If liquidity and low minimum investment thresholds are top priorities, no one can beat ANote Music for music royalty investing. Based out of Luxembourg, the platform operates entirely on Euros, but is open to Americans. It already has a small library of competitive investment options that continues to gradually expand.

| Potential Yield | 2.5-15% |

| Potential Appreciation | Possible appreciation and possible depreciation |

| Minimum Investment | €7 |

| Investor Requirements | No accreditation requirement |

| Liquidity | Good – Secondary market is present, with limited trading hours |

| Other Highlights | Life of copyright assets can produce yield for 70+ years |

If you’d like to learn more, we have a comprehensive overview down below.

- What Is ANote Music?

- How Does Investing On ANote Music work?

- Frequently Asked Questions About ANote Music

- I Live In The US. Can I Still Invest In ANote Music's Offerings?

- How Are Cryptocurrencies Used On The Platform?

- Do Significant Events In The Cryptocurrency Space Impact The Safety Or Value Of My Investments On ANote Music?

- Are These Offerings SEC-qualified?

- Are There Any Foreign Exchange (FX) Hedging Techniques Used?

- Learn More

- ANote Music Referral Code

What Is ANote Music?

ANote Music is a Europe-based music royalty investment platform. It is built on a two-sided marketplace model. On one side are investors looking for diversification, yield, and passive income opportunities. On the other side are artists and music rights holders looking to capitalize on the future long-term earning potential of their assets.

How Does Investing On ANote Music work?

ANote Music has both a primary and secondary listing market for music royalties. All listings are for shares of catalogs of music assets.

Primary Market

The primary market is where all brand-new listings debut. The ANote team targets having new catalog offerings available roughly every two months. Listings on the primary market follow a Dutch auction model.

Auctions

Since all new assets debut through an auction, it is important to understand how they work.

New assets will have a starting price, a target total amount for the auction, and a time limit. In the most recent auctions, the targets have been quickly reached. This suggests that anyone planning to participate should assume the minimum threshold will be reached and that demand will continue past the starting price.

Once the minimum threshold has been met, new bids can still be entered. In order to secure shares, these subsequent bids will need to come in at a higher price. These higher-priced bids will displace the earlier, lower-priced bids. A significant number of bids may come in for an asset, resulting in a lot of action in the auction.

All of the action comes to an end once the time expires. Once the auction has ended, all of the entered bids will be sorted by price-per-share, from highest to lowest. The system will then go through that list from the top-down, counting shares. After all the available shares have been accounted for, the system stops.

That very last bid that the system stopped on is what determines the final price-per-share. The final price per share is what all winners of the auction will actually pay, even if they had bid significantly higher.

Shares have often traded for higher prices in the secondary market than their final auction price. This is mostly for a variety of market factors, rather than a change in the underlying value of the asset. However, it does mean that if there’s an asset for auction on the primary market that you like, it may be the most cost-efficient opportunity to purchase shares.

Secondary Market

There is also a secondary market to purchase shares of previously launched catalogs.

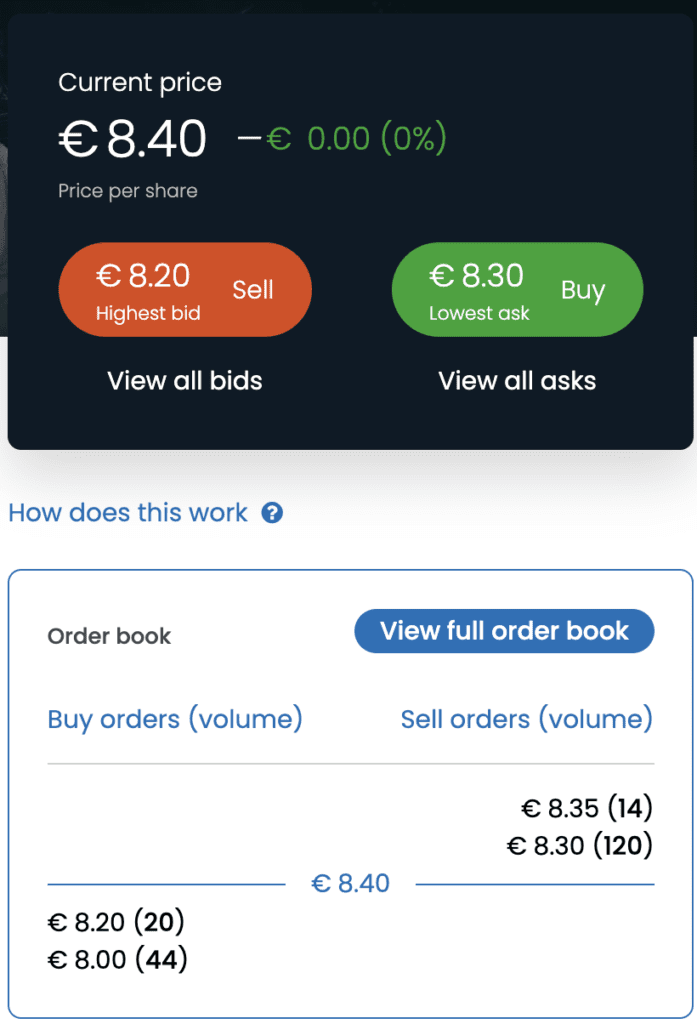

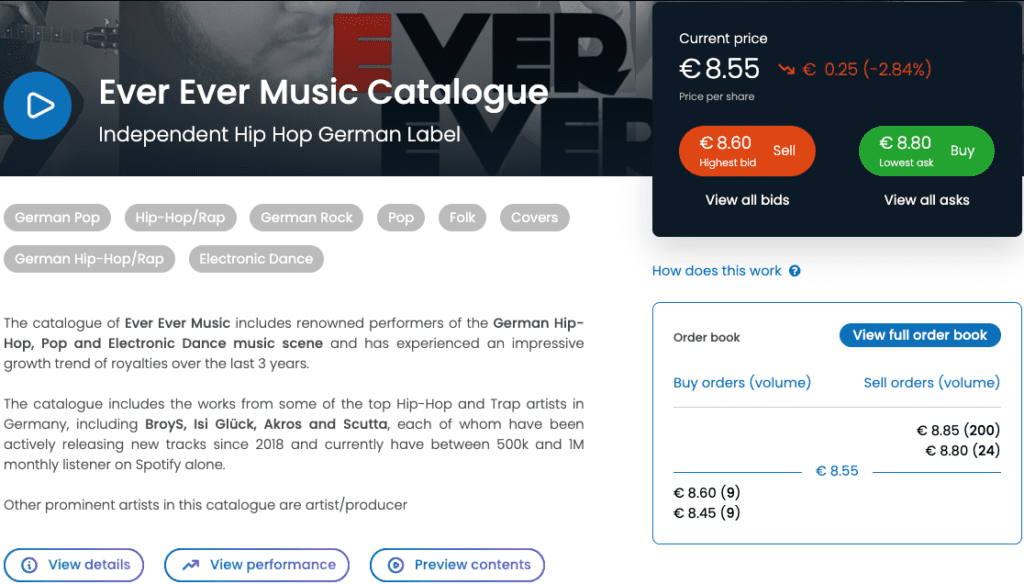

On the listing page of any existing asset on the platform, you’ll see the current price, as well as buy and sell buttons. The buttons will show the price from the top of the offer book. It won’t, however, show you how many shares are available at that price.

To find more information, you can look below those buttons. There you’ll also see a limited snippet of the order book. It shows the top two buy and the top two sell orders. It includes the prices of those orders and the number of shares associated with each. There’s also a button you can click to see the full order book.

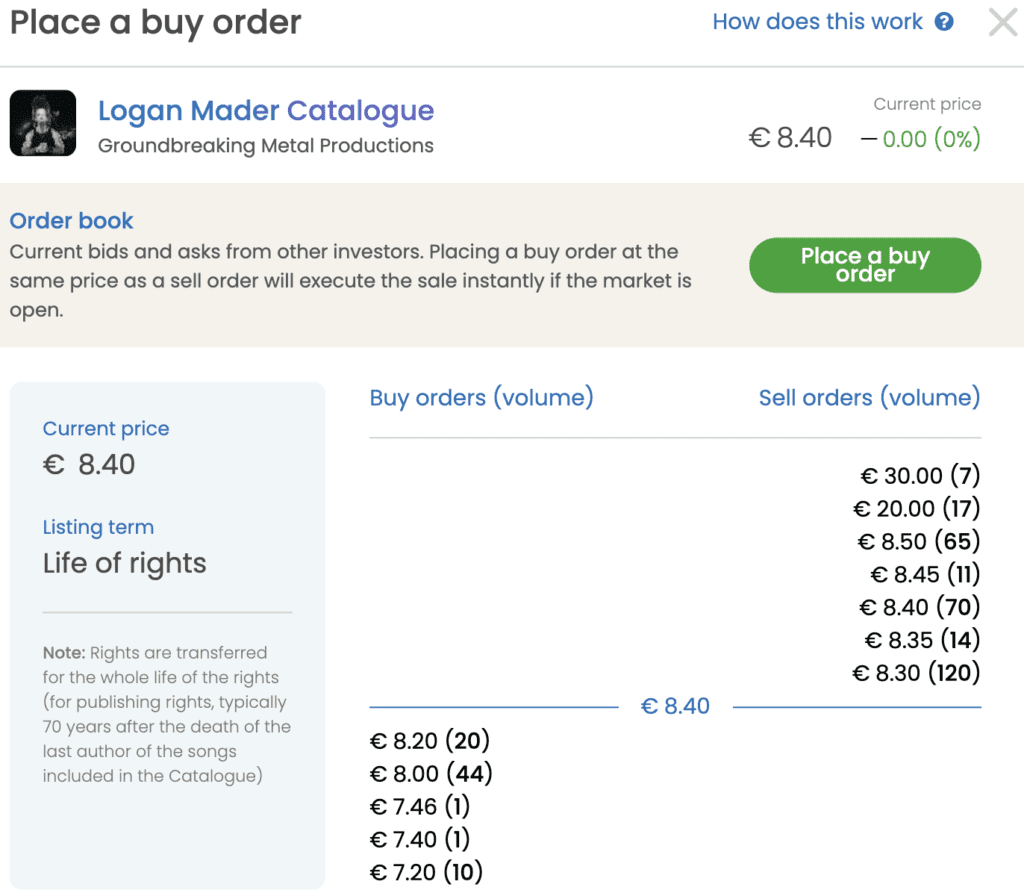

When looking at the full order book, you can see all the registered buy and sell orders. It also provides a sense of what the overall liquidity is. In this example, there are 304 shares listed for sale. Of those, 24 shares are exorbitantly priced. That leaves us with 280 shares that can be immediately purchased without meaningfully impacting the price. There are only 76 shares in the buy orders, with prices dropping quite quickly. In the current market condition, it is much easier to purchase than to sell around the current price.

Placing An Order

There are two methods for placing an order – Budget view and Price view. For purchasing shares, you can choose between both. For selling shares, only the price view is available.

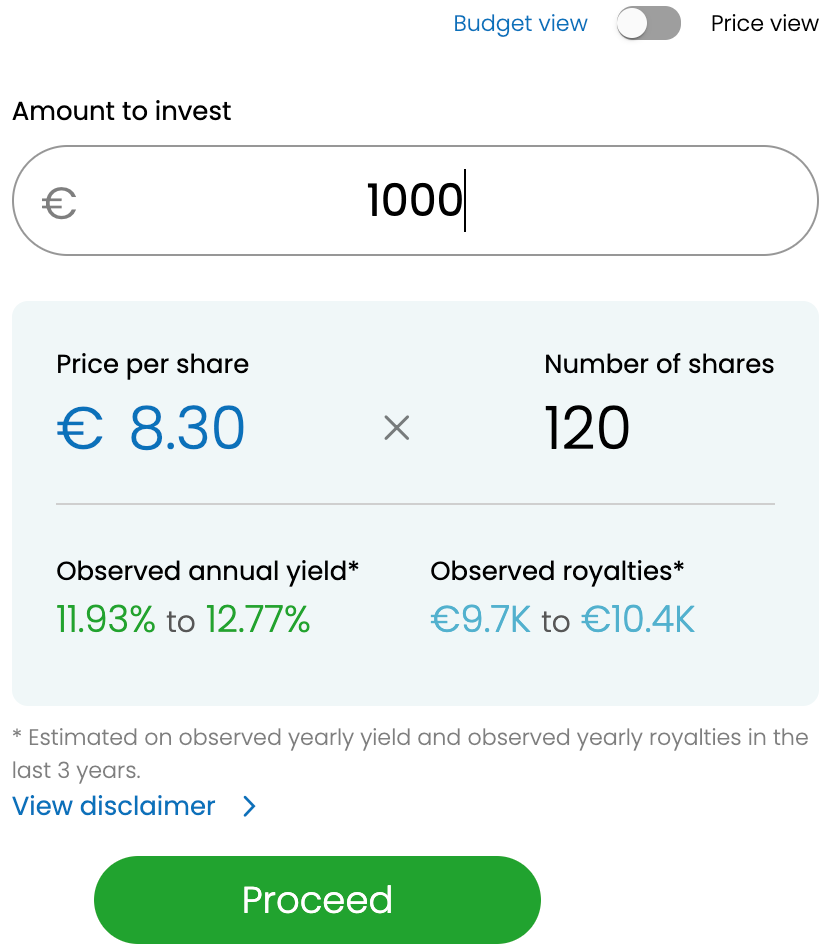

The Budget view allows you to enter a target amount to invest and automatically converts it to a number of shares for purchase.

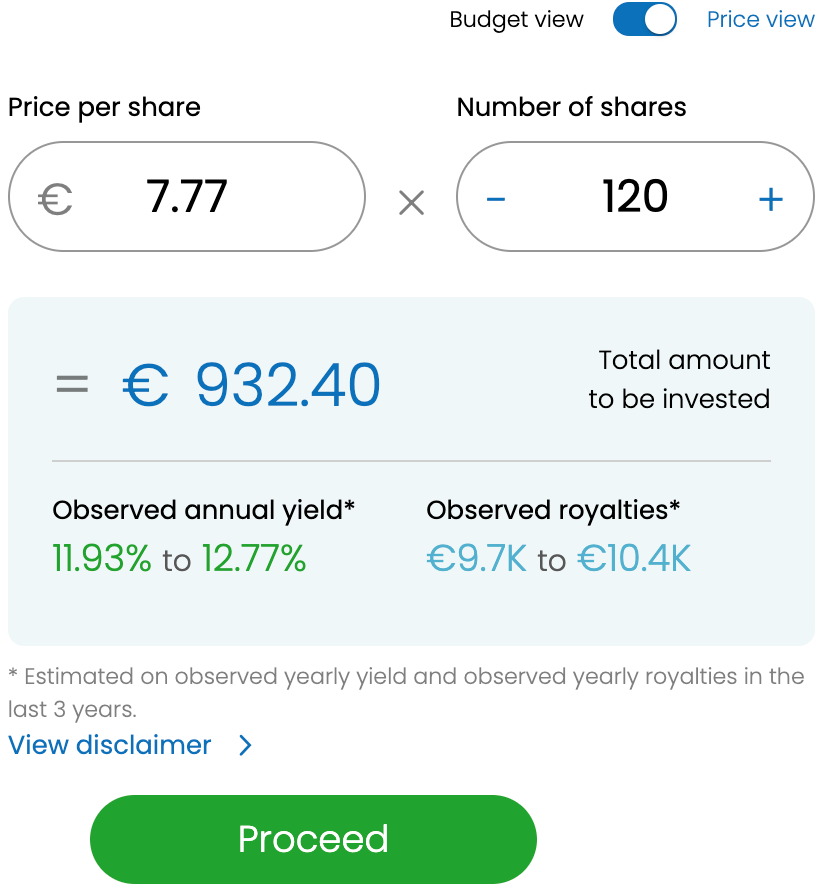

For Price view orders, you enter a fixed price to buy or sell at and the number of shares to transact at that price. This is effectively a limit order. It is always possible that your order isn’t matched, even over an extended period of time. This is much more likely if you are trying to purchase significantly below the market price or sell shares at a price significantly above it.

Note that for purchase orders, the observed annual yield does not update based on your inputs. If you are jumping in to purchase shares significantly above the market price, it is assured that your observed yield will be noticeably lower than what is displayed.

Hours Of Operation

The secondary market is not “open” 24 hours a day. It is “open” for only a portion of the day, just like the stock market. The hours of operation are Europe-centric, so users on the Pacific Coast of the US will almost always see the market as “closed.”

This isn’t actually an issue though.

While the market is closed, you can still place orders. They’ll go straight into the order book, just as it would if the market were open. The only difference is that orders will not be matched while the market is closed. As soon as the market opens up, the orders you placed can be matched.

Understanding The Asset Listing Page

Asset listings pages are organized into rows of information and interaction.

On the first row is a banner image. This helps give a sense of character to the asset and help connect to some of the holdings.

Just past the banner will be summary information, links to skip down to specific sections of the listings, as well as the Buy button, Sell button, and Order book snip that we covered earlier.

Performance

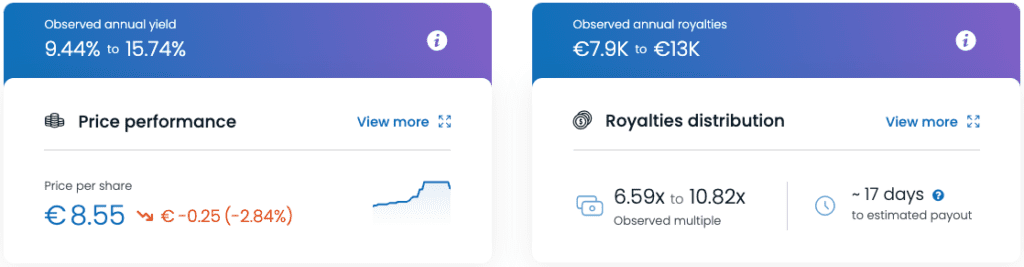

After the initial information is a summary of the performance and valuation. Both of these cards have a “View more” link. Clicking this will provide additional information.

Price Performance

On the left, the current share price and a sparkline graph of the recent price history is displayed. If you click on the “View more” link, a new window will pop up with further details.

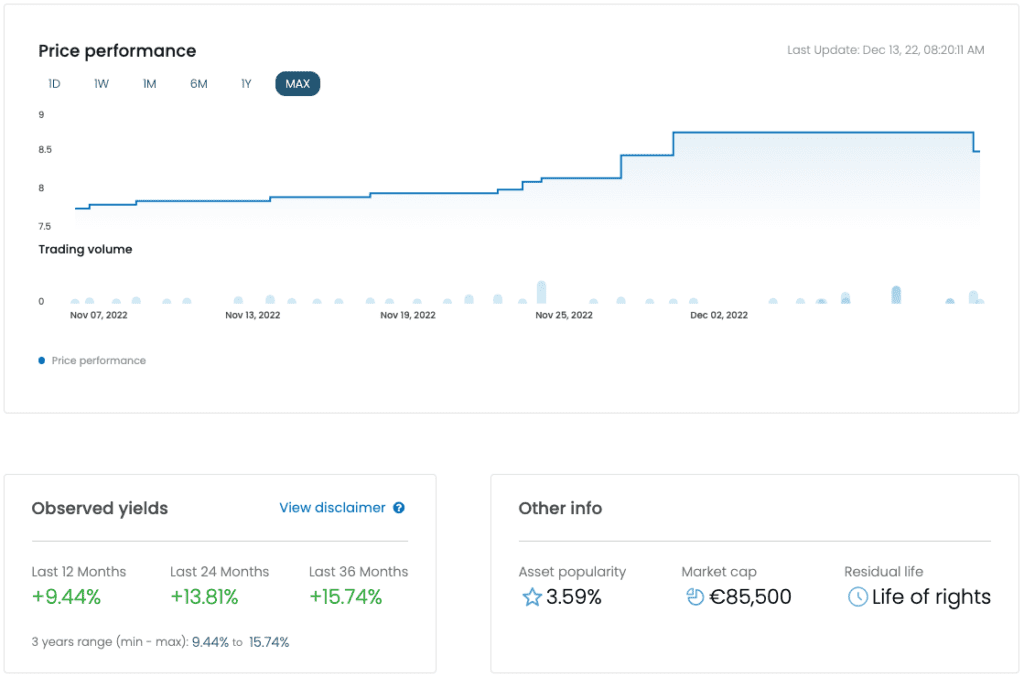

In the expanded price performance view, you can see more information about the trading of the asset, the yields, and some other info.

The price chart shows a line graph of the price per share of the catalog over time. It also shows a bar graph of the trading volume, so it is easier to see when trading occurred and how many shares traded hands at periods of updated valuations. The graphs can also be modified to show the data across various timespans.

The observed yields show what the trailing annual yields have been over a 1, 2, and 3 year time period. In the case of our example, we see that the yield for the last 36 months was just under 16%. However, the yield for the last 12 was around 9.5%.

This shows that the royalty payouts have been declining year-over-year. It is common for newer songs to see a decline in earnings as they age before reaching more stable levels. It is possible that investors could see a yearly yield that is 9.44% or one that is higher. However, given the recent trend, investors should be prepared for the possibility that it may continue to decline.

Lastly, there is some other information about the asset. This includes the percentage of accounts on ANote Music that hold the asset, the market cap, and the residual life on the asset. ANote Music DOES have asset offerings for terms other than the life of rights, so this is worth paying attention to.

Royalties Distribution

On the right, the royalty and valuation information is seen. First is the observed annual royalty payment information. This is expressed as a range with a high and a low payment number.

Below that is the “observed multiple,” which is also expressed as a range. This is showing, based on the current share price, what multiple of the royalty earnings the shares are currently valued at.

Additionally, there is also a “View more” button. Hitting that will display an additional window with more information.

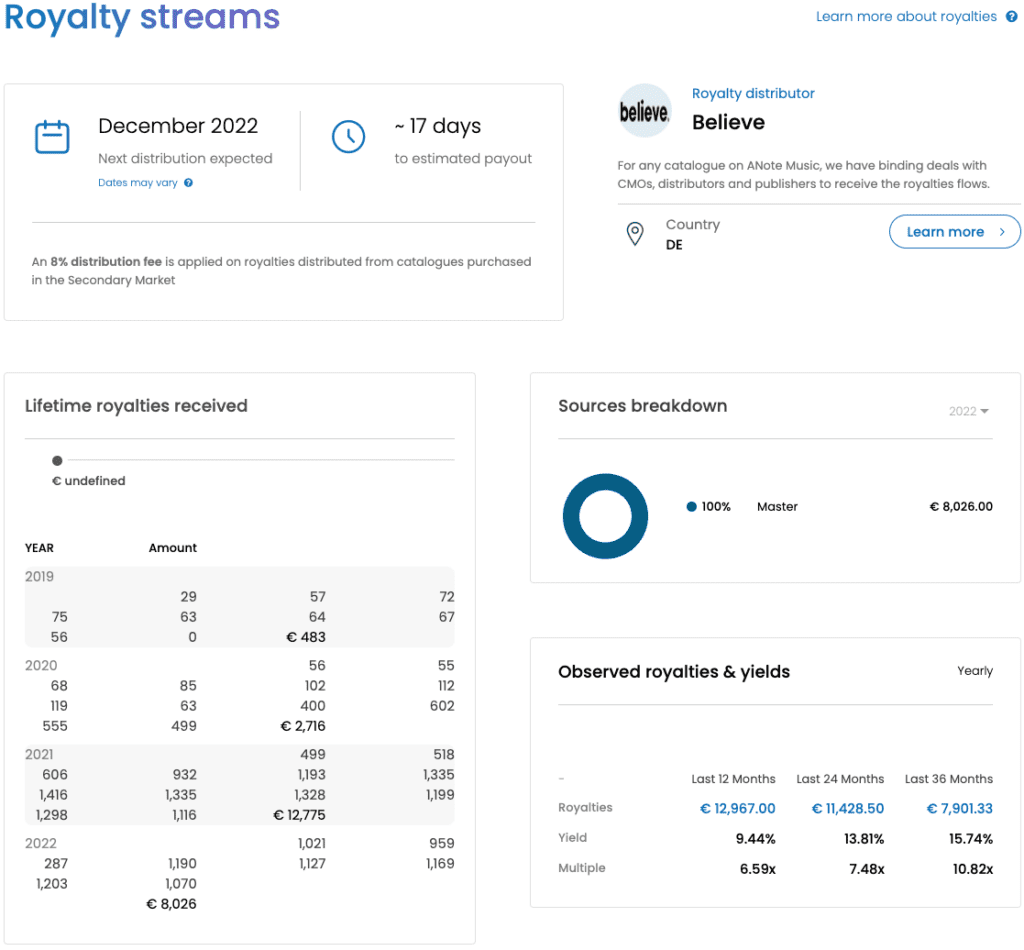

The expanded view has a variety of new details available. In the top left, there is information about the timing of the next music royalty distribution. You can also find information about the royalty distributor in the top right.

The bottom left contains a full table and bar graph of quarterly royalty payouts. Since the example we’re using is the newest listing on the platform, that may be why this information is not properly formatted and fully available.

In the bottom right are two other pieces of information. The first is the source of the royalty earnings. There is only one source in the case of our example. However, there could be multiple different types such as publishing and songwriter royalty sources. Additionally, there is a table showing the royalty amount, yield, and multiple for the last 1, 2, and 3 years.

Song & Artist Information

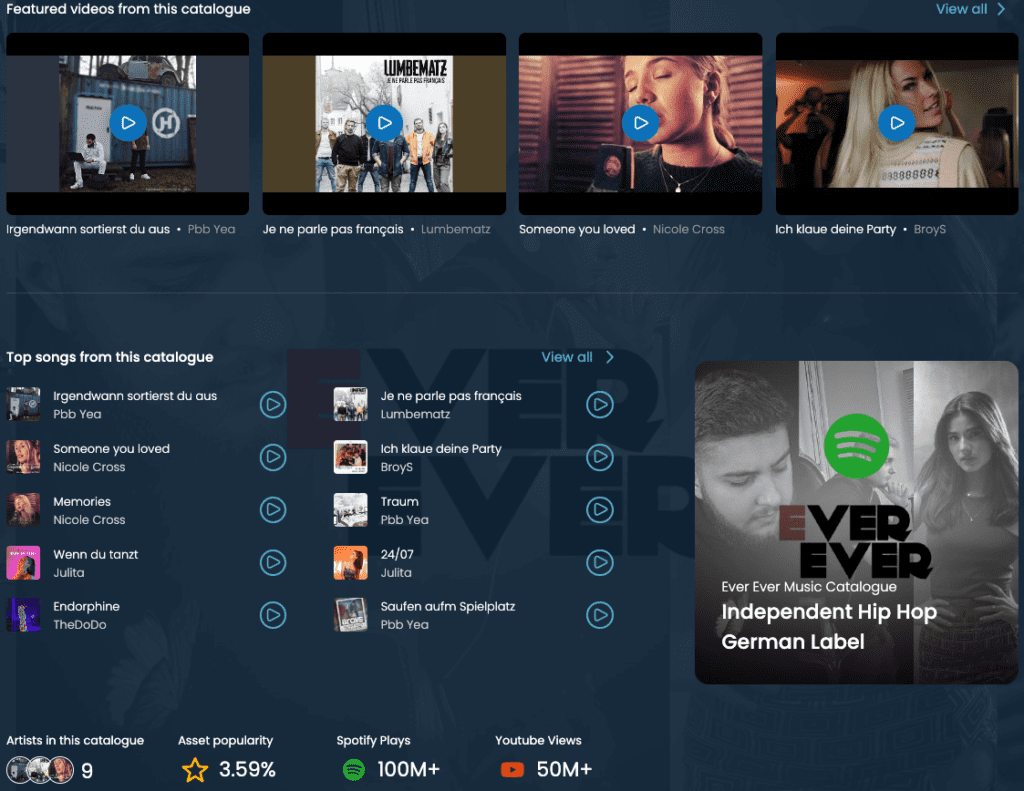

After the financial information, the listing provides more information about the songs and artists in the catalog.

This section provides links to watch videos or to play top songs from the catalog. It also includes the number of unique artists, the percentage of ANote Music accounts holding the asset, and the numbers of Spotify plays and YouTube views.

Catalogue Details

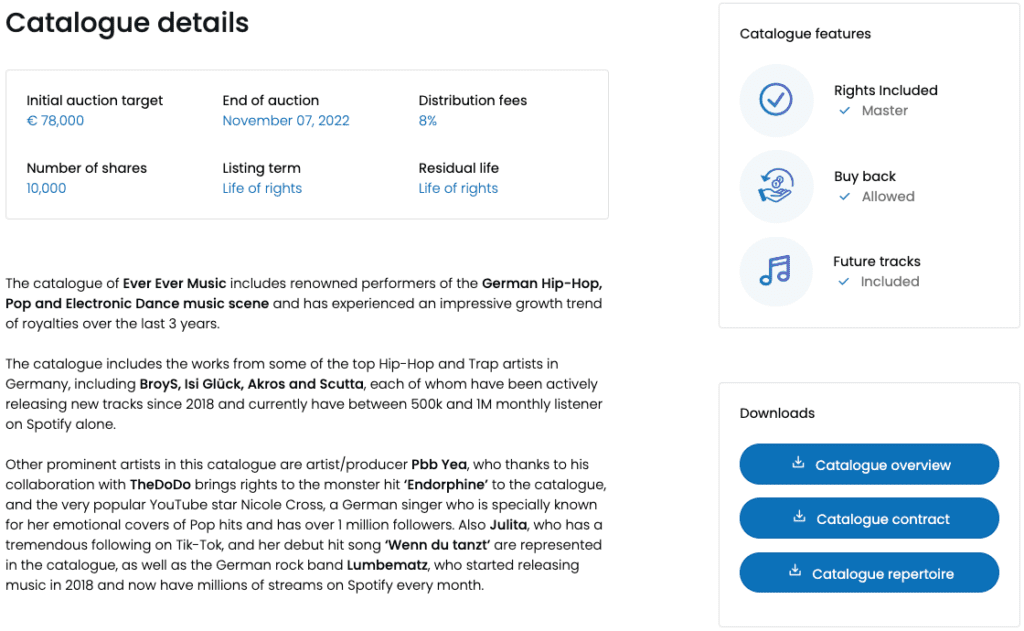

The Catalogue details section expands on the written summary at the beginning of the listing. It also provides several important details about the catalog.

There are details about the size and timing of the initial auction. The Distribution fee and number of shares are detailed. Listing term tells us how long the asset produces income for. For some assets this will simply be the life of rights. For those with a different term, such as 10 years, the residual life is very important. An asset may have produced royalties for 10 years, but if it was listed on the platform 8 years ago then there’s only 2 years of earnings remaining.

Additionally, there are usually several download links available. These provide additional details about the asset and contract around its listing.

There is also a highlight of the catalog features. This includes the type of music rights included, whether buy back is allowed, and whether future tracks are included. A couple of these are worth a further look.

Buy Back

Buy back is a unique feature to ANote Music. It allows for the selling party to repurchase all the royalties they sold on ANote Music. In order to do so, they have to pay 15% more than the market price per share. That price is calculated using the volume-weighted average share price, based on the past 31 days of trading.

Since ANote Music is a two-sided marketplace, they have to serve the interests of both investors and artists. The buy back provides a safety net for artists.

Imagine an artist that was initially having a good career. They are able to sell some of their music royalty rights for what seem like good prices. Then, their career starts to take off. Now, it looks like they’re on track for superstardom. Suddenly, those earlier royalty sales could now end up costing the artist a fortune in payouts they’d be missing out on.

The buy back provides protection against that case. This protection makes it easier for the ANote Music team to work with rights holders to get great listings onto the platform.

Future Tracks

Another unique characteristic of ANote Music offerings is the inclusion of future tracks in some of the offerings. This means that the number of music royalty generating properties inside an asset may increase without investors doing anything. To what extent that impacts the earnings of the catalog and the value over time remains to be seen.

The catalogue will include also royalties from future tracks produced or acquired by Ever Ever Music during the listing term.

– Ever Ever Music Catalogue Listing Overview

Fees

ANote Music charges fees to each side of the marketplace.

Music rights holders that are selling parts of their catalogs on the platform are subject to a listing fee.

Investors will pay a distribution fee out of their music royalty earnings. The distribution fee is 4% for shares acquired in the primary market and 8% for shares acquired in the secondary market. However, fees are capped at 0.5% of the share’s value.

For example:

- Let’s say a share of the catalog is worth €100.

- Let’s also say that €10 were received as music royalty payments for the year.

- Finally, let’s assume the shares were purchased on the secondary market.

When the 8% distribution fee is calculated from the €10 royalty payment, we would expect to lose €0.80 to the fee. However, distribution fees are capped at 0.5% of the share value or €0.50 (based on €100/share). In this case, the fee would be €0.50, or just 5%. That’s nearly identical to the 4% paid by those who purchased shares on the primary market.

Finally, there are fees to transfer money into the platform as well. The size varies based on the payment method. For credit cards, it’s about 2%. That drops down to 1% for crypto currency deposits and falls to 0.5% for bank transfers.

Frequently Asked Questions About ANote Music

I Live In The US. Can I Still Invest In ANote Music’s Offerings?

Yes, you can. There are two things to keep in mind though.

First, everything on the platform operates in Euros. That means foreign exchange rates will affect your return. Sometimes it may be a positive, other times it may be a negative.

Additionally, please be aware that not all US banks will accept deposits in Euros!

Second, there are no features on the platform to cater to US tax needs. In other words, you won’t receive a 1099 form. You will have the ability to download a yearly statement from ANote Music, but you will need to determine the correct way to file it in your US tax return.

How Are Cryptocurrencies Used On The Platform?

It is possible to fund your ANote Music account using cryptocurrencies, but no crypto knowledge is required to use the platform.

Additionally, blockchain technology is used by the platform. Transaction information is mirrored onto the Algorand blockchain to ensure a permanent, immutable record is always maintained.

Do Significant Events In The Cryptocurrency Space Impact The Safety Or Value Of My Investments On ANote Music?

No. There are no risks to your ANote Music investments from the market prices of cryptocurrencies, notable bankruptcies in the space, or other events within the cryptocurrency industry. We discussed this with the ANote Music team to help explain why this is the case.

First, the company does use the Algorand blockchain, but it is only to provide additional transparency and security of the transaction records for assets. If the Algorand blockchain were to simply shut down, the platform would continue to operate as normal.

Second, all operations on the platform happen in Euros. While it is possible to fund your account using cryptocurrencies, ANote Music uses a third party partner for that process. The third party receives the cryptocurrency and deposits the equivalent amount of Euros into your ANote Music account. At no point is ANote ever “holding” the cryptocurrencies used to fund the account. This also means they have no risk relating to the price movements of those currencies.

Are These Offerings SEC-qualified?

No. Since ANote Music is based out of Europe, offerings are neither qualified, nor governed by the SEC. Rather than the SEC, they would fall under Luxembourg’s CSSF.

In our discussions with the ANote Music team, they indicated that music royalties are considered intellectual property under local law and therefore would not require oversight of the CSSF. However, they also indicated that they have coordinated with the CSFF to ensure that the platform conforms to standard requirements for financial investments. Additionally, the CSFF is aware of the ANote Music platform and has provided a positive opinion on allowing it to perform.

Are There Any Foreign Exchange (FX) Hedging Techniques Used?

As investors with United States dollars, the exchange rate between USD and Euros can impact the earnings we receive. While it is possible for businesses to develop hedging strategies that help to stabilize the variances in currency conversion rates, this is not something currently employed by ANote Music. This means that moves between these two currencies simply are what they are.

Learn More

Please take a look at our other music royalty resources:

Introduction To Music Royalties

New to the asset class? No worries! Take a look at this approachable introduction to get started.

How To Value Music Royalties

Learning how to value music royalties can be tricky. This guide will help explain what you need to know.

To learn more about ANote Music, their FAQ is a great place to explore.

ANote Music Referral Code

Are you interested in getting started with ANote Music? If you register with this referral link or use the referral code dc588c while registering, you can get up to a €25 bonus. To be eligible for the bonus, you must open your account using our referral link or code, confirm your identity, and successfully invest €200.