for just over 1 year. So we don’t have any information for this metric.

The Dollar Age is a metric produced by Royalty Exchange that applies time-weighting to the LTM of songs in the catalog. The age of a song is important because new songs tend to see large declines in their earnings over the first few years before eventually stabilizing.

We covered this in a bit more detail above. There’s also this Royalty Exchange blog article about Dollar Age if you’d like to learn more about the calculation.

The Type, Years Remaining, and Expiration Date are all closely related. Life of Rights type assets won’t have any information for Years Remaining or Expiration Date. For 10-Year and 30-Year assets, you’ll see how long remains from the original 10 or 30 year term, as well as the specific date the asset will stop producing royalties.

Lastly, there is information about the Last Transaction Price and Last Transaction Date. This tells us when an asset was last sold and for what price.

Purchase, Bidding, And Sale History

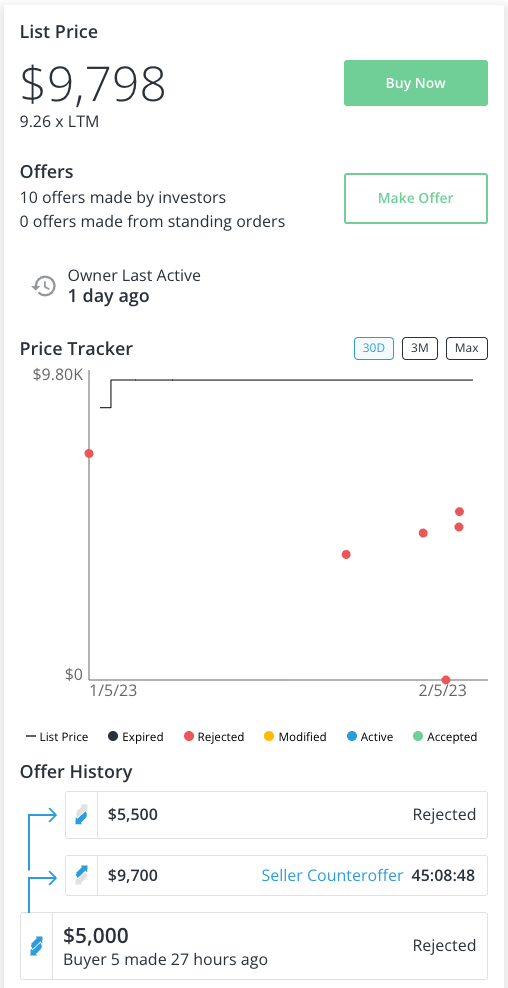

After the summary, you can see the price and bidding history for the asset. You can also directly purchase the asset yourself at the Buy Now list price, or use the Make Offer button to submit a bid.

In the case of our example, the Buy Now price is $9,790, which is equivalent to a 9.26 LTM valuation. If you were willing to pay that price for the asset, you can have it with no competition.

For bids, there have been 10 offers made by investors in total. The Price Tracker allows you to see activity for the offers and list price over time. The solid black line shows the list price and the colored dots are different investor bids. Bids are color-coded based on the results. For example, rejected bids are in red and expired bids – where the owner did not respond – are in black.

There is also an Offer History table. It also shows the history of investor bids, but with added information like owner counteroffers. In this case, the owner doesn’t seem willing to budge below $9,700 right now.

Lastly, you can see the asset’s Sale History, when earnings statistics were last updated, and any other information. This is also where you can download a more detailed .csv file of the asset’s earnings over time.

Income Breakdowns

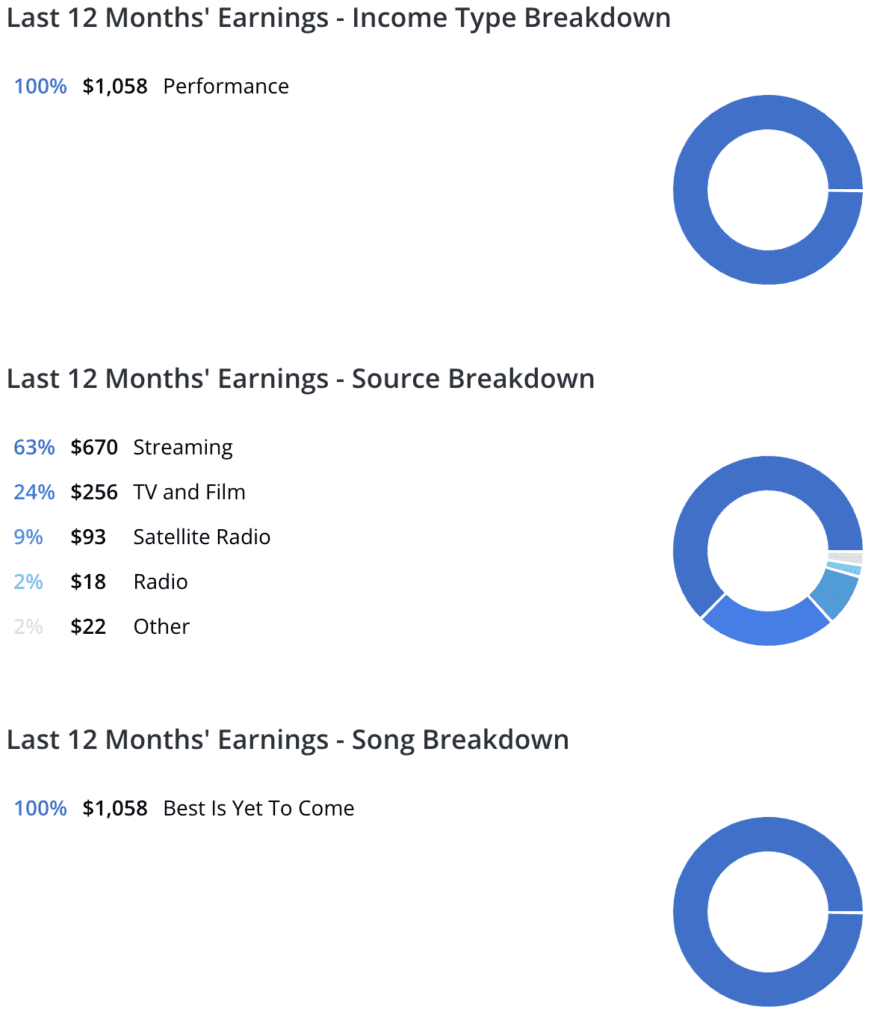

While earlier sections of the listings gave us a summary of how much the asset produced, this section helps us understand how it earned them. This starts with a few pie charts of the last 12 months’ earnings.

The Income Type Breakdown pie chart explains the type of music rights that generated the asset’s earnings. In this example, the asset only includes the public performance rights, so 100% of earnings came from that.

Next, we can see a pie chart showing the Source Breakdown. This helps us understand the different types of media that generated royalties for this asset. The asset headline included the Streaming Heavy label, which we can see reflected here. About 63% of earnings came just from streaming.

Lastly, the Song Breakdown shows which songs in the asset are producing the majority of the earnings. In this example, there’s only one song, so 100% of the earnings are from that. Even in assets with a large catalog of many songs, there’s usually a small number of songs that make up the majority of the earnings.

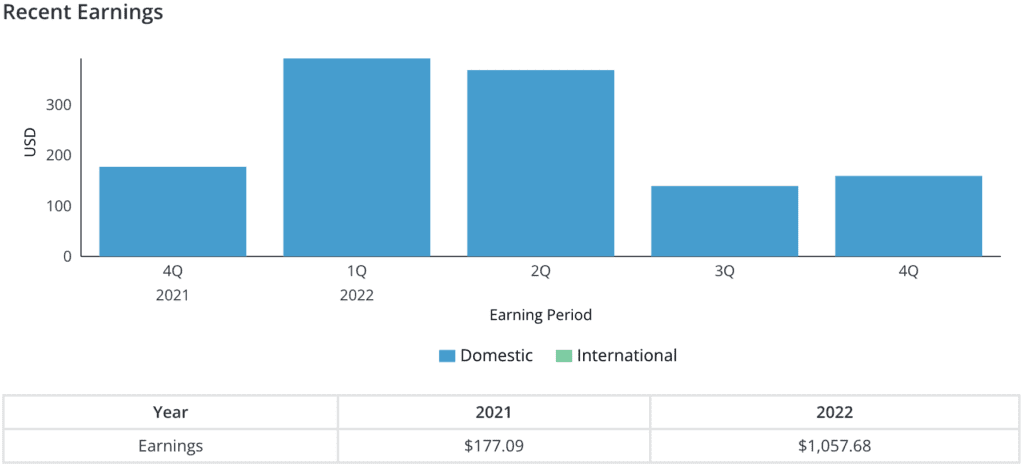

In addition to the pie charts, there is also information about how the asset performed over the last 3 years, if the information is available. This breakdown also shows the distribution of “domestic” vs “international” earnings.

In this example, the song is less than 3 years old, so we only have 5 quarters of data. It also appears that it has not produced any earnings from international sources so far. We can also see the total earnings from 2021 and 2022.

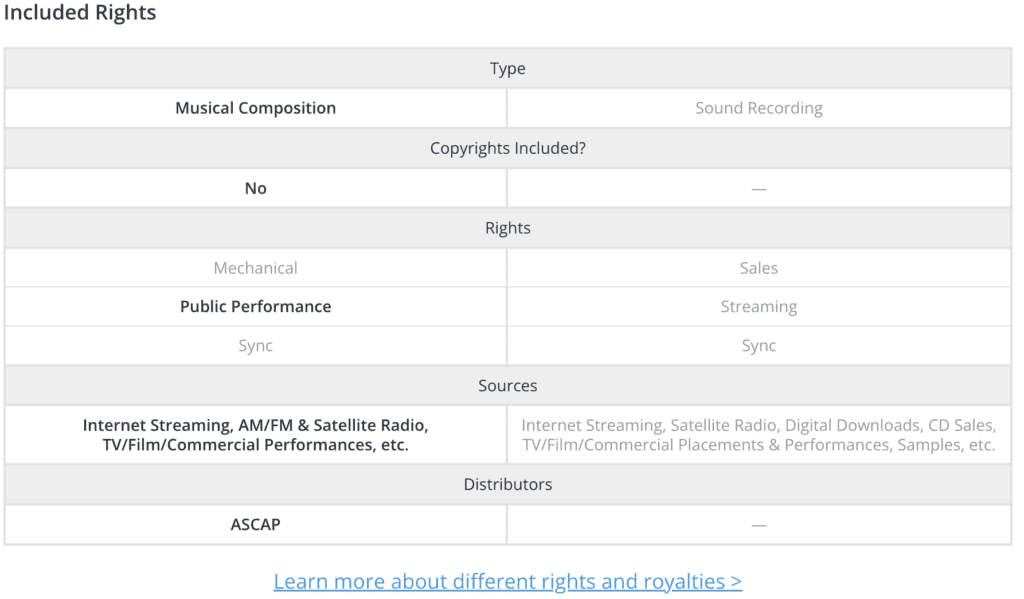

Rights Included

There are many different types of music rights and sources to earn from. The Included Rights table provides a simple summary of this.

We can see that the only type of rights included is Public Performance. This makes sense as we saw 100% of income came from Performance in the Income Type pie chart. Based on the sources, we’d expect to see Streaming, Radio, TV, Film, and more generate income. These were all present in the Source Breakdown chart above.

Additional Asset Information

There are a few other pieces of information at the end of the listing that are mostly information in nature.

This final section includes information about the royalty distributor, official music videos from songs in the catalog from YouTube, and a full list of all tracks included in the asset.

Royalty Exchange’s All Access Membership

Royalty Exchange is the only music royalty investment platform that offers a subscription.

What Does It Include?

Their All Access Membership provides several benefits:

- Automated Investing through unrestricted Standing Orders

- No asset purchasing fees

- Monthly insight reports

- Lower fees to sell an asset on the marketplace

- Access to Private Syndicate offerings

- Greater access to data and the Royalty Exchange analyst team

We’ll take a look at standing orders a bit more closely in the next section. We’ll look at the rest of the benefits in some more detail here.

The reduction in purchasing fees is the easiest way to make this subscription worthwhile. There’s a $500 minimum for any asset purchase on the platform. For someone that is a frequent investor on the platform, these savings could make the subscription worthwhile.

The monthly insight reports are on various educational topics. These include things like how to model music catalog valuations and potential tax advantages of music royalty assets. Royalty Exchanges provides this Tax Benefits of Royalty Investing document as an example of what’s included in one of the reports.

Members also have to pay 20% lower fees for selling assets on the secondary market. Even with that discount, these sales still carry a 12% fee.

Having access to private syndicate offerings is potentially interesting. However, as we’ve previously covered, it does not appear there have been any offerings in recent years. There are no signs that these will be returning either.

The access to the Royalty Exchange analysis team is a very unique feature. Members can utilize an “Ask an Analyst” feature. This allows investors to get answers about catalog questions and valuation advice within one business day.

It is also mentioned that All Access members can download “raw earnings history data” for all “marketplace” listings. We assume this means all the listings on the eXchange. Since it is possible for non-All Access members to download a “Raw Data File (.csv)” from listings on the eXchange, it’s unclear what benefit this provides. This could be a feature that was originally exclusive to All Access members, but was later given to all users.

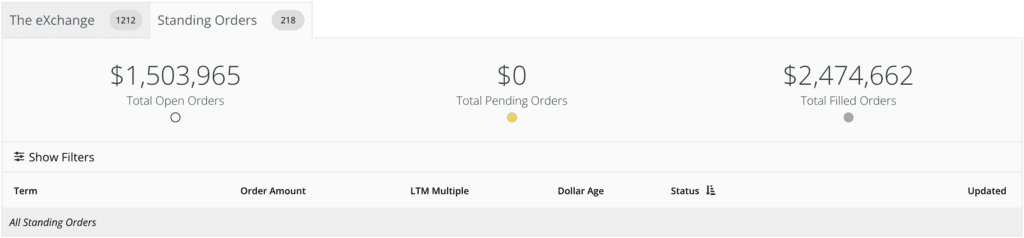

Unrestricted Standing Orders

When looking at the All Access Membership page, the first benefit they advertise is “Automated Investing.” There’s also a case study and some data points on how it has improved ROI. Let’s take a closer look.

On Royalty Exchange, the automated investing is accomplished through Standing Orders. All users of Royalty Exchange can place one standing order at a time for “term” offerings (only 10-Year assets). These orders also have to be for assets under $25,000.

The benefit exclusive to All Access Members is the ability to place Standing Orders without the same restrictions. This includes placing orders on Life of Rights assets, as well as for assets over $25,000 in value.

One way to assess this feature is to take a look at the Standing Orders order book. If we sort by “Status,” we can group all the filled orders together. The list of filled orders is also sorted by the “Updated” date with older orders on the top and newer ones on the bottom.

There are a few things that stand out from reviewing the filled standing orders:

- The overwhelming majority are for 10-Year assets

- There have been around 30 filled standing order for Life of Rights assets in the past 4 years

- In the past year there were no successful orders for Life of Rights assets

- Within the past two years, there were 2 sales for 10-Year term assets with a sale price greater than $25,000.

This suggests that All Access members do not often get to take advantage of the expanded automated investing features of the membership. Those considering purchasing the subscription should keep this in mind. Standing Order sales do happen. Some of them might even be spectacular deals for investors. However, those sales are not that common.

That having been said, I should note that there are many offers that are made from Standing Orders. It’s not possible to assess how often these serve as the starting point for deals that ultimately complete.

How Much Does The All Access Membership Cost?

For the first year, you’ll have to pay $4,997. For every year after that you’ll need to shell out $997 to maintain your membership.

Frequently Asked Questions About

Royalty Exchange

What Is Royalty Exchange?

Royalty Exchange is a marketplace for music rights holders and investors. It allows rights holders to make sales of their rights for cash right now. On the other hand, it provides investors with the chance to acquire an uncorrelated asset that can generate passive income.

Is Royalty Exchange Legit?

Yes, Royalty Exchange is legit. It’s a legitimate marketplace to buy and sell royalties.

Are There Any Tax Benefits To Investing On Royalty Exchange?

While neither Asset Scholar nor Royalty Exchange are tax advisors or experts, Royalty Exchange believes there could be. Based on this 2018 PDF they wrote for All Access members, assets purchased on Royalty Exchange should be eligible for amortization.

What Is The Minimum Investment On Royalty Exchange?

Royalty Exchange doesn’t have a minimum investment. Rights holders can set a “Buy Now” price on their assets and investors can submit bids as well. Thus, the price of each asset varies. Typically, the lowest priced assets start around $10,000.

Does Royalty Exchange Charge Fees?

Yes, Royalty Exchange charges fees to both buyers and sellers. Buyers pay 1% of the purchase price or $500, whichever is higher, unless they have purchased the All Access Membership. The fees paid by sellers can vary. For listings on the primary market, fees are negotiated before listing. For secondary market listings, fees are expected to be 15%.

What Is The All Access Membership?

The All Access Membership is a Royalty Exchange subscription. It costs $4,997 for the first year and $997 a year after that. All Access members won’t pay fees for buying assets on the platform. They also get access to more features, information, and support on the platform.

Where To Learn More

If you’re new to investing in music royalties, we have an overview of this unique asset class to help get you started. Royalty Exchange also has several introductory resources about investing in this asset class. Music Royalties 101, Intro To Royalties and Royalty Exchange, and Why Music Royalties Belong In Your Portfolio.

To learn more about Royalty Exchange, take a look at their FAQ. They also have periodic “investor office hours” where you can ask questions. Here’s a link to the recording for their November 2022 session.