Groundfloor could be the perfect platform to diversify your investments, get uncorrelated returns, and generate passive income from high-yield, secured real estate debt.

| Potential Yield | 2.5-14% |

| Potential Appreciation | LRO and Note investments do not appreciate (yield only). Offerings being piloted on Groundfloor Labs may appreciate. |

| Minimum Investment | $10 |

| Investor Requirements | No accreditation requirements for loan (LRO) or Note offerings. Accreditation may be required for access to Groundfloor Labs offerings. |

| Liquidity | Extremely limited – No secondary market |

| Other Highlights | LRO offerings are secured by the underlying property value. |

If that sounds interesting to you, then take a look below. This post has everything you need to know before making your first investment.

What Is Groundfloor Real Estate?

Groundfloor is effectively two services in one, bridging investors to each other for mutual benefit.

Borrowers

On one side of the service are borrowers, basically real estate developers and investors. These developers are receiving loans from Groundfloor. The loans generally fall into one of three categories:

- Loans are used to pay for costs to construct a new house. The loan is repaid by the sale of the completed house.

- Loans to purchase and renovate or rehabilitate a property. These are sometimes called “fix and flip” projects. The loan is repaid by the sale of the house after work has been completed.

- Loans taken by property owners. The house is used as collateral and the loan is repaid without changing and selling the house.

Investors

The other side of the service are the investors on the platform. They have a consistent flow of loans they can start investing in for as little as $10.

On an annualized basis, the loans currently available on the platform have yields ranging from 7% — 13%.

How Does Groundfloor Work?

Despite being focused on real estate, Groundfloor’s core offerings are functionally very different from other platforms like Fundrise or Arrived Homes. Let’s start with the framework of how things work when you invest with Groundfloor.

Types Of Offerings

There are four types of offerings currently available:

- LRO Loans — Short-term real estate debt investments. These are open to non-accredited investors.

- Anchor Investor Loans — LRO Loan opportunities exclusive to accredited investors. To apply go to Investor Account > Account Settings > Anchor Investor Program.

- Groundfloor Notes — Short-term loans given to Groundfloor itself. These are covered in this section below.

- Groundfloor Labs — These are effectively beta tests for new ways of investing in real estate that may appear on the platform in the future. This article covers Labs in detail.

Deal Flow Process

- First, borrowers approach Groundfloor requesting access to capital for their real estate projects (for example, a fix-and-flip).

- After reviewing the application and performing due diligence, they may offer a loan.

- If a loan is offered and successfully closed, Groundfloor will provide the borrower with the funds.

- The loan is listed on the platform and made available for retail investors.

Investors then purchase shares of the loans or lend money through Groundfloor Notes to earn yield. This provides more working capital to bring new loans onto the platform.

Does Groundfloor Charge Fees?

Yes, but only for borrowers. Investors in the fractional real estate debt investments that Groundfloor offers do not pay any fees.

How Does Groundfloor Make Money?

Groundfloor makes its money from their loan offerings in two main ways:

- Collecting fees and closing costs from borrowers associated with the loan applications and servicing.

- Interest earned on the loans offered by Groundfloor before shares are bought by investors.

What Are The Benefits For Borrowers?

There are many banks. There are very few lending services designed to meet the needs of investors in these types of real estate projects. For example, borrowers can receive loans for properties with values as low as $75,000 and with deferred payments.

What Are The Benefits For Investors?

Investors have access to high-yield debt that is secured. If borrowers are unable to repay and unable to come to a workout agreement, Groundfloor can foreclose on the property in order to recoup investor funds.

Investing In Groundfloor’s LRO Loan Offerings

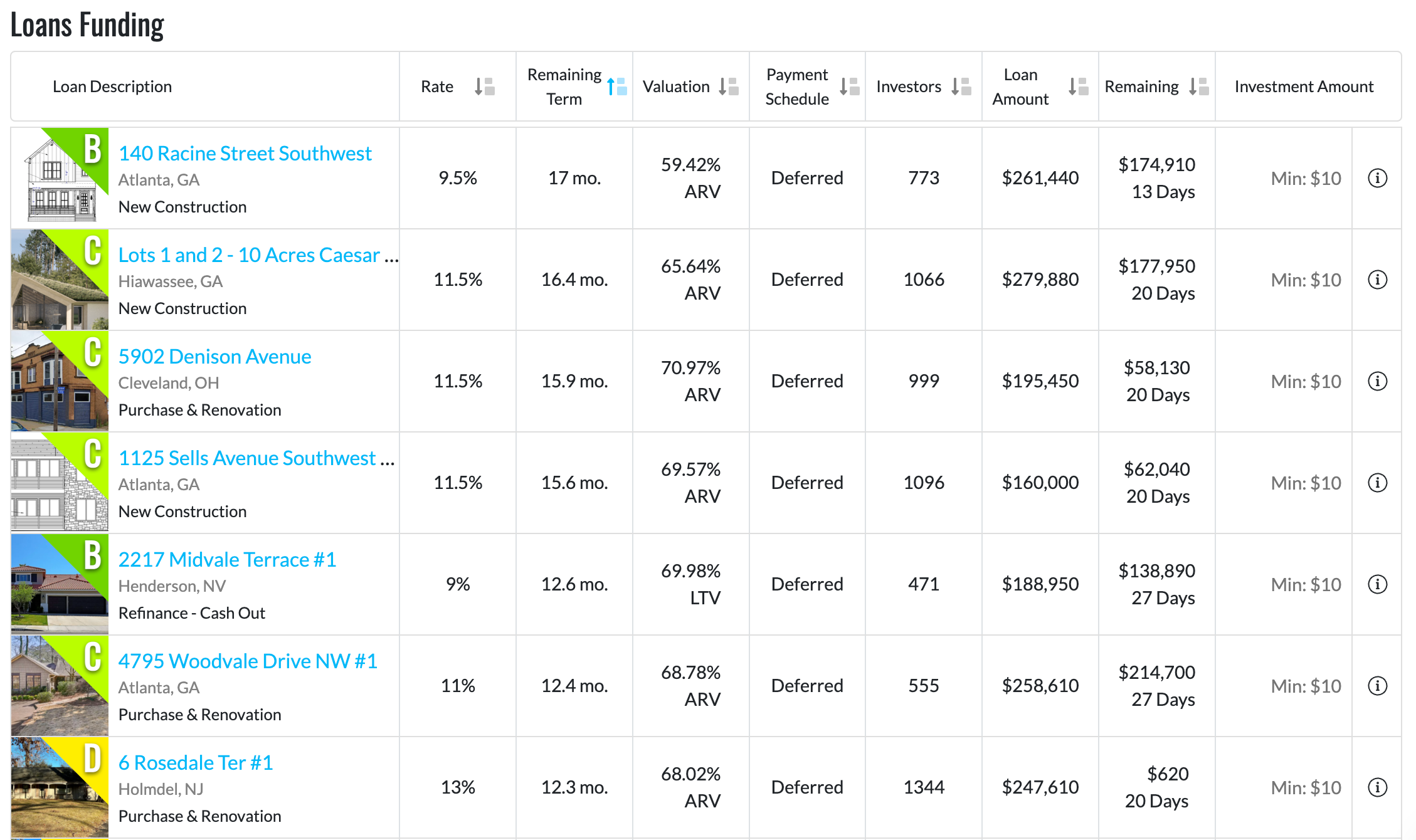

From the “Invest” page there is a list of loans and notes available. We’ll focus on loans during this section. This link will take you to the Groundfloor Notes section.

The list of loans funding on the Invest page will include a variety of information to help you understand the opportunity at-a-glance. Let’s start by reviewing the information available for each loan offering.

Loan Description — How To Get More Information

The property address is a hyperlink. Clicking it takes you to a page with a bunch of additional details about the loan. That includes risks related to the project, borrower information, and different parameters that went into the loan grade.

Understanding Loan Letter Grades

Every loan on the platform has a letter grade. These attempt to easily estimate the level of risk investing in a given loan carries.

The better the letter grade (“A” is the best, “G” is the worst), the lower the risk. Investments that are lower risk carry lower yields. For example, newly originated “A” grade loans carry interest rates around 7.8%. The target rate for new “D” grade loans is 12.9%.

Are Loan Letter Grades Useful?

Based on a loan grade analysis Groundfloor performed in May, yes. The “A” grade loans had lost 0% of principal invested, while “E” grade loans lost a painful 14.62%.

Note: It appears the sample size of “E” loans is only 7. It’s possible the loss rate would be lower with more “E” grade loans offered through the platform and included in the analysis.

What To Expect From LRO Repayments And Returns

There are 3 variables that define the expectations:

The payment schedule for LRO loans is always deferred. That means there’s no interest or principal paid until the loan is repaid in full.

The loan is due to be repaid at the end of the remaining term. It is possible for loans to be repaid much earlier. It is also possible for loans to need an extension and be repaid later.

The rate is the annualized interest rate on the loan. How much you should expect to actually receive from your investment is driven by the remaining term.

An Example Return From An LRO Investment

It’s a bit difficult to develop a mental model of what to expect when all three variables influence the return. To help, we’ll go through an example. Let’s assume the following:

| Loan Parameter | Parameter Value |

|---|---|

| Loan Rate | 12% |

| Payment Schedule | Deferred |

| Remaining Term | 12 Months |

| Our Investment Size | $100 |

| The Date Of Our Investment | January 1, 2023 |

| When The Loan Is Repaid | End Of Remaining Term |

- Since the remaining term is exactly 12 months away, we expect repayment on January 1, 2024.

- Since 12 months is 1 year exactly, we expect to get the full annualized rate of 12%.

- With a deferred payment schedule, all principal and interest will be paid at once.

That Sounds Great, But Are There Any Exceptions?

Yes, there are two main reasons why the repayment timing or the repayment amount could differ from expectations.

Let’s modify the previous scenario. Instead of the loan being repaid at the end of the remaining term, the loan will be repaid 6 months early — on July 1, 2023.

An annualized rate of 12% is equivalent to 1% per month. Since the loan is repaid after 6 months, we would expect to receive a $106 repayment on July 1, 2023.

It is also possible for loans to repay late.

If a loan can not be paid at the end of the remaining term, it can be extended. Groundfloor will enter into a workout agreement with the borrower. If an agreement can’t be reached or if the loan continues to not be repaid, they can initiate foreclosure on the property.

The main goal of the foreclosure will be to recover as much of the principal investment as possible. In this scenario, some amount of principal loss is possible, but not certain.

How Often Do Exceptions Occur?

From a combination of experience and data, very often.

On the data side, this blog post from Groundfloor shows how often loans of different grades enter an extended or default state. For loans with grades “A” through “C,” loans were extended 14–26% of the time. They defaulted 8–21% of the time. However, even in the defaults the losses ranged from 0.00–2.21%.

On the experience side, loans are repaid early fairly often. I suspect that borrowers request more time than they think they’ll actually need. That lets them hit a few project delays without worrying about the pressure of the loan coming due.

Helpful Resources For Loan Portfolio Construction

One of the most important factors when building a portfolio of LRO loans is diversification. Don’t believe me? Here’s what Groundfloor says on the matter:

For new investors especially, we recommend spreading your dollars across many LROs rather than concentrating them in just a few. Thanks to Groundfloor’s low minimum investment size of $10 per loan, we make it easy to do just that.

May 2022 Diversification Analysis

The Diversification Analysis posts, like the one above, are worth reading. There’s also two other types of regular posts from their blog that are worth reviewing.

These posts are filled with information about what’s happening with real loans that were offered on the platform. The first part of the post covers loans that were repaid in the last month. The posts also cover how they handled “troubled” loans.

You will eventually end up with “troubled” loans in your portfolio. It’s basically unavoidable. These posts will give you insight into how they handle them.

Here’s one of the Asset Management posts from earlier this year – Asset Management Monthly Update, June 2022.

Loan Grade Analysis posts evaluate how LRO loans of different grades have performed on the platform. It analyzes important factors like the rate of return and loss ratio.

There are many loans available with different letter grades and potential returns. The loan grade analysis will help you better understand the risks and rewards that come along with them.

Here’s a Loan Grade Analysis post from earlier this year – May 2022 Loan Grade Analysis.

How To Invest In LRO Loans On Groundfloor

Groundfloor provides 3 different ways to make investments.

Automatic Investments

Uninvested money in your account can be automatically put to work. Navigate to Investor Account > Account Settings > Auto Investing to configure this.

The configuration allows you to specify the maximum amount of money to be invested per loan based on the letter grade. For example, you could allow up to $50 to be invested into individual “A” grade loans, but only allow $10 to be invested into individual “D” grade loans.

This option pairs nicely with Recurring Transfer Schedules, which are automated monthly deposits into Groundfloor. This setting is also found under Account Settings.

Automatic investments will also help keep using the platform a passive investing experience. It also makes sure that when loans are repaid, that money is promptly put back to work.

Investment Wizard

At the top of the “Invest” page, you’ll see “Diversification Made Simple! Try our new Investment Wizard today.” Clicking that link will bring up the wizard.

The wizard will guide you through selecting loans to invest in. It will allow you to review allocations before finalizing an investment.

Manual Investing

It is also possible to individually review loans and manually invest in individual loans.

This can be done from the “Invest” page by filling out the “Investment Amount” column, clicking the green “Invest >” button at the bottom of the page, and going through any confirmation screens.

Frequently Asked Questions About LRO Loan Offerings

What Is The Default Rate On Groundfloor?

On Groundfloor, loans are classified as in default when the Groundfloor team is pursuing foreclosure to recoup as much investors principal and owed interest as possible. It is fairly common for loans to meet their original schedule and be extended.

The November Asset Management Monthly Update gives a view into these metrics. Of 1,286 active LRO loans, 101 or 7.8% were in default. While that may look like a high number, it’s important to remember that the loans are secured with a first lien position against the property.

There were 9 LROs that were in default and repaid in November. While investors were expecting to return 10.12% on those investments, they instead received 6.74%. It’s less than expected, but still a long way away from a loss of principal.

How Often Do Investors Lose Principal On LRO Investments?

What Do You Actually Own When Investing In Groundfloor Loans?

How Many Real Estate Loans Are Available To Invest In?

How Long Do Loans Take To Pay Back?

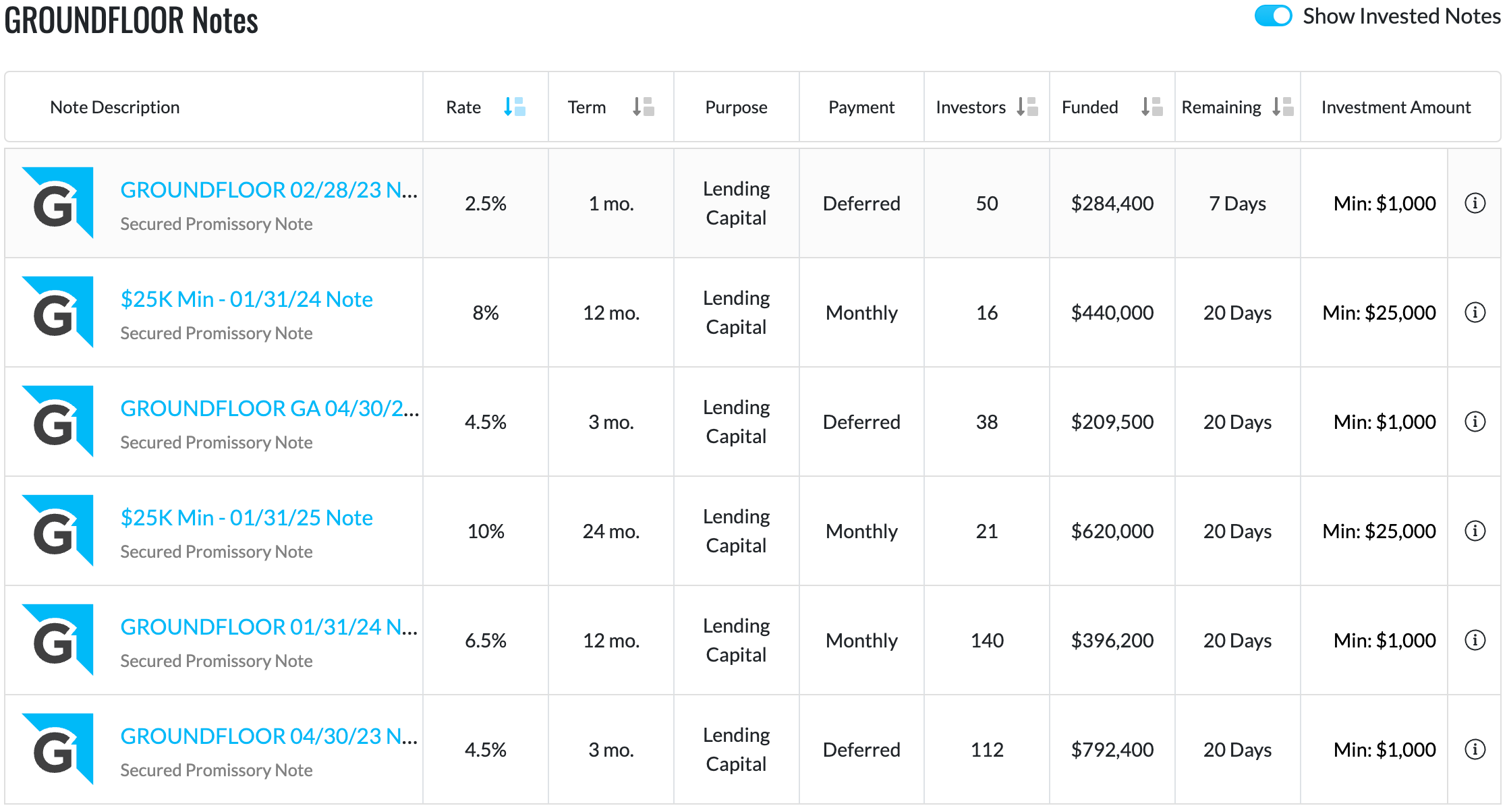

What Are Groundfloor Notes?

Groundfloor Notes are loans issued to Groundfloor itself. They use the proceeds to fund new loans to real estate investors. Those are the same loans that will later be issued on the platform for investors to buy shares of.

Groundfloor states that their note offerings are secured by a collection of real estate loans that have been funded, but have not been listed on the platform for investors.

Unlike with the residential real estate loan offerings, some Notes do offer the ability for interest to be received monthly, as opposed to in a single, deferred balloon payment at the end of the term.

The minimum investment in Groundfloor Notes is currently $1,000. This varies based on the offering, however. Some offerings have minimums as large as $100,000.

What Is Groundfloor Labs?

Labs is the way the Groundfloor team beta tests and gauges interest in new ideas. These ideas include new types of investment opportunities and products, but also includes other aspects of site experience like payment rails.

Labs investments are more restrictive – available to only accredited investors or Groundfloor shareholders. They also carry a $1000 minimum investment.

Additionally, investments in this category are inherently less polished. While the deals are still well-vetted, the user experience is much more limited. Some examples include not being able to use automatic investing for Labs and only receiving updates through monthly emails.

So far Labs has had a variety of different investment categories ranging from construction equity to cash flow advances. Check out the article below to learn more:

Common Groundfloor Questions

Yes, Groundfloor is a legitimate US business. Founded in 2013 and based in Georgia, Groundfloor operates in financial and investment services focused on real estate.

As part of their investment offerings, they have filed many pieces of supporting documentation with the SEC. The SEC Filings page on the Groundfloor website provides links to their various filings.

In order to support and scale their operations, Groundfloor has required investment capital. They have routinely leveraged equity crowdfunding frameworks that allow regular people to become shareholders.

Why does that matter? Well, this fundraising strategy requires them to publicly file documentation about the operation, risks, and financials of the company. You can find many of these details directly from their last WeFunder raise. Alternatively, their Form C submission to the SEC provides similar details and more.

Groundfloor Referral Code

You can register using this referral link or with the referral code Y953ED to receive a bonus. You’ll get $100 in bonus cash to invest on the platform when you invest $1000 or more. If you’re planning to invest anyway, you may as well get $100 extra for doing it.