Arrived Homes allows you to make fractional investments into long and short term rental real estate properties for as little as $100.

Multiple types of investment products offer different risk and reward choices.

A high-level overview of some important characteristics of Arrived. Please keep in mind that some aspects are related to the characteristics of the type of assets available on the platform.

If you’d like to learn more, we have a comprehensive overview down below.

- What Is Arrived Homes?

- How Does Arrived Homes Work?

- Understanding Investment Offerings

- FAQ About Arrived Homes

- Is Arrived Homes Legit?

- Who Can Invest On Arrived?

- Does Arrived Homes Have An App?

- How To Invest In Arrived Homes (The Company)?

- Can I Sell My Arrived Homes Property Stock?

- When Does Arrived Homes Pay Dividends?

- What Tax Forms Does Arrived Homes Provide?

- Is Arrived Homes Publicly Traded?

- Is Arrived Safe?

- Is Arrived Homes A Good Investment?

- Who Owns Arrived Homes?

- Is Arrived Homes A REIT?

- Where To Learn More

What Is Arrived Homes?

Arrived Homes (a.k.a. “Arrived”) is a leader in the fractional real estate investing space.

Their success is due, in part, to their notable investors. This currently includes names like the Bezos Expeditions (yes, as in Jeff Bezos) and Uber CEO Dara Khosrowshahi. According to Crunchbase, Arrived has raised a staggering $162M in funding.

Arrived currently has two types of offerings:

- Single Family Rentals – These are residential real estate properties for long-term rental near popular metropolitan areas.

- Vacation Rentals – These are residential properties that are designed to be short-term rentals on services like Airbnb. These are sometimes located in major metropolitan areas, but can also be located in more remote vacation-oriented destinations like The Smoky Mountains.

Accredited and non-accredited US investors can participate in any of their offerings for as little as $100 per property.

How Does Arrived Homes Work?

On a basic level, investing on Arrived will be similar to using other investment platforms. However, there are a variety of important differences and key points that investors should be aware of. We’ve broken them down below in different headings.

Investment Process

First, you’ll need to register on the website. In order to invest, you should expect to need to provide details so that Arrived can complete their Know Your Customer (KYC) requirements.

New investment offerings are periodically launched on the platform. There’s no set cadence, but there are usually multiple new properties available each month.

You’ll be notified of upcoming launches via email. Once the notifications are out, you can preview the listing to decide if it seems like a fit for you. Later there will be another email notification (or text message if you sign up for it) when the properties are live and accepting investments.

Once investments are live, you can specify your investment amount and purchase shares. You’ll have to review and sign some documents about the offering before completing the investment. Funds will then be pulled from your linked bank account within a few business days.

What Do You Own When Investing?

In some ways the term “fractional real estate” is misleading. As you might expect, it’s not very practical to own individual $100 squares of a property. So fractionalization uses a different structure.

The underlying real estate asset will be owned by a series LLC. When you purchase “shares of the property” what you’re really purchasing are shares of the LLC. It’s a very common structure used in alternative investments, as well as real estate deals that involve multiple investors.

Logically, especially for the vacation rentals, it may make more sense to think of the investment as a share of the business that owns and operates the real estate. That distinction makes it easier to understand the idea of things like capital for improvements and cash reserves being built into the offering price and structure.

Arrived Homes Fees

Arrived Homes charges fees for both their short and long term rental offerings. There are multiple types of fees, which we’ll cover in detail below.

Sourcing Fee

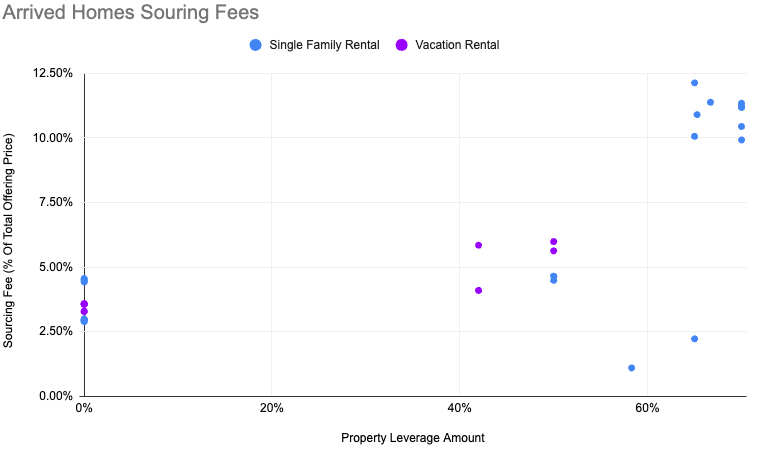

Both types of offerings have a sourcing fee. The amount varies based on the offering. Below we charted the sourcing fee for 35 properties, though not all points are clearly visible due to overlap:

In the data we can see that there’s a rough correlation between the property leverage amount and the sourcing fee. Arrived did make some effort to reduce sourcing fees on leveraged properties before the interest rate environment made it untenable to have more leveraged offerings.

While more analysis may be required to make a full conclusion, it seems like Vacation Rental offerings tend to have a slightly higher sourcing fee than Single Family Rentals for their amount of leverage. That is not always the case, however.

Here’s a few examples from the chart above:

| Property (Type) | Leverage Amount | Sourcing Fee |

|---|---|---|

| The Regal (VR) | 50% | 5.63% |

| The Mimosa (SFR) | 50% | 4.49% |

| The Knoll (VR) | 0% | 3.57% |

| The Bella (SFR) | 0% | 2.94% |

| The Burlington (SFR) | 0% | 4.55% |

Asset Management Fee

Each offering will also owe a yearly asset management fee.

| Offering Type | Asset Management Fee |

|---|---|

| Single Family Rental | 0.6% of property purchase price per year (cash) |

| Vacation Rental | 0.5% of property purchase price per year (shares) 5% of gross revenue (cash) |

For Single Family Rentals, the fee is 0.6% of the property purchase price per year. The fee is paid as a cash payment, taken from the offering’s cash flow.

That does mean leveraged properties will effectively pay a higher fee as a percentage of the funds raised from investors. As an example, The Mimosa has 50% leverage. Arrived estimated the asset management fee would be $1,290, or ~0.86% of the ~$150K raised from investors in the offering.

For Vacation Rentals there are two components to the fee. Arrived will receive 5% of gross revenue, as well as 0.5% of the property purchase price each year.

However, the 0.5% portion of the fee is paid as series interests (shares of the property). This will have a dilutive effect on investor’s ownership of the property over time.

From an initial review, this does not seem to move the needle much on investor returns when compared to the fee being paid from cash flows. In fact, if the property appreciates poorly over the holding period, Arrived may receive less than if they had simply taken the 0.5% as a cash payment.

Property Management Fee

Managing a property – finding tenants, managing maintenance requests, helping guests with bookings on Airbnb – requires both time and people. That means there are fees associated with this as well.

| Offering Type | Property Management Fee |

|---|---|

| Single Family Rentals | Varies, typically 6-8% of rents |

| Vacation Rentals | Varies, typically 15-35% of gross revenue |

For Single Family Rentals, things are pretty straightforward. Property managers typically receive 6-8% of rent with a monthly minimum.

Vacation Rentals are where things get a bit more interesting. Since these types of properties are more high-touch and time-intensive, the fees are much higher. They can range from 15-35% and include more complex structures and variable rates. For example, there can be a base fee of 15%, which can grow to 20% after certain performance thresholds are achieved.

Arrived has started to move property management in-house, instead of negotiating deals with different third-party management companies. They have a flat 20% fee. As more properties transition to in-house management, there will also be greater consistency and predictability in the fees.

Other Fees

There are other fees and expenses associated with the offering, ownership, and operation of the property.

There is a 1% brokerage fee for every offering. This is paid to Dalmore Group, LLC.

If there are costs or expenses for a property, such as repairs, the payment for that will come from the property’s cash reserves. This will ultimately affect dividend payments to investors or the cash available at the sales of a property.

When the property is ultimately sold, or “disposed” of, there are closing costs that apply for the transaction. This is expected to be 6-7% of the sale price. If the costs are less, Arrived will receive the cost savings as income.

Cash Flow Payouts

Investors will receive dividends on a quarterly basis. The payouts occur in January, April, July, and October for the previous quarter’s results. For example, the January payouts will be based on the performance of October, November, and December.

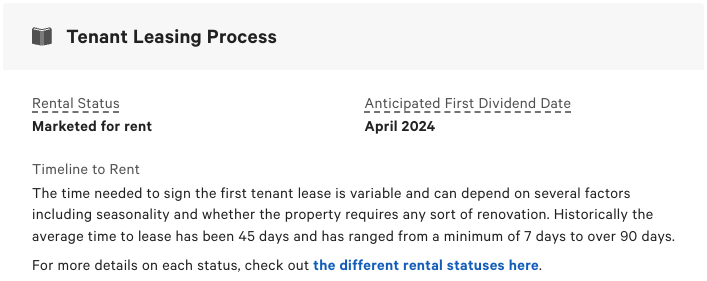

Not all offerings will deliver their first payouts at the same time.

New Single Family Rentals may be in different rental status when they’re made available for investment. Generally speaking, properties that are already rented will start payouts first. Vacation Rentals also have variance depending on how much work and time is ready to get them onboarded to platforms like Airbnb for bookings.

Share Price Updates

Share prices are updated quarterly around the same time that dividend payouts are delivered (so also in January, April, July, and October) after a minimum holding period.

Single Family Rental properties will receive their first update 6 months after escrow close and Vacation Rental properties will be updated after 12 months.

It’s important to note that the close of escrow will not be perfectly synchronized with the close of the offering. It can often be delayed from when all the shares are sold. That means a September offering, for example, may not get an update until July.

For any investments you’ve made, you can see the timeline for the first valuation update from the Portfolio page.

This help center page explains in more detail how share prices are calculated.

Understanding Investment Offerings

Arrived has a variety of information for each offering available on the site. We’ll break down a listing in the sections below.

Real Estate Property Summary

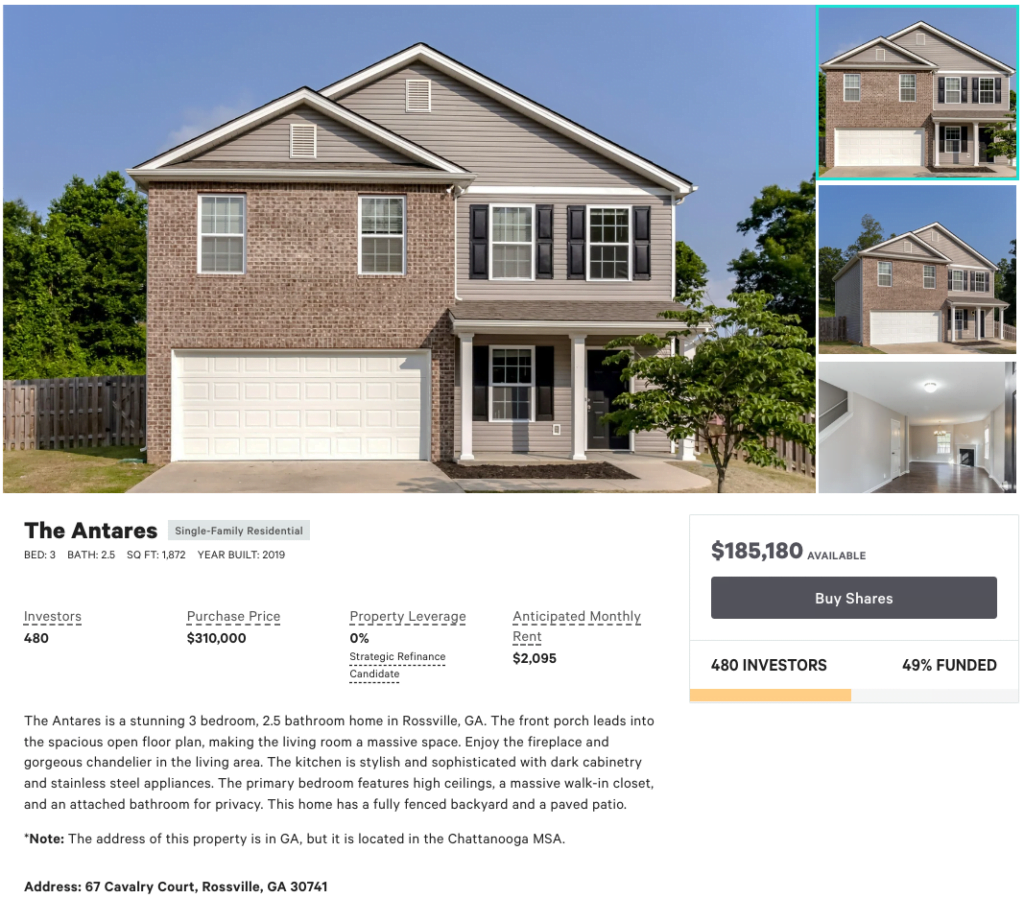

Upon clicking on any listing, you’ll be greeted by an initial summary view.

The first thing you’ll see are photos of the property. The main photo being displayed is in the center area and the queue of photos is just to the left of that. By advancing through the queue, it will also advance to show previews of other photos. In other words, there are always more than just the 3 initial photos you see.

Below the photo area you’ll see:

- The name of the property,

- Whether it’s a Single Family or Vacation Rental offering,

- The number of bedrooms and bathrooms,

- How many square feet the property is and what year it was built,

- How many investors have participated in the offering so far,

- The purchase price of the property (note that this is not the total amount being raised for the offering, you’ll see that in a later section),

- If there’s any leverage on the property,

- What the anticipated monthly rent is,

- A brief description of the property,

- The property’s address, and

- How much of the offering is still available for investment

Tenant Leasing Process / Property Management Partner

This section varies slightly based on whether the offering is a Single Family or Vacation Rental property.

In both cases, the main takeaways are 1) the rental status or rent-ready date for short-term rental properties and 2) the anticipated date for the first dividend payouts.

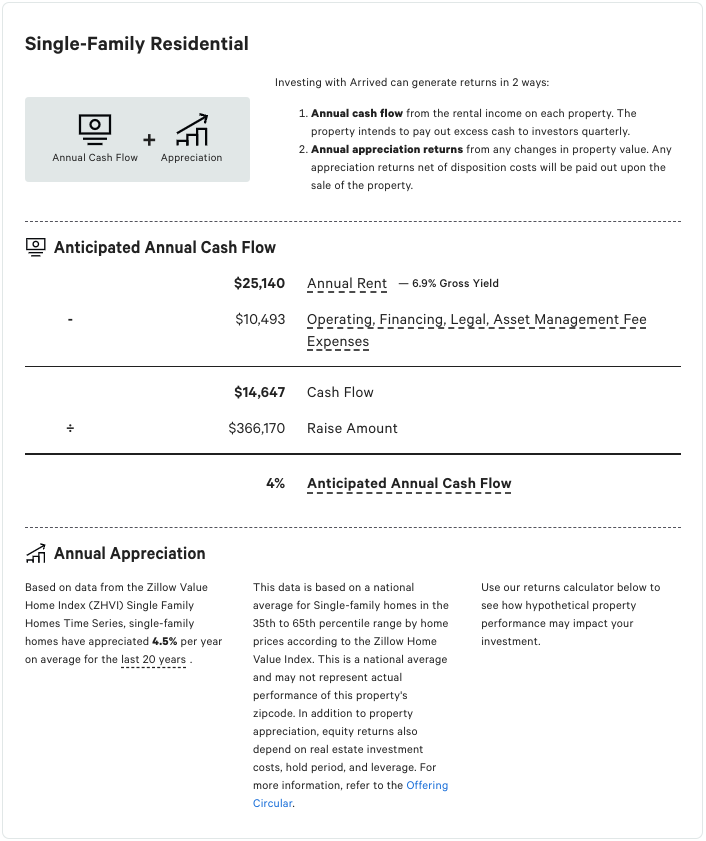

Investment Strategy Hypothetical Returns

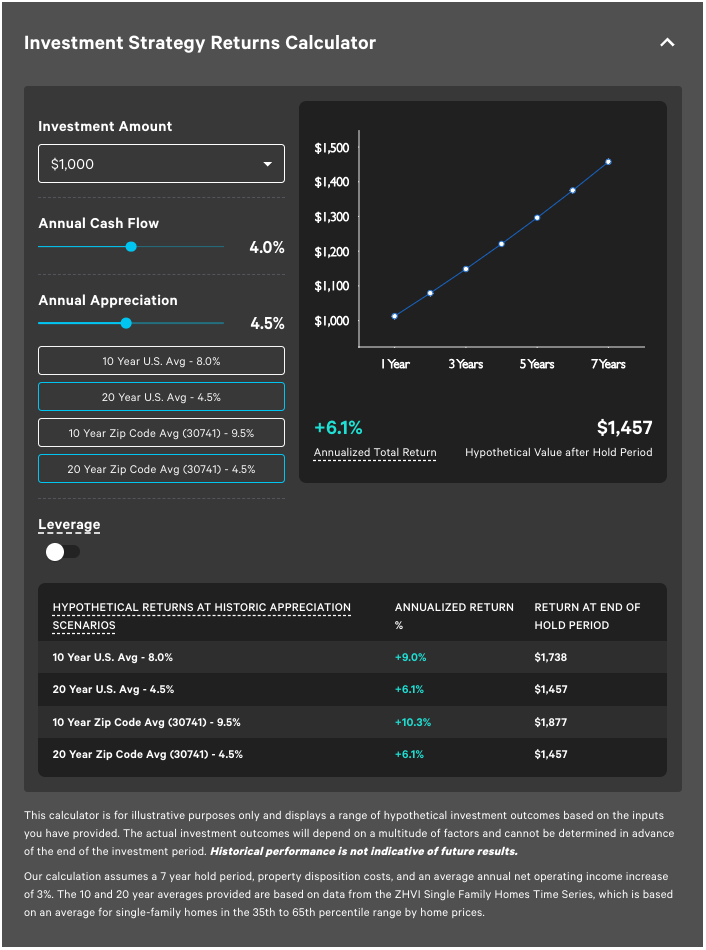

After covering the basics of the property, the potential returns are shown for the offering. This is a very important section to review carefully.

The first section provides an explanation of how returns are received – cash flow and appreciation. Then it breaks the anticipated cash flow down into more detail.

The main takeaway is the anticipated annual cash flow. This is what you’ll be receiving each quarter as dividends. It’s also an opportunity to see the gross yield and to consider different scenarios.

For example, if we assume the fees and expenses will remain the same and assume that annual rent was 10% lower than anticipated the cash flow would drop to 3.31%.

Over the course of a year, it’s not that hard to miss by 10%. The property is vacant for longer than expected and/or rents for less than anticipated. Would the offering still be interesting at 3.31% instead of 4% in the first year?

Next, there is a calculator to help understand how different cash flow and appreciation rates would impact the total investment return.

The calculator gives you the ability to adjust the cash flow and appreciation. For appreciation, they have some pre-set values you can select.

You can also toggle leverage on and off. When set to on, the results are modeled based on 55% leverage at 5% interest rate. This is important and relevant since the newer un-leveraged offerings are candidates for strategic refinancing in the future.

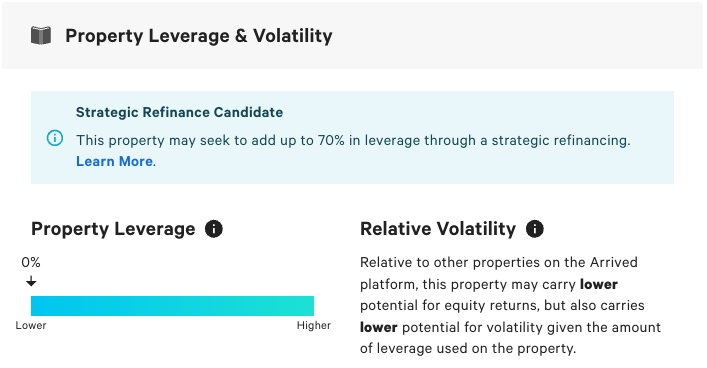

Property Leverage & Volatility

After seeing the potential returns, investors are able to review information about the leverage associated with the offering. Offerings with higher leverage will have more volatility associated with them.

Given the current state of mortgage and interest rates, there have not been any new leveraged properties. That means the volatility of the current offerings will be lower than some of the past offerings.

Many of these newer un-leveraged offerings are candidates for strategic refinancing. Basically, this means that if mortgage rates change in the future, the Arrived team may take out a mortgage for the property.

In such a case, the cash received from the mortgage will be distributed to investors. From then on the property will be leveraged. In this situation, the volatility of returns will also increase as well.

It’s also worth noting that Arrived’s leveraged real estate offerings have interest-only loans and they’ve historically been 5-7 years in length. That means the principal is not paid down over the course of the offering and the lifetime of the loan.

The Market

Next, there is information about the real estate market that the property offering is a part of. This will be based on the metro statistical area (MSA). There is an example below.

This property is some distance away from Chattanooga and across the border in Georgia. However, it’s still considered to be part of the Chattanooga metro area.

There is also a small map that shows the location of the rental property. You can interact with the map to zoom or pan around to see more information.

We have a map of fractional real estate offerings covering 326 Arrived properties (so far) and hundreds from other platforms too!

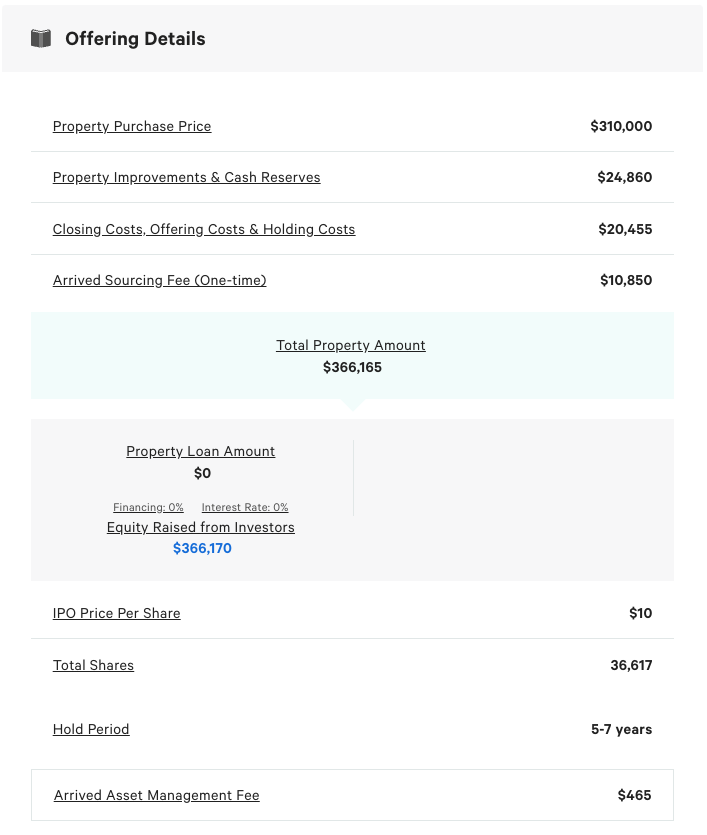

Offering Details

The next section outlines the financial details of the offering.

As you can see from the example above, the total amount raised from investors (~$366K) is greater than the property purchase price ($310K). The additional funds being raised are broken down in the table above. They can be attributed to the sourcing fee, improvements and cash reserves, as well as other associated costs with closing the real estate transaction.

You can also see the loan amount, price per share (always $10), holding periods, and the quarterly asset management fee.

Documents & Common Questions

Finally, the offering provides a few sections with more information about the offering itself, as well as how Arrived Homes works. The documents actually all link to their SEC filings, which contain a wealth of details about things like the use of proceeds, as well as the risks with the investment.

FAQ About Arrived Homes

Is Arrived Homes Legit?

Yes, Arrived Homes is a legitimate company and investment platform. Their investment offerings are qualified by the SEC and their equity crowdfunding campaign will require them to file a Form C with the SEC, which will disclose many details about the company and their finances.

Who Can Invest On Arrived?

Any US citizen or residents that are 18 years or older are able to invest on the platform.

Does Arrived Homes Have An App?

Yes, Arrived Homes has an app. It is currently available on the Apple App Store.

How To Invest In Arrived Homes (The Company)?

As a private company, it is typically not possible to invest in Arrived Homes the company. However, Arrived is doing a community round on Wefunder. They plan to raise $1M through the campaign. There is currently an investment maximum of $500.

Can I Sell My Arrived Homes Property Stock?

No, you cannot currently sell any property shares purchased on Arrived before the termination of the offering. A secondary market does not exist and one may never emerge. The investments should be considered illiquid for 5-10+ years.

When Does Arrived Homes Pay Dividends?

Arrived pays dividends in January, April, July, and October each year.

What Tax Forms Does Arrived Homes Provide?

Arrived Homes provides 1099-DIV tax forms.

Is Arrived Homes Publicly Traded?

No, Arrived Homes is not a publicly traded company.

Is Arrived Safe?

All investments carry risk, which is true for Arrived’s offerings as well. No matter how good projected returns are, there is always the risk for loss of principal when making an investment on the platform.

Arrived also lacks liquidity for investment offerings. Once an investment is made, there is no way to sell early and get your principal back. You’ll have to wait until the property is ultimately disposed of, potentially 10-15 years later.

Is Arrived Homes A Good Investment?

It is difficult to say if Arrived Homes is a good investment platform for you. For it to be a good investment, you have to be comfortable with a lack of liquidity for many years and make investments over a long time period.

Additionally, in exchange for making real estate an entirely passive and fractional investment process, Arrived investors encounter more fees than if they bought and managed the properties entirely by themselves.

Who Owns Arrived Homes?

Arrived Homes is a privately owned company. It is owned by the founding members, the employees, and their investors.

Is Arrived Homes A REIT?

No, Arrived Homes is not a REIT. Arrived Homes is an investment company that sources SEC-qualified real estate offerings for their investor base.

Arrived Home’s Single Family Rental offerings look to qualify as, and be taxed as, a REIT. However, their Vacation Rental offerings are NOT classified as REITs.

Where To Learn More

Modeling Arrived Returns

Before the new return calculators debuted, we took a stab at modeling what they could look like.

Arrived Homes Vs Here

See how Arrived compares to Here for fractional vacation rental investment offerings.

To support an ad-free experience, we may earn a commission from links on this page.